EssilorLuxottica (ENXTPA:EL): Reassessing Valuation After a Recent Share Price Pullback

EssilorLuxottica Société anonyme (ENXTPA:EL) has quietly pulled back over the past month, slipping around 10%, even as its one year and three year returns remain strongly positive for long term shareholders.

See our latest analysis for EssilorLuxottica Société anonyme.

The recent 30 day share price return of around minus 9.7% has cooled EssilorLuxottica Société anonyme’s earlier momentum, but its year to date share price gain and strong multi year total shareholder returns still point to a broadly constructive trend.

If EssilorLuxottica’s move has you reassessing the space, it could be worth scanning other established names across healthcare stocks for fresh long term ideas.

With shares still up strongly over three and five years but trading below analyst targets and some intrinsic estimates, investors face a key question: is EssilorLuxottica undervalued today, or is the market already baking in its next leg of growth?

Most Popular Narrative: 10.6% Undervalued

Compared with EssilorLuxottica Société anonyme’s last close at €284.9, the most widely followed narrative sees fair value notably higher at €318.65, framing the recent pullback against a still upbeat long term outlook.

Investments in smart eyewear, AI-enabled vision solutions, and MedTech (Ray-Ban Meta, Oakley Meta, Nuance Audio, acquisition of Optegra Eye Clinics) capitalize on long-term demand for technologically advanced and personalized eye health platforms, catalyzing product mix upgrades and higher ASPs, which will benefit gross margin and future earnings.

Curious how this vision tech push translates into that higher fair value, sustained margin gains, and future earnings power? The narrative’s financial roadmap may surprise you.

Result: Fair Value of €318.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside rests on successful execution, as tech adoption or regulatory setbacks in smart eyewear and MedTech could quickly challenge that constructive thesis.

Find out about the key risks to this EssilorLuxottica Société anonyme narrative.

Another Lens On Valuation

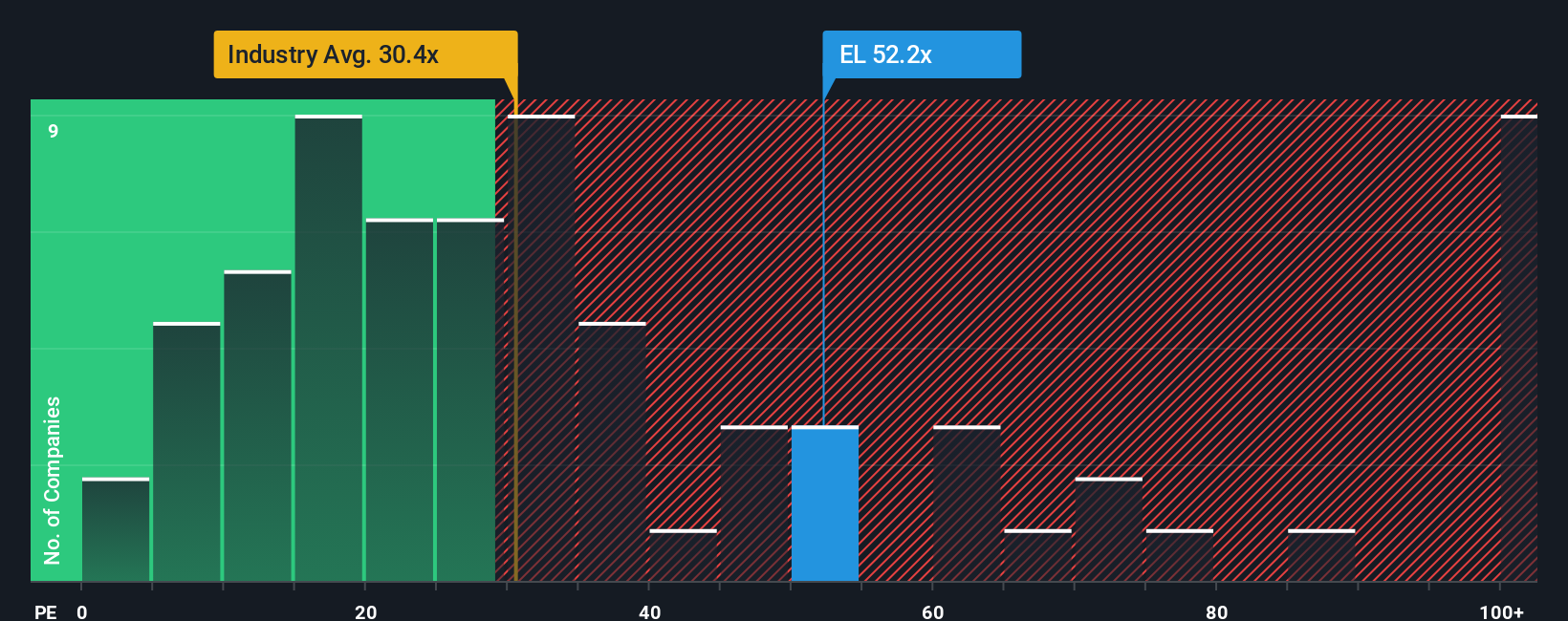

While the narrative points to a 10.6% upside, our earnings multiple view is more cautious. EssilorLuxottica trades on a rich 55.2x price to earnings ratio versus a 25x industry average and a 32.7x peer average, which is above a 45.4x fair ratio and raises the risk of a sharp de rating if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EssilorLuxottica Société anonyme Narrative

If you see EssilorLuxottica’s story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EssilorLuxottica Société anonyme.

Looking for more investment ideas?

Before you move on, lock in your next moves with focused stock ideas that could sharpen your portfolio and uncover opportunities others are still overlooking.

- Supercharge your hunt for mispriced quality by scanning these 905 undervalued stocks based on cash flows that appear cheap against their cash flows and future potential.

- Capture the next wave of innovation by targeting these 25 AI penny stocks positioned at the intersection of automation, data, and intelligent software.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that may add yield alongside capital growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com