ADF Group (TSX:DRX) Q3 Margin Compression Undermines Bullish Earnings Rebound Narrative

ADF Group (TSX:DRX) has just posted Q3 2026 results that put revenue at about CA$71.4 million and EPS at roughly CA$0.36, giving investors a fresh read on both top line momentum and per share profitability. Over the past few quarters, the company has seen revenue move from around CA$74.9 million in Q2 2025 to CA$80.0 million in Q3 2025, then CA$77.4 million in Q4 2025 before landing at CA$71.4 million in the latest quarter. EPS shifted from about CA$0.51 to CA$0.55, then CA$0.31 and now CA$0.36. With that backdrop, the spotlight now turns to how margins are holding up and what that means for the sustainability of these results for shareholders.

See our full analysis for ADF Group.With the headline numbers on the table, the next step is to weigh them against the prevailing narratives around ADF Group and see which stories the latest margins and growth trends actually support.

See what the community is saying about ADF Group

Margins Softening on Trailing Basis

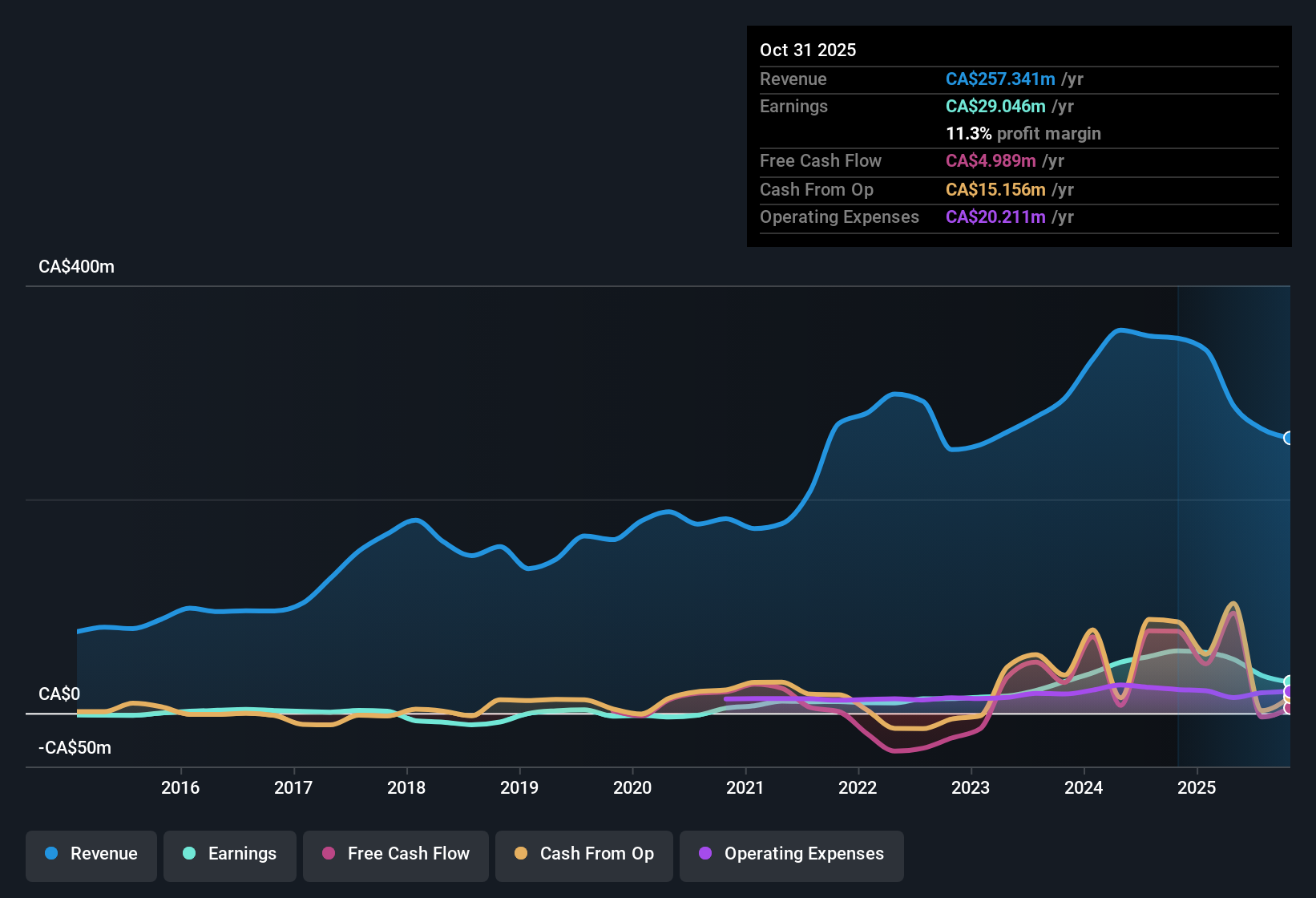

- Over the last 12 months, net profit margin was 11.3%, down from 16.6% a year earlier, even though Q3 2026 net income of about CA$10.3 million looks solid on its own.

- Bears focus on this margin squeeze and the fact earnings were negative over the most recent year, yet

- five year earnings still grew around 38.5% per year, showing a very different long term story,

- so the bearish concern about structurally weak profitability is not fully reflected in the multi year track record.

Fast Revenue Outlook Versus Slower Earnings

- Revenue is forecast to grow roughly 34.1% per year, but trailing 12 month net income of about CA$29.0 million is well below the CA$58.2 million level from a year earlier, so profit has not kept pace with the growth story.

- Consensus narrative highlights work sharing and new USMCA related exemptions as tools to protect margins, yet

- the move from a 16.6% to 11.3% net margin shows that costs have still bitten into profitability recently,

- so the idea that these initiatives fully offset higher tariffs and FX pressures is only partly backed by the latest numbers.

Mixed Signals From Valuation Metrics

- At a share price of CA$8.54, ADF trades at about 8.4 times earnings, below peers on 29 times and the Canadian Metals and Mining industry on 20.9 times, but still above a DCF fair value of roughly CA$3.27.

- Bulls point to the low P E versus the market as a value angle, but

- the DCF fair value gap and weaker trailing earnings of about CA$29.0 million versus CA$58.2 million a year ago mean the valuation case leans heavily on a rebound,

- so the bullish view that the stock is simply cheap on earnings multiples has to be weighed against the more cautious DCF signal.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ADF Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and, if you think the story should read differently, use that view to build a quick narrative in minutes, Do it your way

A great starting point for your ADF Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

ADF Group’s softer margins, weaker trailing earnings and reliance on a rebound make the current growth and valuation story less dependable than bulls suggest.

If you want steadier momentum, use our stable growth stocks screener (2095 results) to quickly focus on companies that are already delivering consistent revenue and earnings progress, rather than hoping this recovery plays out.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com