ABC-Mart (TSE:2670): Valuation Check After Strong November 2025 Sales Growth and Renewed Investor Attention

ABC-MartInc (TSE:2670) just posted November sales that should catch investors attention, with all stores up 7% and existing stores rising about 6% from a year ago, signaling solid demand momentum.

See our latest analysis for ABC-MartInc.

That upbeat November trading update comes after a choppier year, with the share price at ¥2,730.5 leaving investors with a negative year to date share price return but a still respectable five year total shareholder return. This suggests long term momentum remains intact despite recent volatility.

If ABC-MartInc’s latest figures have you rethinking the retail space, it might be worth seeing what else is out there by exploring fast growing stocks with high insider ownership.

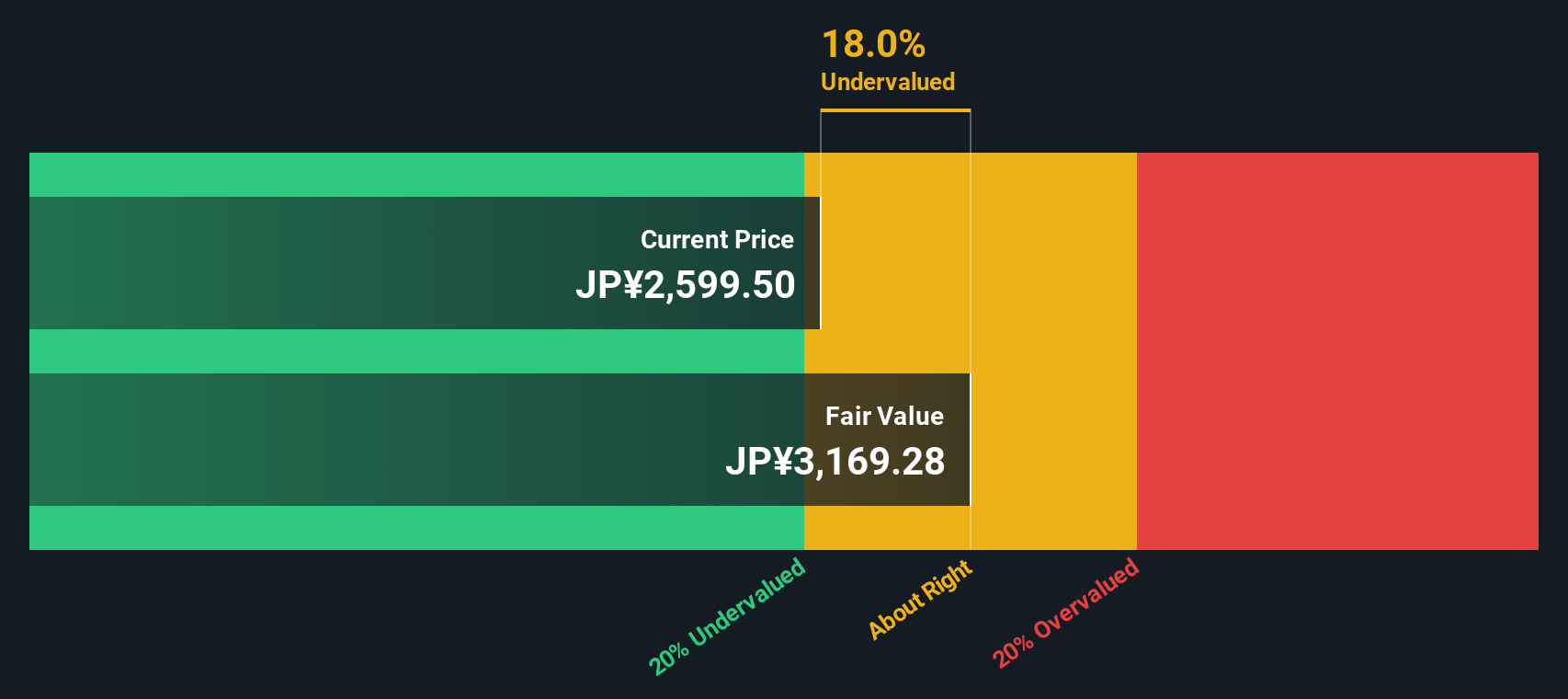

With the shares still down double digits over the past year but trading at a discount to analyst targets and intrinsic value estimates, is ABC-MartInc quietly undervalued, or is the market already pricing in its next leg of growth?

Price-to-Earnings of 14.8x: Is it justified?

On a headline basis, ABC-MartInc changing hands at a 14.8x price-to-earnings multiple looks slightly expensive against the Japanese specialty retail pack and the wider market.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings, a key yardstick for mature, profitable retailers like ABC-MartInc. In effect, it reflects how much future earnings power the market is baking into the current share price.

Despite the premium to the JP Specialty Retail industry’s 14.1x average, the stock appears to offer relatively attractive value when compared with both its own fundamentals and closer peers. Our work suggests the market may be underestimating ABC-MartInc’s earnings profile. The SWS fair price-to-earnings ratio is indicated at 17.6x, and peer companies are on an even higher 25.1x average. These are levels the market could potentially move toward if confidence in growth and margins improves.

Explore the SWS fair ratio for ABC-MartInc

Result: Price-to-Earnings of 14.8x (UNDERVALUED)

However, softer consumer spending or execution missteps in overseas expansion could stall earnings progress and keep the valuation discount from closing.

Find out about the key risks to this ABC-MartInc narrative.

Another View on Value

Our DCF model points to a fair value of about ¥3,154 per share, leaving ABC-MartInc trading roughly 13% below that level. That supports the idea of undervaluation, but hinges on cash flow assumptions holding up if growth keeps slowing. Are analysts still too cautious, or is the market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ABC-MartInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ABC-MartInc Narrative

If this narrative does not quite align with your view, or you would rather dig into the numbers yourself, you can build a personalized take in just a few minutes, Do it your way.

A great starting point for your ABC-MartInc research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Before you stop here, lock in an edge by using the Simply Wall St Screener to uncover fresh opportunities that other investors might be overlooking.

- Capitalize on mispriced quality by targeting companies that look cheap on future cash flows using these 904 undervalued stocks based on cash flows.

- Ride the next wave of innovation by focusing on breakthrough automation and machine-learning leaders through these 25 AI penny stocks.

- Strengthen your income stream by finding reliable payers with attractive yields via these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com