Undiscovered Gems in Middle East Stocks for December 2025

As the Middle East markets experience a positive shift, buoyed by the U.S. Federal Reserve's recent interest rate cut, Gulf indices have shown gains with Dubai and Abu Dhabi leading the charge. In this dynamic environment, identifying promising stocks involves looking for companies with solid fundamentals and growth potential that can capitalize on favorable economic conditions and strategic market positioning.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

ALEC Holdings PJSC (DFM:ALEC)

Simply Wall St Value Rating: ★★★★★☆

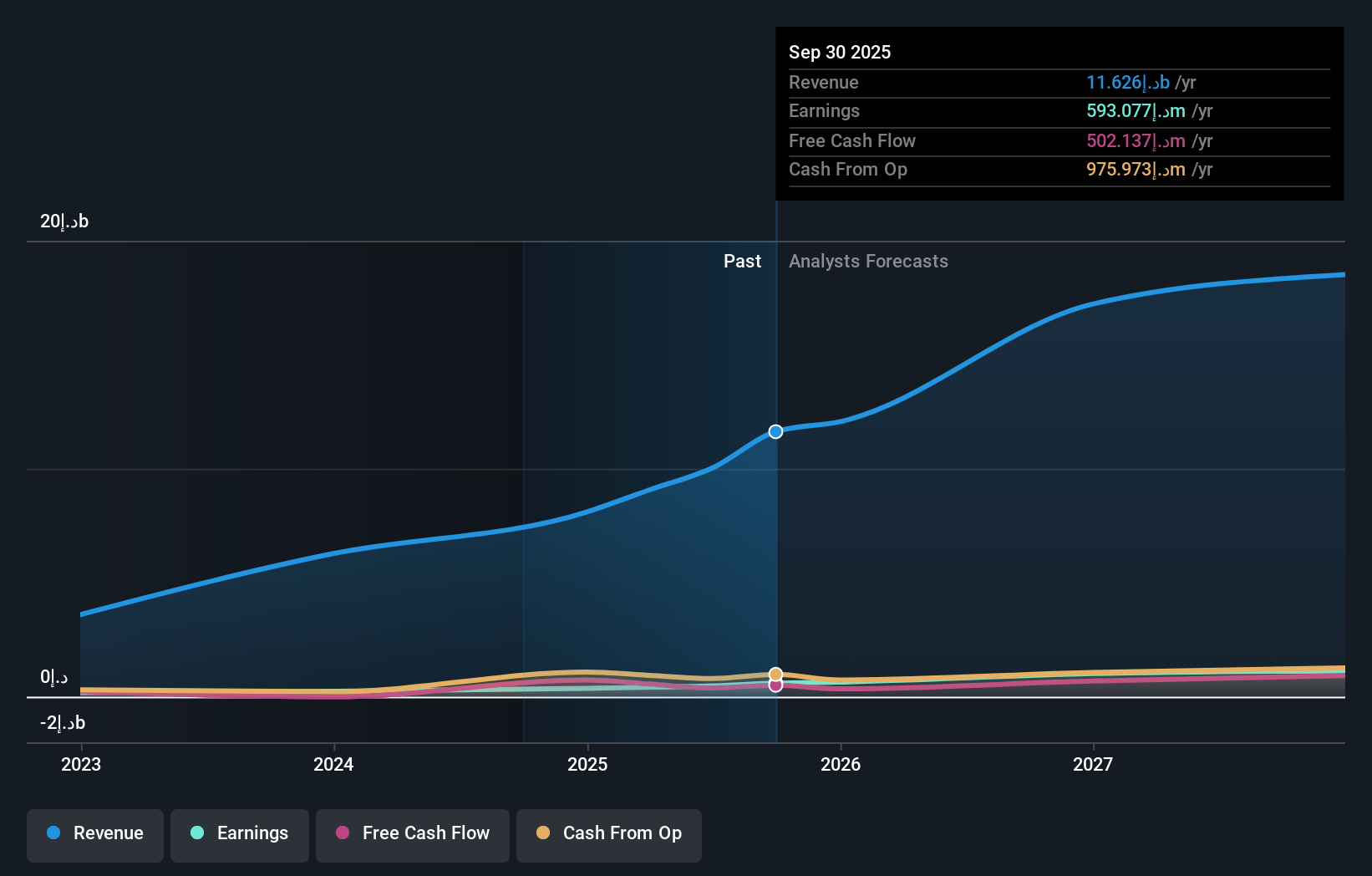

Overview: ALEC Holdings PJSC is involved in engineering and constructing building projects, airport infrastructure, industrial, energy, and commercial flagship projects with a market capitalization of AED 7.20 billion.

Operations: ALEC Holdings PJSC generates revenue primarily from building and infrastructure construction services (AED 6.17 billion) and energy projects (AED 4.20 billion). The related businesses segment contributes AED 2.62 billion to the revenue stream.

ALEC Holdings PJSC, a small player in the Middle East construction sector, recently reported impressive financial results. For the third quarter of 2025, sales reached AED 3.54 billion compared to AED 1.94 billion the previous year, while net income rose to AED 192 million from AED 71 million. Earnings per share for nine months increased to AED 0.086 from AED 0.04 last year. The company completed a significant IPO worth AED 1.4 billion in October and is trading at nearly half its estimated fair value, suggesting potential undervaluation despite robust earnings growth of over 79% last year and strong cash flow generation.

- Click here and access our complete health analysis report to understand the dynamics of ALEC Holdings PJSC.

Examine ALEC Holdings PJSC's past performance report to understand how it has performed in the past.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

