Asian Growth Stocks With Strong Insider Confidence

Amidst a backdrop of mixed economic signals across global markets, Asian equities have been catching the eye of investors, particularly with China's tech-driven momentum and Japan's nuanced monetary policy shifts. In such an environment, growth companies with high insider ownership often stand out as promising candidates due to the alignment of interests between company leaders and shareholders, suggesting confidence in their long-term potential.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Bora Pharmaceuticals (TWSE:6472) | 11.9% | 20.3% |

Here's a peek at a few of the choices from the screener.

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★★

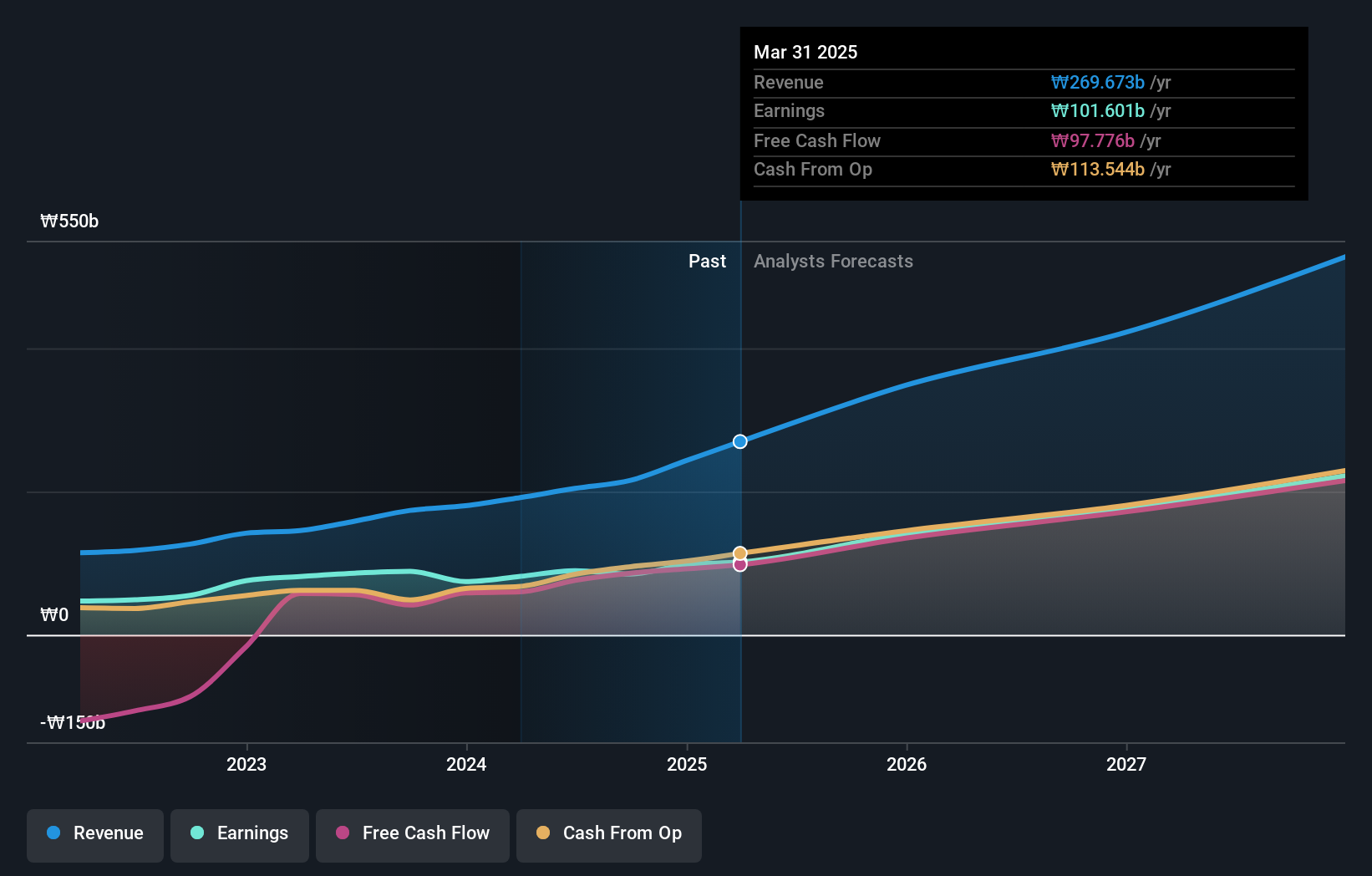

Overview: CLASSYS Inc. is a global provider of medical aesthetics devices with a market cap of ₩3.91 trillion.

Operations: The company generates revenue from its Surgical & Medical Equipment segment, amounting to ₩317.80 billion.

Insider Ownership: 10.7%

Revenue Growth Forecast: 26% p.a.

