3 European Dividend Stocks With Up To 9.5% Yield

As the European market navigates mixed returns and inflationary pressures, investors are keenly observing opportunities that align with potential interest rate adjustments in the U.S. and UK. In this context, dividend stocks can offer a compelling option for those looking to balance income generation with market stability.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.22% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.81% | ★★★★★★ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.17% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.05% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.52% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.34% | ★★★★★★ |

| Afry (OM:AFRY) | 3.98% | ★★★★★☆ |

Click here to see the full list of 204 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. offers a range of banking and financial products and services to individual, business, and corporate clients in Italy, with a market cap of €18.92 billion.

Operations: Banco BPM S.p.A.'s revenue is derived from providing a variety of banking and financial services to individuals, businesses, and corporate clients in Italy.

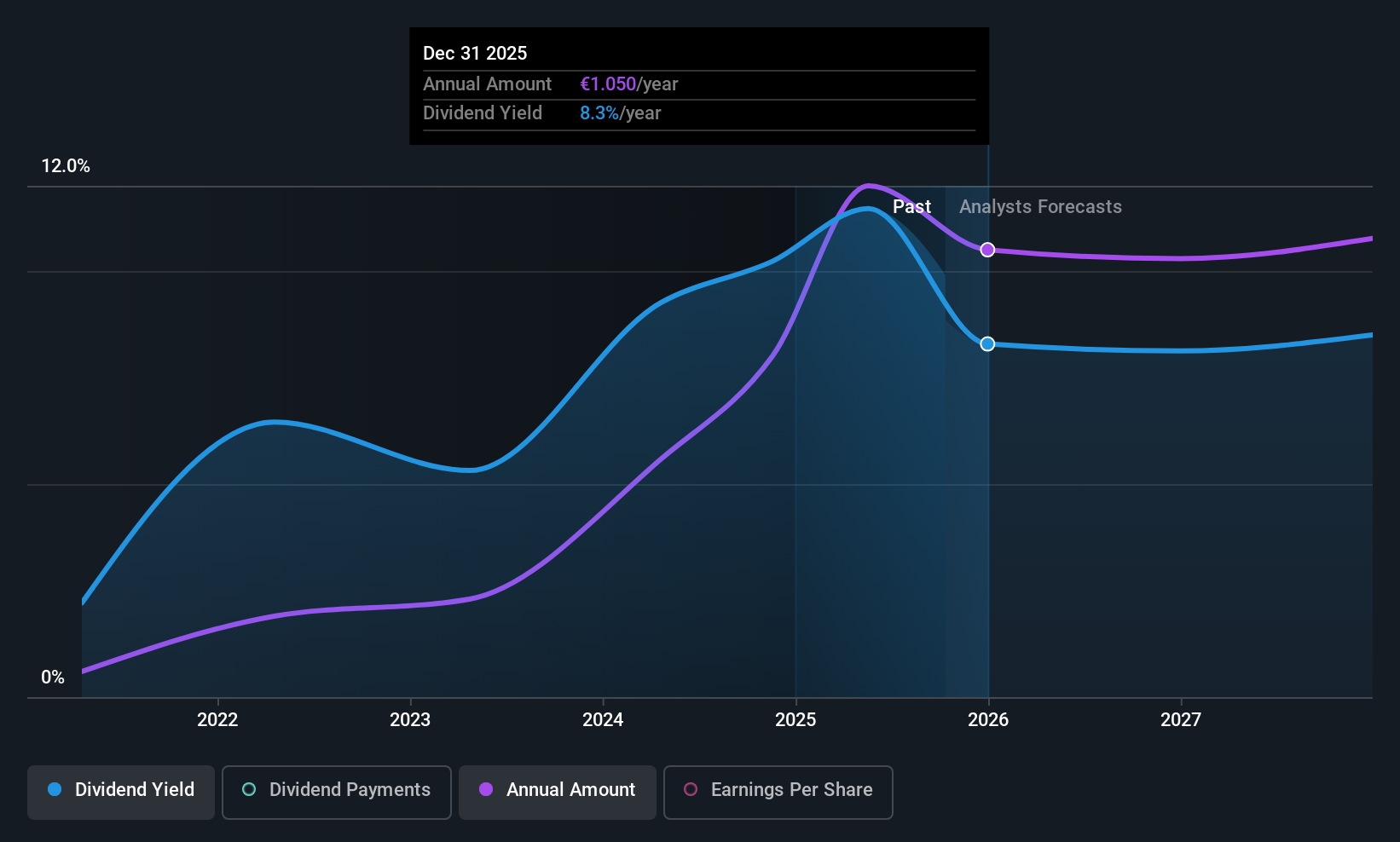

Dividend Yield: 9.5%

Banco BPM's dividend yield is among the top 25% in Italy, supported by a payout ratio of 84.6%, which suggests dividends are covered by earnings. Despite being relatively new to dividend payments with less than a decade of history, its dividends have been stable and growing. However, the bank faces challenges with a high level of bad loans at 2.5%. Recent earnings showed net income for nine months was €1.66 billion, slightly down from the previous year.

- Get an in-depth perspective on Banco BPM's performance by reading our dividend report here.

- Our expertly prepared valuation report Banco BPM implies its share price may be lower than expected.

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial banking service provider operating in Italy, Germany, Central Europe, and Eastern Europe with a market cap of €106.48 billion.

Operations: UniCredit S.p.A. generates revenue from its operations primarily in Italy (€10.71 billion), Germany (€5.28 billion), and Russia (€1.32 billion).