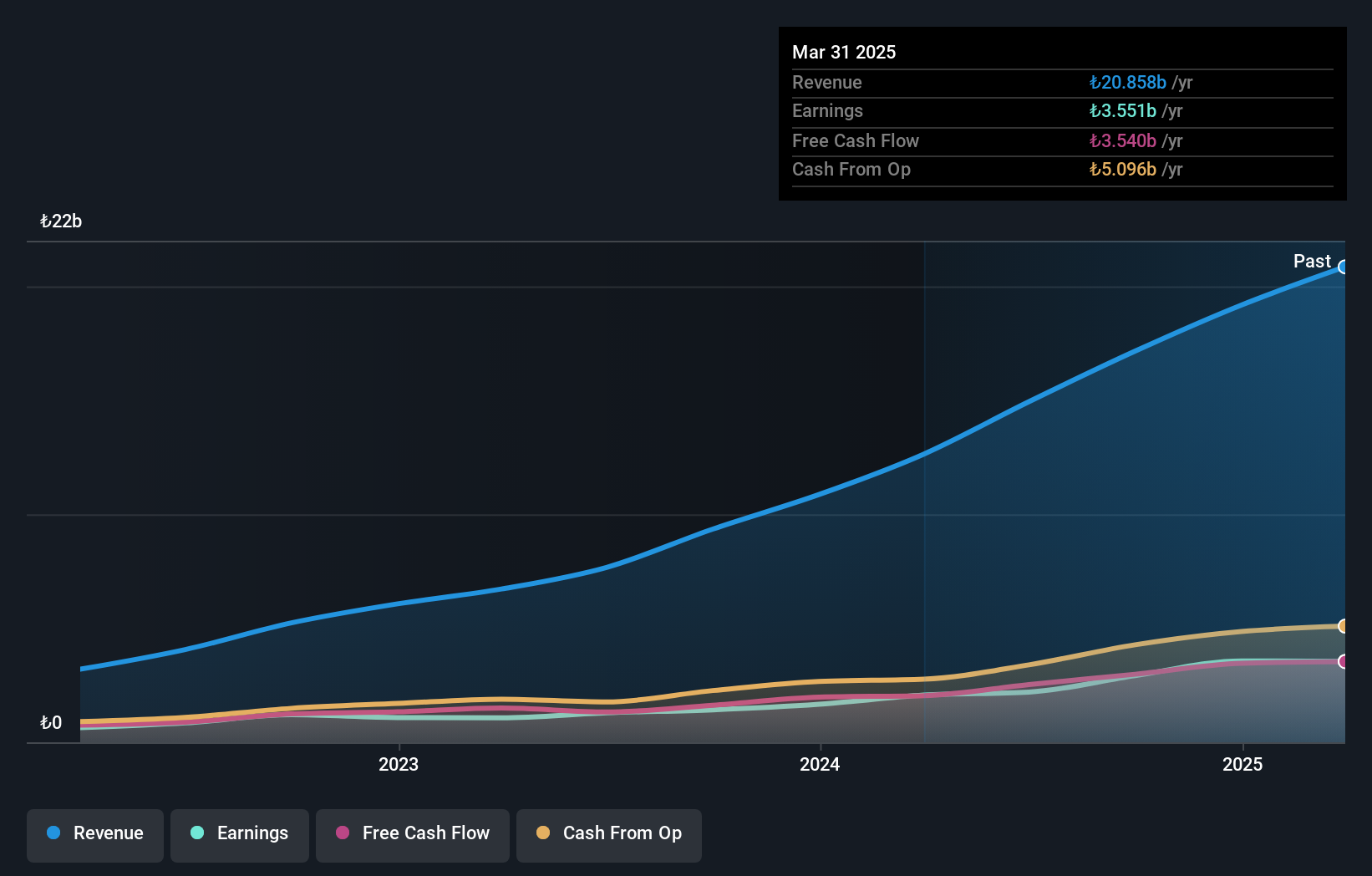

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to domestic and international airlines as well as private air cargo companies primarily in Turkey, with a market capitalization of TRY38.69 billion.

Operations: Çelebi Hava Servisi generates revenue primarily from airport ground services, including ground handling, which contributes TRY15.02 billion, and cargo and warehouse services, which add TRY7.13 billion.

Çelebi Hava Servisi, a notable player in the infrastructure sector, has demonstrated resilience with its debt to equity ratio dropping significantly from 258.3% to 66.3% over five years. The company's net income for the third quarter reached TRY 1,404 million, slightly up from TRY 1,395 million last year. With a price-to-earnings ratio of 12.2x compared to the TR market's 18.2x and strong EBIT coverage of interest payments at 11.4 times, Çelebi appears undervalued and financially robust within its industry context. Despite a dip in nine-month net income this year compared to last year's TRY 2,515 million, their financial metrics suggest stability and potential for future growth.

Bet Shemesh Engines Holdings (1997) (TASE:BSEN)

