Global Dividend Stocks And 2 Other Strong Income Generators

As global markets navigate the anticipation of interest rate decisions and mixed economic signals, investors are keenly observing how these factors impact their portfolios. In such an environment, dividend stocks stand out as reliable income generators, offering potential stability and consistent returns amidst market fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.40% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.78% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.95% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| NCD (TSE:4783) | 4.17% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.77% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.48% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.79% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.41% | ★★★★★★ |

Click here to see the full list of 1305 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

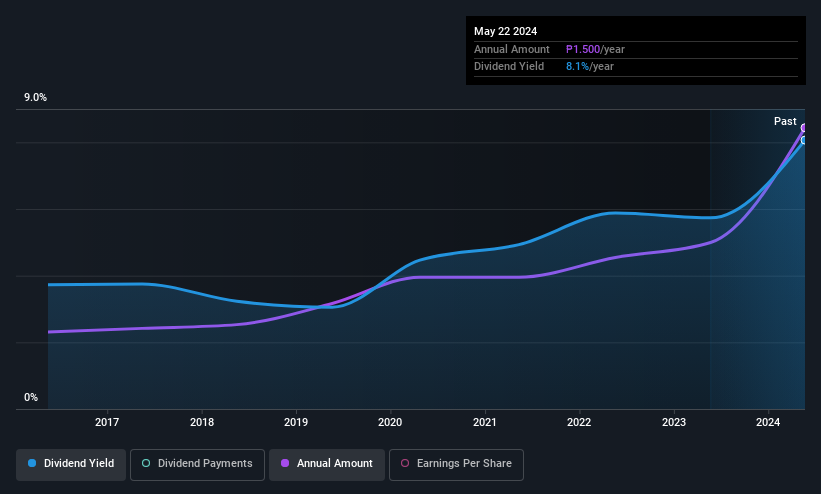

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages the South Harbor Port of Manila and the Port of Batangas in Batangas City, Philippines, with a market cap of ₱65.82 billion.

Operations: Asian Terminals, Inc. generates its revenue primarily from its Ports Business segment, which amounts to ₱18.60 billion.

Dividend Yield: 4.3%

Asian Terminals, Inc. offers a stable dividend profile with payments covered by earnings and cash flows, reflected in a payout ratio of 38.1% and cash payout ratio of 62.3%. Despite trading below estimated fair value, its dividends have been reliable and growing over the past decade. Recent earnings show increased sales but slightly lower quarterly net income year-on-year at PHP 1.35 billion for Q3 2025, indicating resilient performance amidst market fluctuations.

- Click here and access our complete dividend analysis report to understand the dynamics of Asian Terminals.

- Insights from our recent valuation report point to the potential undervaluation of Asian Terminals shares in the market.

