Reassessing The Trade Desk (TTD) Valuation After Steep Share Price Slide and Competitive Pressures

Trade Desk (TTD) is back in the spotlight after a steep share price slide, with investors trying to reconcile short term pressure from higher costs and tougher competition with its long term connected TV and retail media ambitions.

See our latest analysis for Trade Desk.

The latest move takes Trade Desk’s 30 day share price return to a steep negative 16.24%, compounding a year to date share price loss of 68.56% and a 12 month total shareholder return of negative 72.28%. This indicates clearly fading momentum despite ongoing CTV and AI driven growth efforts.

If Trade Desk’s volatility has you rethinking your options, this could be a good moment to explore high growth tech and AI stocks as potential alternatives or complements in the same broader theme.

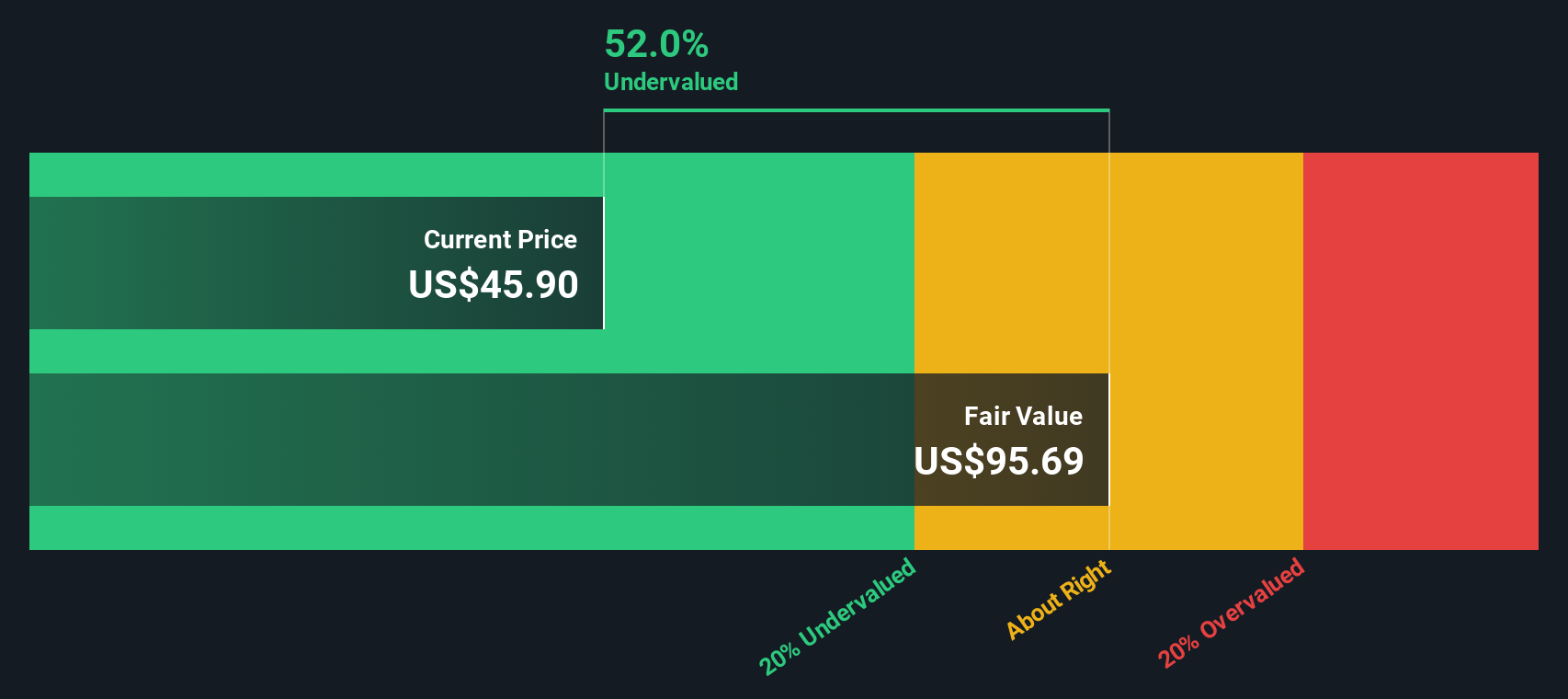

With shares now trading at a steep discount to analyst targets despite double digit revenue and profit growth, the real question is whether Trade Desk is now undervalued or if the market is accurately pricing in softer future growth.

Most Popular Narrative Narrative: 40.6% Undervalued

With the narrative fair value sitting well above Trade Desk’s last close of $37.02, the story hinges on robust growth and richer margins ahead.

The full rollout and high adoption of the new AI powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to >20% better campaign performance and causing existing clients to increase spend at a much faster rate; as the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

Want to see the revenue runway and profit uplift that support this valuation gap? The narrative is based on accelerating earnings power and a punchy future multiple. Curious how those elements combine into a large upside case? Read on to unpack the full playbook behind this fair value assessment.

Result: Fair Value of $62.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view still hinges on resilient ad budgets and slowing competitive encroachment from larger walled gardens and emerging AI driven ad platforms.

Find out about the key risks to this Trade Desk narrative.

Another Angle on Valuation

Our DCF model paints a very different picture, suggesting Trade Desk is trading about 54.6% below its fair value, with an estimated worth near $81.63 per share. If cash flow assumptions are closer to reality than multiples, could today’s pain be tomorrow’s upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Trade Desk Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Trade Desk.

Looking for more investment ideas?

Before you leave Trade Desk behind, consider your next move with fresh, data driven opportunities from the Simply Wall St screener so you are not chasing yesterday’s story.

- Capture potential mispriced opportunities by scanning these 905 undervalued stocks based on cash flows that may offer stronger upside relative to their current market expectations.

- Ride powerful secular trends by targeting these 25 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that could provide more dependable yield alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com