Simply Wall St Value Rating: ★★★★★★

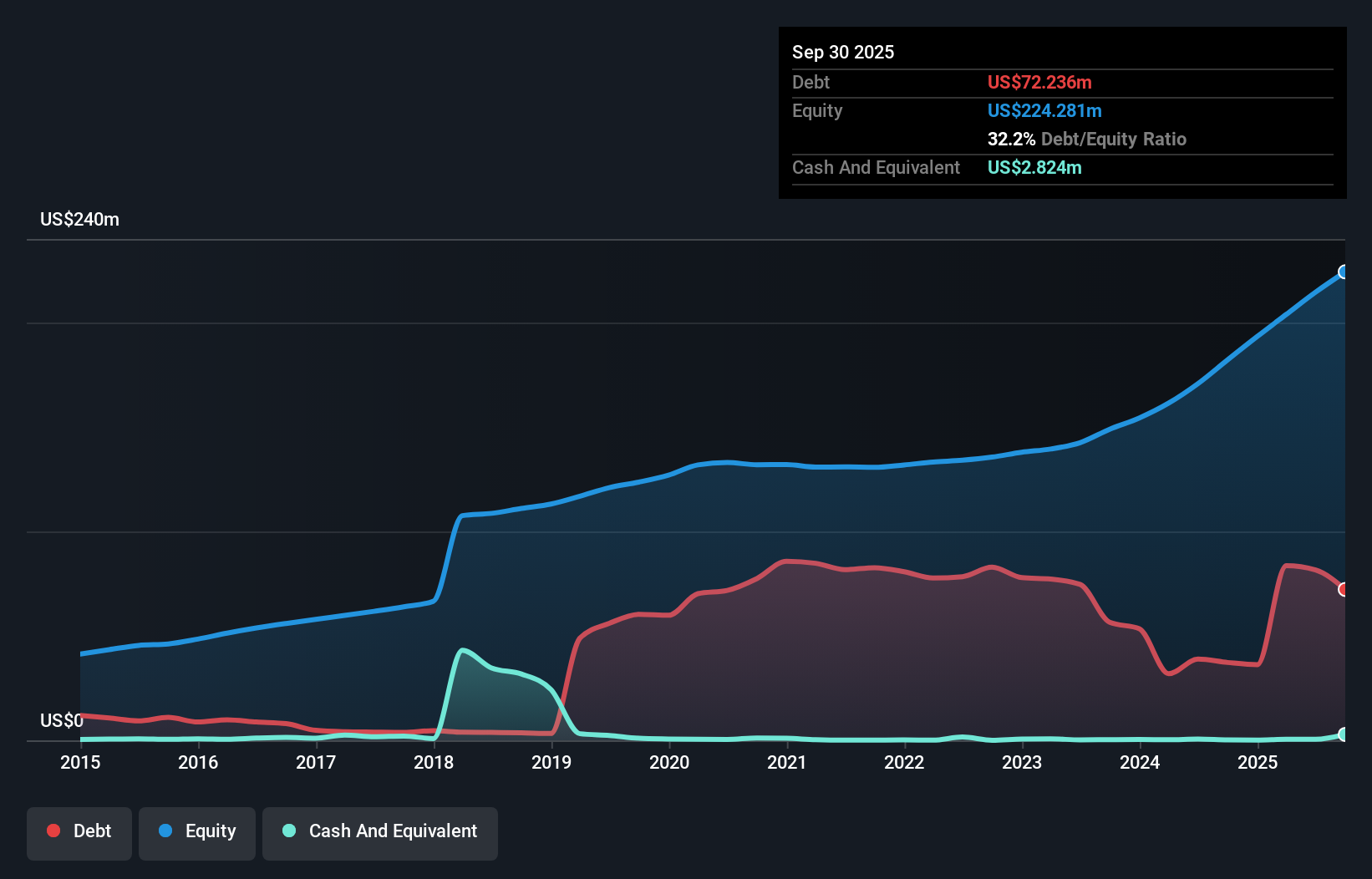

Overview: Bet Shemesh Engines Holdings (1997) Ltd focuses on producing jet engine parts in Israel and has a market capitalization of ₪5.64 billion.

Operations: Bet Shemesh Engines generates revenue primarily from two segments: Engines ($132.78 million) and Manufacturing of Parts ($180.94 million). The company has a market capitalization of ₪5.64 billion.

Bet Shemesh Engines Holdings, a notable player in the aerospace sector, has shown robust financial health with a satisfactory net debt to equity ratio of 30.9% and impressive earnings growth of 52.2% annually over five years. Despite not outpacing industry growth last year, the company maintains high-quality earnings and well-covered interest payments at seven times EBIT coverage. Recent reports indicate sales for Q3 reached US$84.67 million from US$67.68 million previously, although net income slightly decreased to US$10.06 million from US$10.39 million a year ago, reflecting stable yet cautious progress in its financial journey.

Turning Ideas Into Actions

- Delve into our full catalog of 181 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com