How Siemens’ Higher Dividend and Buybacks Will Impact Siemens (XTRA:SIE) Investors

- Siemens Aktiengesellschaft has announced an increased annual dividend of €5.35 per share, payable on 17 February 2026, alongside continued execution of its share buyback program, which has repurchased 19.19 million shares since February 2024.

- This combination of a higher cash payout and ongoing share repurchases underscores Siemens’ emphasis on returning capital to shareholders while it invests in automation and digitalization opportunities such as control room solutions.

- We’ll now examine how the higher annual dividend influences Siemens’ investment narrative around automation strength and capital allocation priorities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Siemens Investment Narrative Recap

To own Siemens, you need to believe in its ability to convert long term demand for automation and digitalization into steady cash generation, despite cyclical and geopolitical headwinds. The higher €5.35 dividend and ongoing buybacks support the income and capital return story, but do not materially change the key short term catalyst, which is a recovery in Digital Industries demand, or the biggest risk, which remains weaker automation spending in China and Europe.

The most relevant announcement alongside the dividend is the continued share buyback, which has retired 19.19 million shares since February 2024. Together, these capital returns sit against a backdrop of modest forecast revenue growth, a high but manageable debt load, and intense competition in automation and industrial software, which could pressure margins if underlying demand stays sluggish.

Yet behind the generous dividend and buybacks, investors should be aware of the risk that prolonged weak automation demand in key regions could ...

Read the full narrative on Siemens (it's free!)

Siemens’ narrative projects €93.6 billion revenue and €10.5 billion earnings by 2028.

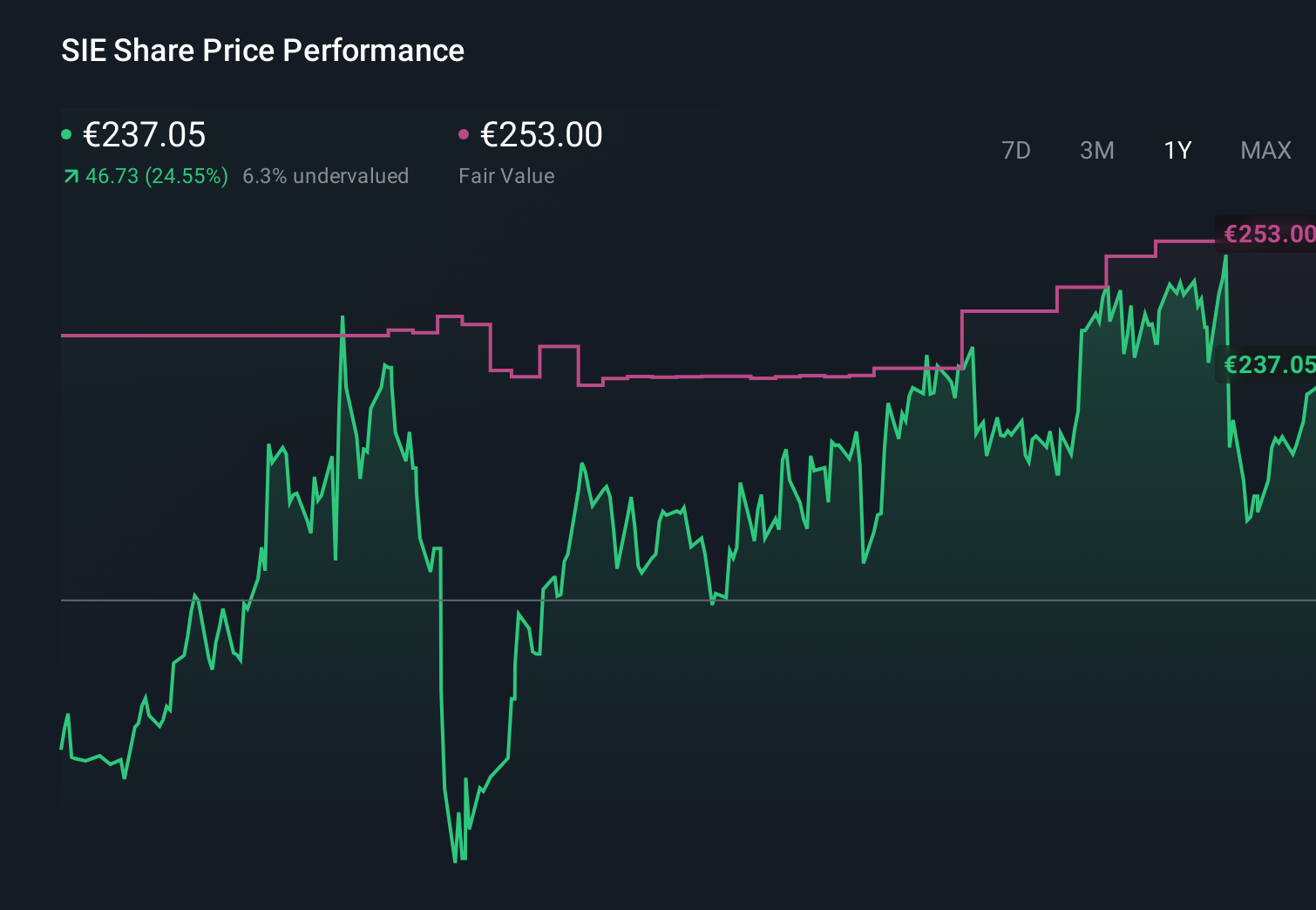

Uncover how Siemens' forecasts yield a €253.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly €208 to €298, underlining how far apart individual views on Siemens can be. You can weigh those opinions against the risk that ongoing macro and geopolitical uncertainty could delay large customer projects and affect earnings visibility.

Explore 9 other fair value estimates on Siemens - why the stock might be worth 13% less than the current price!

Build Your Own Siemens Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Siemens research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Siemens research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Siemens' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com