Byline Bancorp (BY): Reassessing Valuation After Recent Share Price Momentum

Byline Bancorp (BY) has quietly been rewarding patient investors, with the stock up about 12% over the past month and roughly 44% over the past 3 years, outpacing many regional peers.

See our latest analysis for Byline Bancorp.

With the share price now around $30.82 and a solid 30 day share price return alongside a strong three year total shareholder return, the recent upswing suggests momentum is building as investors reassess Byline’s growth profile and risk backdrop.

If this kind of steady momentum appeals to you, it might be a good moment to broaden your radar and explore fast growing stocks with high insider ownership.

But with shares trading just below analyst targets and our model suggesting a sizable intrinsic discount, the key question now is whether Byline is still undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 4.3% Undervalued

Byline’s narrative fair value of $32.20 sits only slightly above the last close at $30.82, hinting at modest upside if assumptions hold.

The successful integration of First Security, including immediate cost synergies and system upgrades, has expanded Byline Bancorp's lending and deposit base while improving operational efficiency, setting the stage for higher net interest income and improved net margins going forward. Byline's continued investment in digital banking upgrades, as demonstrated by the completion of a major online banking systems update, positions the company to attract and retain younger, tech-savvy customers, potentially driving future deposit growth and enhanced fee income.

Curious how steady growth, shifting margins and a richer earnings multiple combine to justify that higher value tag. Want to see the full playbook behind it.

Result: Fair Value of $32.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper credit downturn in its Midwest footprint, or slower than expected First Security integration, could pressure margins and challenge that modest undervaluation case.

Find out about the key risks to this Byline Bancorp narrative.

Another Angle on Valuation

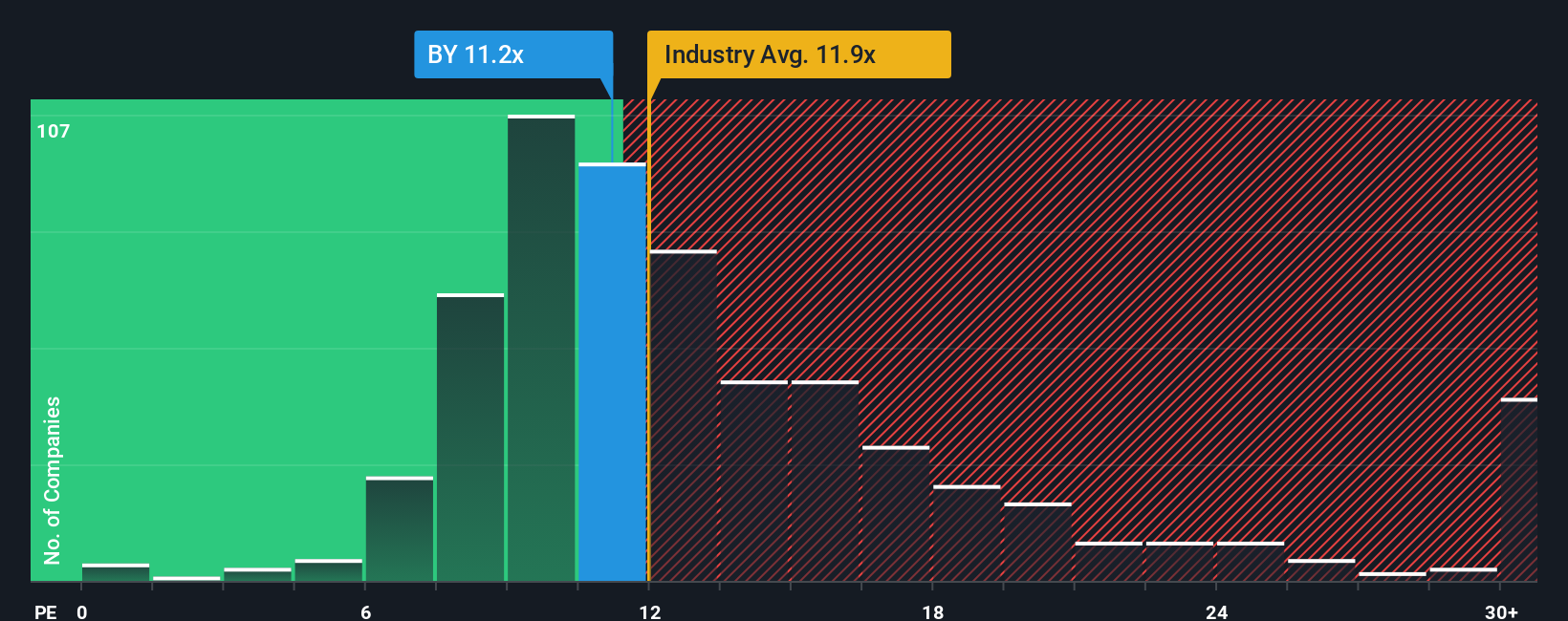

On earnings, the picture is less generous. Byline trades at about 11.2 times earnings, above our fair ratio of 10.6 but below peers at roughly 13 and the US banks industry at 11.9. That gap hints at value, but also at the risk sentiment never fully normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Byline Bancorp Narrative

If you see the numbers differently, or just prefer digging into the details yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Byline Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next move in Byline’s story, give yourself options by using the Simply Wall St screener to uncover fresh, data backed opportunities beyond a single stock.

- Target reliable cash generators with these 12 dividend stocks with yields > 3% that can help anchor your portfolio with consistent income while you pursue growth elsewhere.

- Capitalize on market mispricings through these 908 undervalued stocks based on cash flows and position yourself ahead of the crowd when sentiment finally catches up to fundamentals.

- Ride structural change in finance by using these 80 cryptocurrency and blockchain stocks to locate listed plays on blockchain innovation and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com