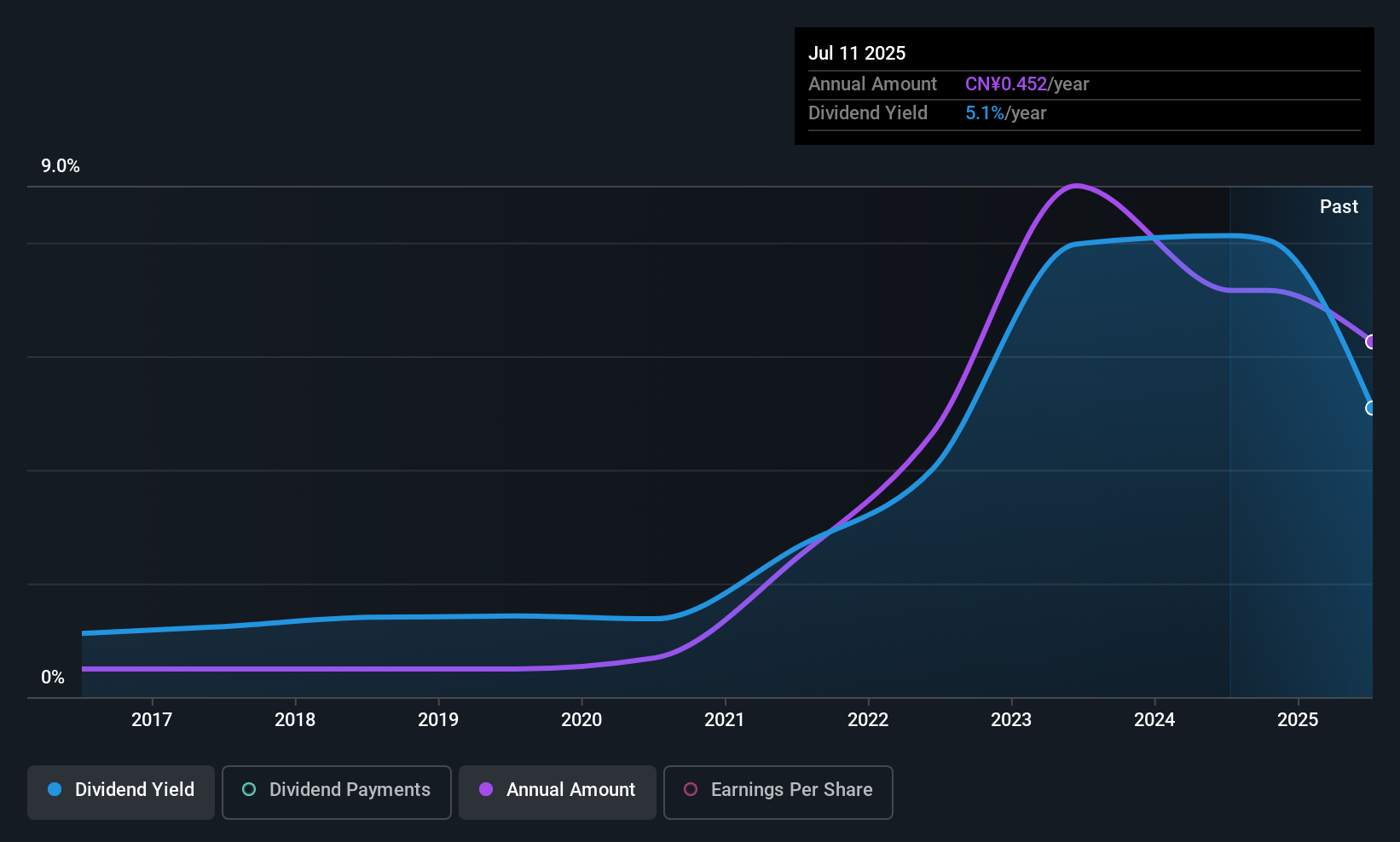

Sichuan Road & Bridge GroupLtd (SHSE:600039)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sichuan Road & Bridge Group Co., Ltd operates in the investment, development, construction, and operation of engineering projects, clean energy, and mining and new materials both in China and internationally with a market cap of CN¥83.89 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates revenue from engineering construction, clean energy, and mining and new materials sectors both domestically and internationally.

Dividend Yield: 4%

Sichuan Road & Bridge Group Ltd. presents a mixed dividend profile, with payments covered by earnings (payout ratio: 50.2%) and cash flows (cash payout ratio: 85.1%). Despite being among the top 25% of CN market dividend payers, its dividends have been volatile over the past decade. Recent earnings indicate solid growth, with net income rising to CNY 5.30 billion for the first nine months of 2025, yet debt coverage remains a concern.

- Dive into the specifics of Sichuan Road & Bridge GroupLtd here with our thorough dividend report.

- The valuation report we've compiled suggests that Sichuan Road & Bridge GroupLtd's current price could be inflated.