CLASSYS demonstrates strong growth potential with earnings projected to grow 30.9% annually, outpacing the KR market. Despite a recent dip in quarterly sales to KRW 243.35 million, net income surged significantly, reflecting operational efficiency. The company's innovative Ultraformer MPT device is expanding in Canada, enhancing its market presence and revenue streams. Trading below estimated fair value, CLASSYS remains attractive for growth-focused investors seeking exposure to high insider ownership within Asia's dynamic markets.

- Take a closer look at CLASSYS' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that CLASSYS is priced lower than what may be justified by its financials.

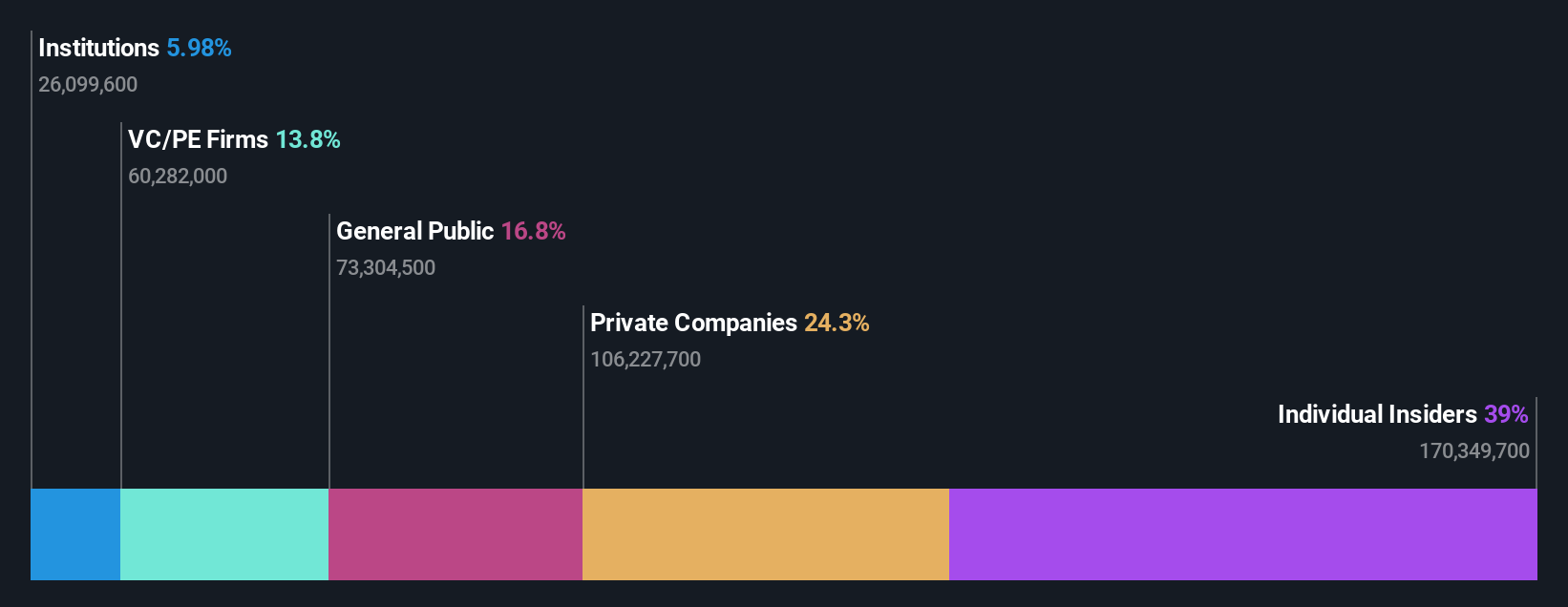

JST Group (SEHK:6687)

Simply Wall St Growth Rating: ★★★★★★

Overview: JST Group Corporation Limited, along with its subsidiaries, provides e-commerce SaaS ERP services and has a market cap of HK$13.07 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, generating CN¥1.01 billion.

Insider Ownership: 39%

Revenue Growth Forecast: 21% p.a.

JST Group shows robust growth prospects, with earnings projected to grow significantly at 90.5% annually, surpassing the Hong Kong market average. The recent IPO raised HK$2.09 billion, reflecting investor confidence despite negative shareholders' equity and debt coverage concerns. Trading below estimated fair value enhances its appeal for investors focused on high insider ownership in Asia's vibrant markets. Revenue is expected to increase by 21% annually, further supporting its growth trajectory amidst evolving corporate governance structures.

- Click to explore a detailed breakdown of our findings in JST Group's earnings growth report.

- The analysis detailed in our JST Group valuation report hints at an inflated share price compared to its estimated value.

