Freddie Mac (FMCC): Assessing Valuation After Michael Burry’s High-Profile Stake and Conservatorship Exit Thesis

Federal Home Loan Mortgage (FMCC) has suddenly jumped onto investors radar after Michael Burry disclosed a sizable stake and laid out a bullish case for its eventual transition out of government conservatorship.

See our latest analysis for Federal Home Loan Mortgage.

That endorsement has landed on top of a huge year for the stock, with a year to date share price return of more than 200 percent and a one year total shareholder return above 300 percent, even after a sharp pullback in the last quarter. This suggests that momentum is still alive but more sensitive to shifting views on regulation and long term profitability.

If Burry’s bet has you rethinking where the next big move might come from, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover other high conviction stories.

With Freddie Mac still loss making but trading at a steep implied discount to future earnings power, has Burry uncovered a mispriced turnaround, or is the market already factoring in a smooth exit from conservatorship and faster growth?

Price-to-Sales of 1.6x: Is it justified?

Federal Home Loan Mortgage is trading on a price to sales multiple of 1.6 times, which screens as materially undervalued relative to both peers and our internal fair ratio work.

The price to sales ratio compares the company’s market value to the revenue it generates, a useful lens for businesses that are currently loss making but still producing substantial top line. For Freddie Mac, this framing matters because profits are negative and forecast to stay that way, so investors are effectively paying for revenue scale and potential future earnings power rather than current net income.

In that context, the current 1.6 times sales looks conservative when compared with the US diversified financials industry average of 2.5 times, and especially with our SWS fair price to sales ratio estimate of 5.5 times. Those gaps indicate the market is pricing in a far weaker long term outcome than either peers trade on or than our fair ratio model implies the shares could move toward.

Explore the SWS fair ratio for Federal Home Loan Mortgage

Result: Price-to-Sales of 1.6x (UNDERVALUED)

However, regulatory setbacks around conservatorship or a prolonged period of loss making could quickly challenge assumptions about the eventual earnings power of Freddie Mac.

Find out about the key risks to this Federal Home Loan Mortgage narrative.

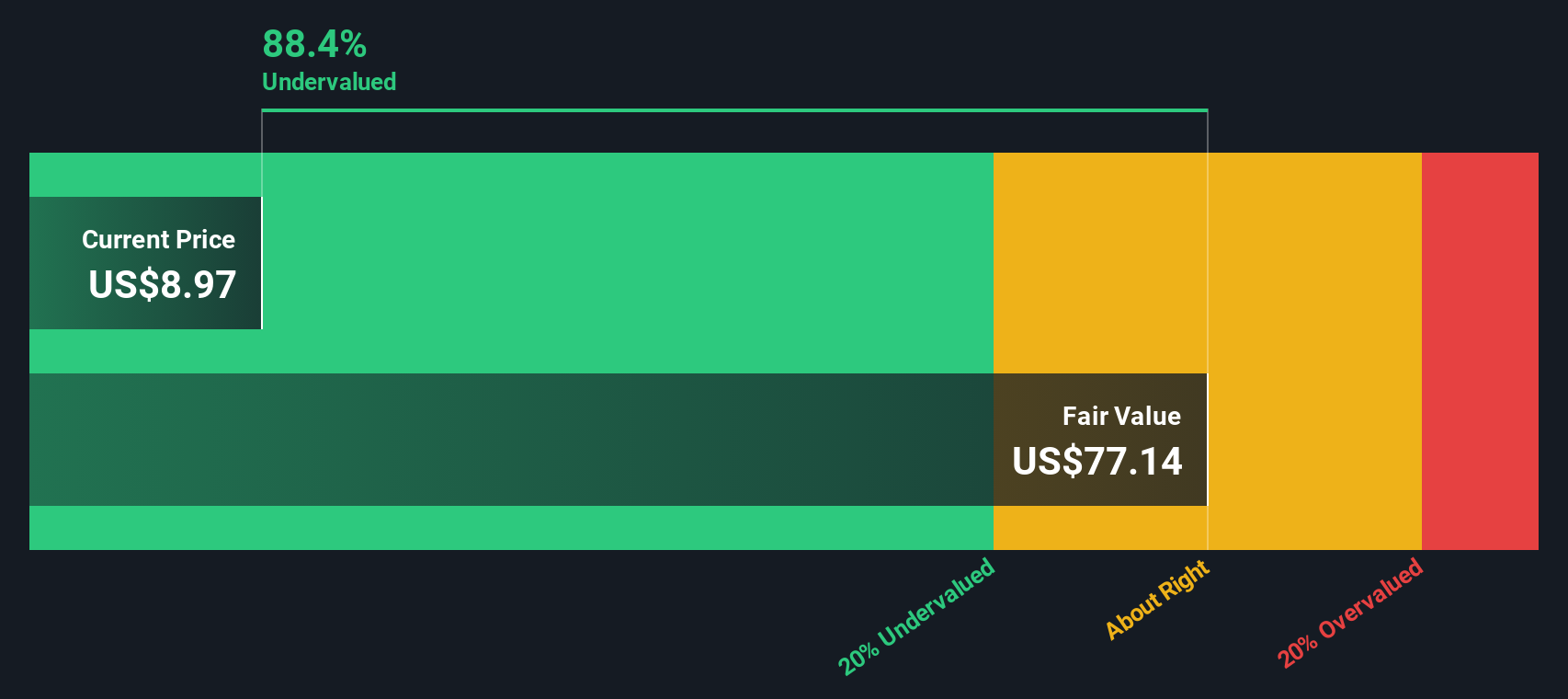

Another View: DCF Points to Extreme Upside

Our DCF model paints a far more aggressive picture, putting fair value near $119.21 per share versus today’s $10.99. This implies that FMCC trades around 90 percent below intrinsic value. If that gap is even half right, is the market overlooking a major repricing opportunity?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Home Loan Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Home Loan Mortgage Narrative

If you see the numbers differently or want to stress test your own assumptions, use our tools to build a full narrative in minutes: Do it your way.

A great starting point for your Federal Home Loan Mortgage research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready for your next smart move? Use the Simply Wall St Screener to uncover targeted stock ideas so you are not leaving potential returns on the table.

- Capture high-upside opportunities early by scanning these 3609 penny stocks with strong financials that already show financial strength instead of relying on hype alone.

- Position your portfolio for structural growth by targeting these 25 AI penny stocks poised to benefit from expanding real world adoption of artificial intelligence.

- Lock in potential income and stability by focusing on these 12 dividend stocks with yields > 3% that can support your long term cash flow goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com