North West (TSX:NWC): Valuation Check After Strong Q3 Earnings Growth and Confirmed Dividend

North West (TSX:NWC) just delivered third quarter earnings that quietly moved the needle, with net income and earnings per share climbing even as sales were roughly flat year over year.

See our latest analysis for North West.

That earnings beat and confirmed $0.41 quarterly dividend seem to be nudging sentiment rather than transforming it. The latest CA$48.06 share price sits alongside a modestly positive 1 year total shareholder return and a much stronger multi year record, suggesting steady momentum rather than a breakout story.

If North West’s measured progress fits your style, this could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With earnings rising faster than sales, a near 22 percent discount to analyst targets, and a long term track record of compounding returns, is North West quietly undervalued or already pricing in its next leg of growth?

Price to Earnings of 16x: Is it justified?

North West's current CA$48.06 share price equates to a roughly 16x price to earnings multiple, which screens as cheaper than comparable consumer retailers.

The price to earnings ratio compares what investors pay for each dollar of current earnings, making it a straightforward yardstick for a mature, profitable retailer like North West. With steady profitability and high quality past earnings, a discounted multiple suggests the market is not fully crediting its recent acceleration in profit growth.

Against both its direct peer group and the wider North American consumer retailing industry, North West trades on a meaningfully lower multiple. It is considered good value versus peer averages of about 22.5x and an industry average near 21.7x, implying investors can access similar or better earnings growth at a noticeably lower price point than many rivals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-earnings of 16x (UNDERVALUED)

However, sustained flat sales or a reversal in North West’s historically strong multi year returns could quickly challenge the case for multiple expansion.

Find out about the key risks to this North West narrative.

Another View on Value

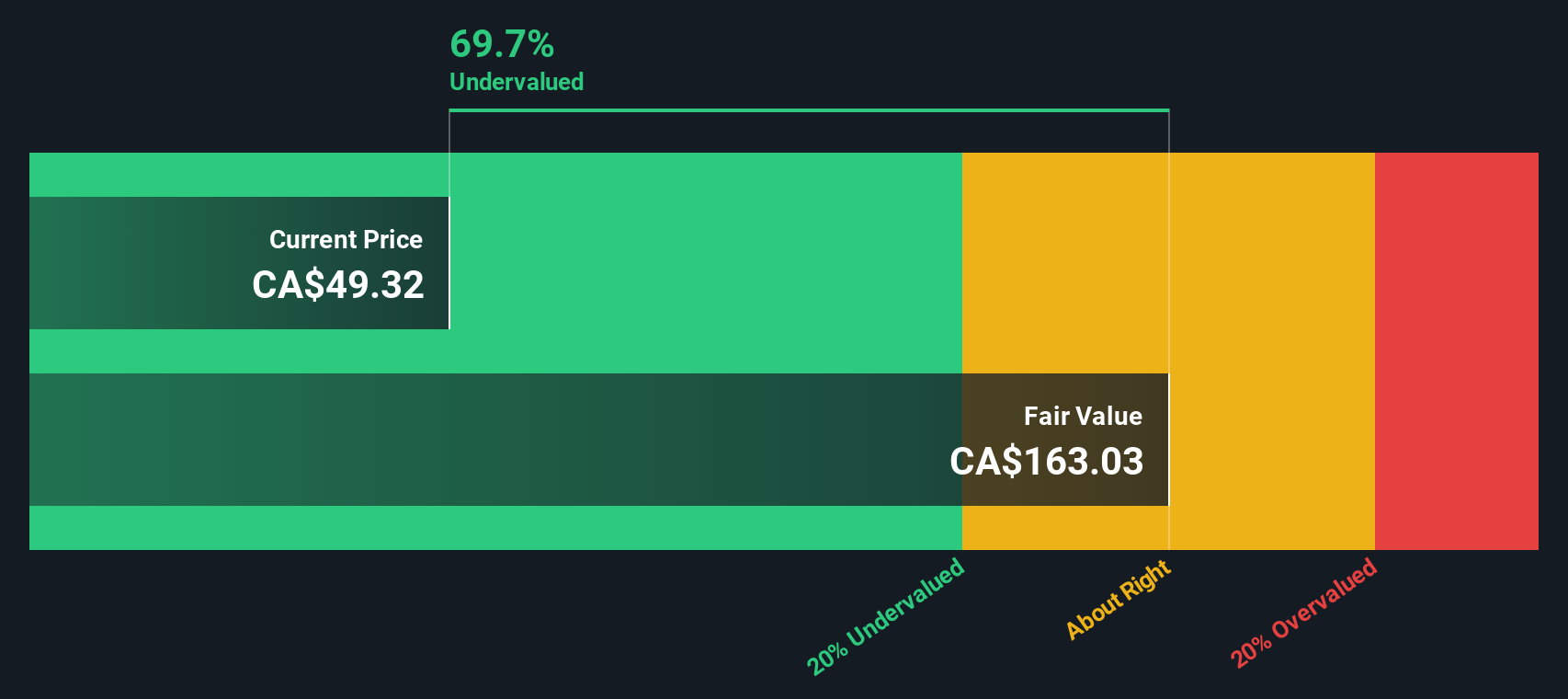

Our DCF model paints a far more dramatic picture, suggesting North West’s fair value is closer to CA$157.52, around 69 percent above today’s CA$48.06 price. If that cash flow path is even roughly right, is the market overlooking a slow burning compounder?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out North West for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own North West Narrative

If this perspective does not line up with your own view, or you prefer to dig into the numbers yourself, you can craft a personalised thesis in under three minutes: Do it your way.

A great starting point for your North West research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity by scanning targeted stock ideas on Simply Wall St’s screener so great candidates do not slip past you.

- Explore higher risk and potentially higher reward opportunities by focusing on beaten-down names among these 3609 penny stocks with strong financials that still have solid underlying businesses.

- Consider companies involved in intelligent automation by assessing future-focused businesses in these 25 AI penny stocks that are contributing to real-world AI adoption.

- Search for quality at a lower price by looking at these 905 undervalued stocks based on cash flows that trade below their estimated cash-flow-based fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com