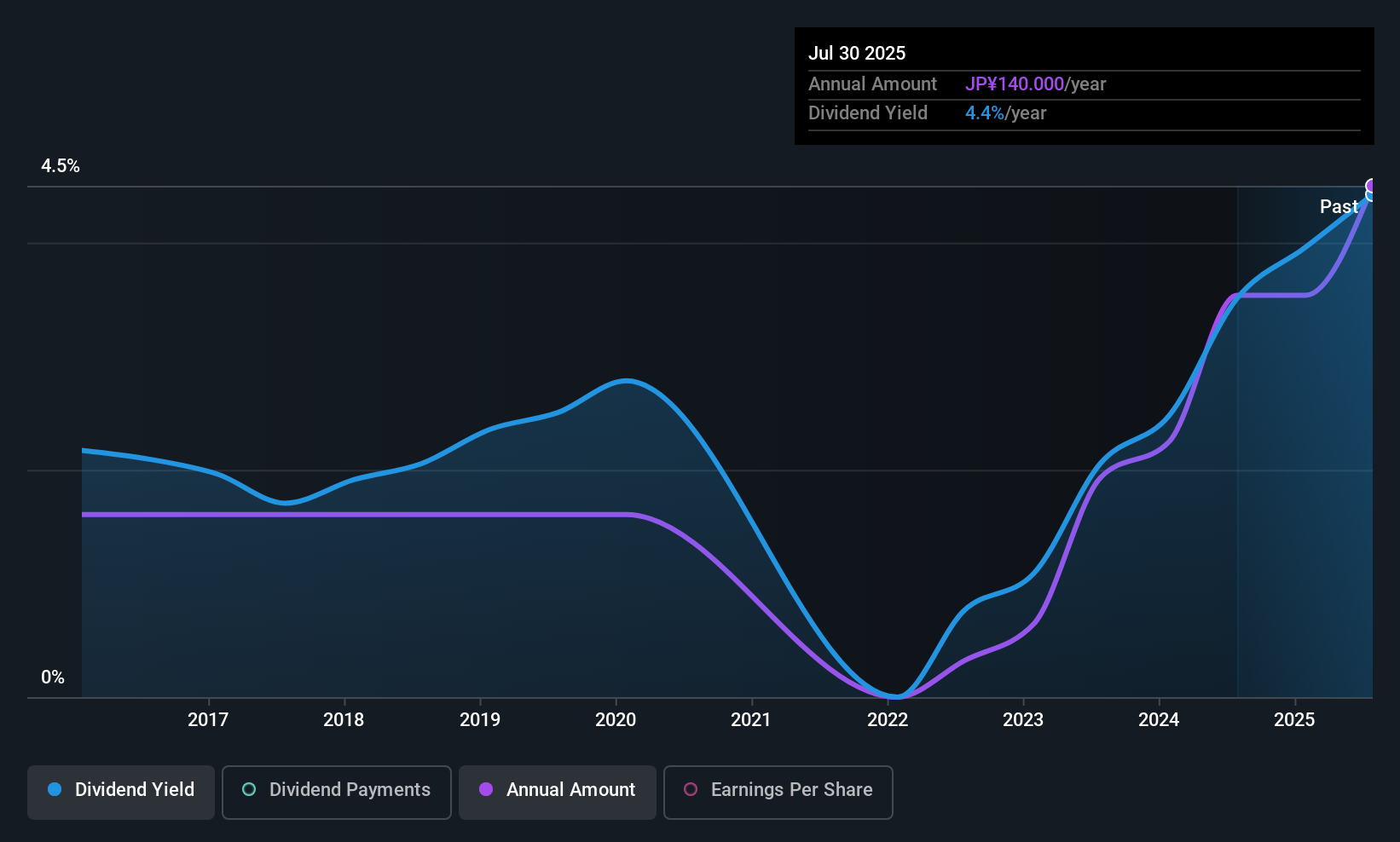

Toho (TSE:8142)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toho Co., Ltd. operates in Japan through its subsidiaries, focusing on food wholesale, cash and carry, and supermarket businesses, with a market cap of ¥36.40 billion.

Operations: Toho Co., Ltd. generates revenue primarily from its Distributor Business at ¥223.37 billion, followed by the Cash and Carry Business at ¥45.75 billion, and the Food Solution Business at ¥17.15 billion.

Dividend Yield: 4%

Toho's dividend profile shows a mixed picture. While the dividend yield is among the top 25% in Japan, payments have been volatile and unreliable over the past decade. However, dividends are well covered by earnings (payout ratio: 38.9%) and cash flows (cash payout ratio: 35.6%). Recent sales figures show strong growth, with October revenue at ¥23.37 billion, reflecting a positive trend after exiting the Food Supermarket business last year.

- Delve into the full analysis dividend report here for a deeper understanding of Toho.

- Upon reviewing our latest valuation report, Toho's share price might be too pessimistic.

Key Takeaways

- Click through to start exploring the rest of the 1302 Top Global Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com