Oracle (ORCL) Margin Expansion Reinforces Bullish AI Infrastructure Narrative After Q2 2026 Earnings

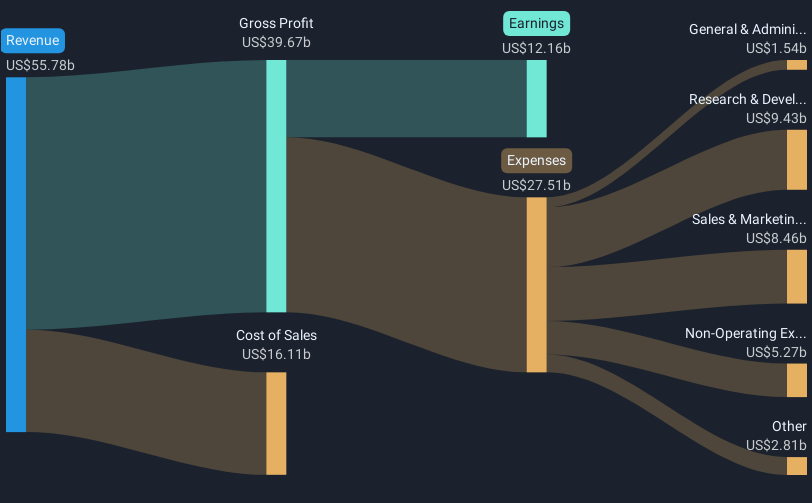

Oracle (ORCL) has just posted a hefty Q2 2026 print, with revenue at about $16.1 billion, basic EPS of $2.14 and net income (excluding extra items) of roughly $6.1 billion setting the tone for this earnings season. The company has seen revenue climb from about $14.1 billion in Q2 2025 to $16.1 billion in Q2 2026, while EPS moved from $1.13 to $2.14 over the same period. This puts solid historical context around the latest numbers and sets up a story where expanding profit margins take center stage.

See our full analysis for Oracle.With the headline figures on the table, the next step is to set these results against the dominant narratives around Oracle to see which stories the numbers support and which ones they start to challenge.

See what the community is saying about Oracle

Margins Step Up With 25.3% Net Profit

- Over the last 12 months, Oracle turned $61.0 billion of revenue into $15.4 billion of net income excluding extra items, which works out to a 25.3% net profit margin compared with 21.2% a year earlier.

- Consensus narrative highlights AI driven cloud demand and higher value enterprise contracts as key margin drivers, and the recent move from 21.2% to 25.3% net margin alongside revenue rising from $54.9 billion to $61.0 billion over the same trailing periods strongly supports that bullish view.

- The story that Oracle is converting AI related remaining performance obligations into higher value cloud and database revenue lines up with net income climbing from $11.6 billion to $15.4 billion year on year.

- Claims that operating scale is improving also fit with basic EPS on a trailing basis increasing from $4.21 to $5.46 while revenue grew at a slower pace.

With margins holding above 25% on $61 billion of trailing revenue, bulls see room for AI infrastructure demand to keep lifting profits before growth slows. 🐂 Oracle Bull Case

32.7% Earnings Growth Faces Debt And Non Cash Scrutiny

- Trailing net income excluding extra items rose from $11.6 billion to $15.4 billion over the last year, a 32.7% increase, while earnings are forecast to grow about 22.4% per year, yet this comes with a flagged high level of non cash earnings and a substantial debt load.

- Bears argue that heavy dependence on AI infrastructure demand and rising capital intensity could pressure free cash flow, and the combination of high non cash earnings and meaningful debt in the risk summary gives that cautious view real footing.

- Concerns about large, multi year AI and database migration projects line up with guidance that revenue is expected to grow roughly 26.8% per year, meaning any slowdown from key AI customers could quickly show up against those ambitious growth expectations.

- With free cash flow already noted as under pressure by a major capital expenditure ramp and a high debt balance in the analysis, skeptics see the current 32.7% earnings growth rate as potentially harder to sustain than the headline suggests.

As Oracle leans into big ticket AI infrastructure and multi year projects, skeptics are watching how quickly high reported earnings translate into cash amid sizable debt. 🐻 Oracle Bear Case

Valuation Balances 36.8x P/E Against DCF Upside

- At a share price of $198.85 and a price to earnings ratio of 36.8 times, Oracle trades above the broader US software industry average of 31.9 times yet below the peer group average of 72.4 times, while still sitting about 9% below a DCF fair value of $218.70.

- Consensus narrative that Oracle can sustain double digit revenue and margin expansion helps justify a premium multiple, but the mix of a P/E above the industry and below peers shows investors are already baking in stronger growth than the average software name without fully endorsing the most optimistic AI scenarios.

- Forecast revenue growth of roughly 26.8% per year and earnings growth of about 22.4% per year explain why the market is willing to pay more than the 31.9 times industry average despite the flagged earnings quality and debt risks.

- The gap between the current $198.85 price and the $218.70 DCF fair value is modest, which means future delivery on those growth and margin assumptions matters a lot for further rerating rather than the stock simply being statistically cheap today.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oracle on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light? Use that viewpoint to build your own narrative in just a few minutes. Start now, Do it your way.

A great starting point for your Oracle research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Despite stellar earnings growth and expanding margins, Oracle carries a heavy debt load and elevated non cash earnings that raise questions about the durability of its performance.

If you want stronger balance sheet support behind future growth, use our solid balance sheet and fundamentals stocks screener (1943 results) to quickly find companies with lower leverage and more resilient financial foundations than Oracle offers today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com