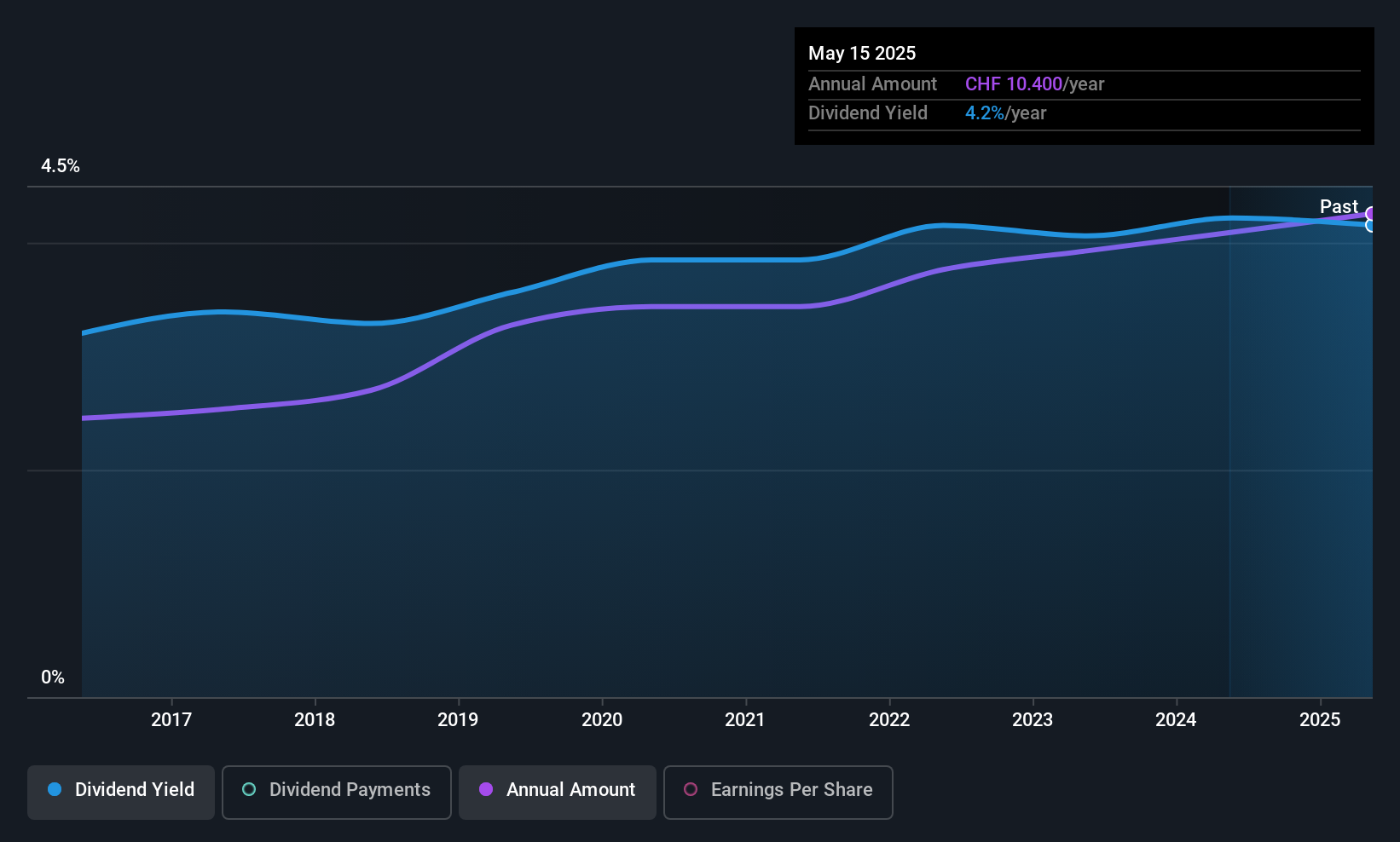

Dividend Yield: 4.2%

UniCredit's dividend yield, at 4.25%, is lower than Italy's top quartile, but its payout ratio of 42.7% ensures dividends are well covered by earnings. Despite a decade of growth in dividend payments, they have been volatile and unreliable. Recent earnings indicate a strong net income increase to €8.75 billion for nine months ending September 2025. The bank faces challenges with high bad loans at 2.3% and low allowance coverage at 78%.

- Navigate through the intricacies of UniCredit with our comprehensive dividend report here.

- The analysis detailed in our UniCredit valuation report hints at an deflated share price compared to its estimated value.

Berner Kantonalbank (SWX:BEKN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Berner Kantonalbank AG provides banking products and services to private individuals and corporate customers in Switzerland, with a market capitalization of CHF2.68 billion.

Operations: Berner Kantonalbank AG generates revenue of CHF555.79 million from its banking products and services for private individuals and corporate clients in Switzerland.

Dividend Yield: 3.6%

Berner Kantonalbank offers a reliable dividend yield of 3.59%, though it falls short of Switzerland's top quartile. The bank's dividends have been stable and consistently growing over the past decade, supported by a reasonable payout ratio of 53.3%. However, there's insufficient data to confirm future dividend coverage or sustainability from earnings or cash flows. Trading at 25% below estimated fair value, BEKN presents potential value for investors seeking steady income streams.

- Click here and access our complete dividend analysis report to understand the dynamics of Berner Kantonalbank.

- Our comprehensive valuation report raises the possibility that Berner Kantonalbank is priced lower than what may be justified by its financials.

Where To Now?

- Click this link to deep-dive into the 204 companies within our Top European Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com