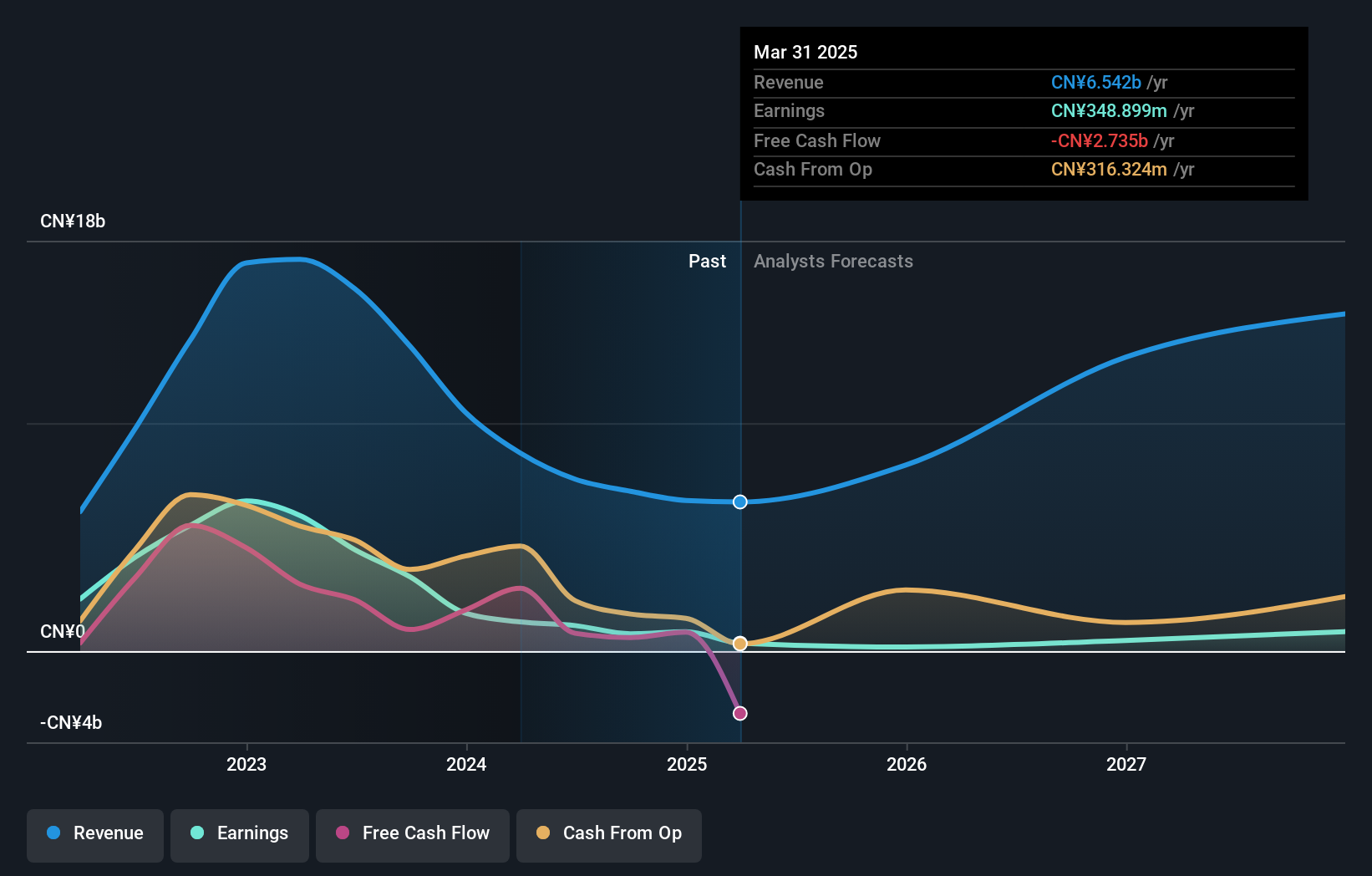

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canmax Technologies Co., Ltd. focuses on the R&D, production, and sale of new energy lithium battery materials, anti-static ultra-clean technology, and medical equipment globally with a market cap of CN¥43.02 billion.

Operations: Canmax Technologies generates revenue through its involvement in the research, development, production, and sale of lithium battery materials, anti-static ultra-clean technology, and medical equipment both domestically and internationally.

Insider Ownership: 32.9%

Revenue Growth Forecast: 34.1% p.a.

Canmax Technologies is positioned for substantial growth, with revenue expected to rise by 34.1% annually, outpacing the Chinese market average. Despite recent earnings challenges, insider ownership remains significant as Contemporary Amperex Technology acquired a 13.54% stake for CNY 2.6 billion in November 2025. The company is projected to achieve profitability within three years, although its return on equity forecast remains modest at 6.4%. Share price volatility persists amidst evolving corporate developments.

- Dive into the specifics of Canmax Technologies here with our thorough growth forecast report.

- According our valuation report, there's an indication that Canmax Technologies' share price might be on the expensive side.

Where To Now?

- Embark on your investment journey to our 636 Fast Growing Asian Companies With High Insider Ownership selection here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com