Knowles (KN): Reassessing Valuation After Harvey Partners’ New Stake and Breakout Growth Signals

Knowles (KN) just landed on more institutional radar, with Harvey Partners taking a fresh stake after a quarter of 7% revenue growth and upbeat guidance that lines up with the stock’s emerging breakout setup.

See our latest analysis for Knowles.

Those bullish signals are already showing up in the tape, with Knowles’ share price at $24.04 and a roughly 20% year to date share price return feeding into a solid 1 year total shareholder return above 20%, suggesting momentum is building rather than fading.

If Harvey’s move has you thinking about what else might be setting up for a breakout, this is a good moment to explore high growth tech and AI stocks as potential next candidates.

With revenue and earnings accelerating, a fresh institutional buyer on the register, and shares still trading below the Street’s price target, is Knowles quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 9.3% Undervalued

With Knowles last closing at 24.04 dollars against a 26.50 dollars fair value, the prevailing narrative argues the stock is still priced below its long run potential, even after the recent run.

Strong and consistent bookings trends, coupled with a robust pipeline of new design wins, are expected to broaden Knowles' addressable market and drive revenue visibility over the next several quarters.

The expansion of specialty film production and the launch of new product lines, such as inductors, are set to increase Knowles' total addressable market, providing incremental growth opportunities that should support revenue acceleration and potentially higher margins as these initiatives scale.

Curious how moderate top line growth, sharply rising margins, disciplined buybacks, and a lower future earnings multiple can all still point to upside? The full narrative lays out the playbook.

Result: Fair Value of $26.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from factory inefficiencies or slower traction in new products could quickly challenge the undervaluation case that investors are leaning on.

Find out about the key risks to this Knowles narrative.

Another Angle on Valuation

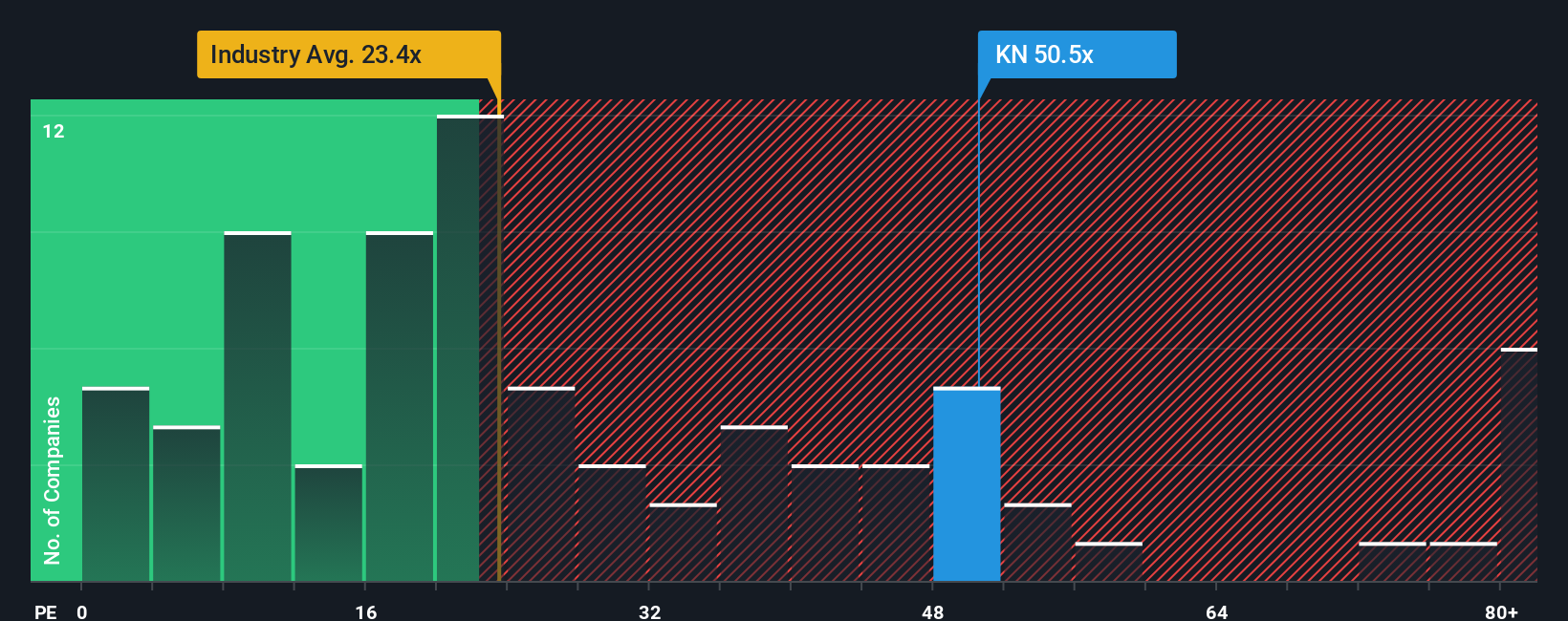

While the prevailing narrative leans on future earnings and growth to call Knowles undervalued, today’s price tells a different story. At 57.2 times earnings, the shares trade well above the US Electronic industry at 25.4 times and a fair ratio of 33 times. This points to meaningful multiple compression risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Knowles Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom Knowles view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Knowles.

Ready for your next investing move?

Don’t stop at Knowles. Use the Simply Wall Street Screener now to uncover stocks that match your strategy before the next wave of opportunities passes you by.

- Capitalize on asymmetric upside by targeting early stage opportunities using these 3609 penny stocks with strong financials before they land on everyone else’s radar.

- Harness the structural shift toward automation and data intelligence with these 25 AI penny stocks shaping the next era of productivity and innovation.

- Lock in potential bargains by focusing on cash flow supported opportunities from these 905 undervalued stocks based on cash flows before their valuations normalize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com