Dividend Stocks To Consider In December 2025

As the U.S. stock market experiences a surge following the Federal Reserve's decision to cut interest rates, investors are eyeing opportunities in dividend stocks that can offer steady income amidst fluctuating market conditions. A good dividend stock typically combines strong fundamentals with a reliable payout history, making it an attractive option for those looking to balance growth potential with income stability in today's dynamic economic landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| United Bankshares (UBSI) | 3.74% | ★★★★★☆ |

| Provident Financial Services (PFS) | 4.60% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.24% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.80% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.30% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.64% | ★★★★★★ |

| Ennis (EBF) | 5.49% | ★★★★★★ |

| CVB Financial (CVBF) | 3.95% | ★★★★★☆ |

| Columbia Banking System (COLB) | 4.92% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.21% | ★★★★★★ |

Click here to see the full list of 113 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

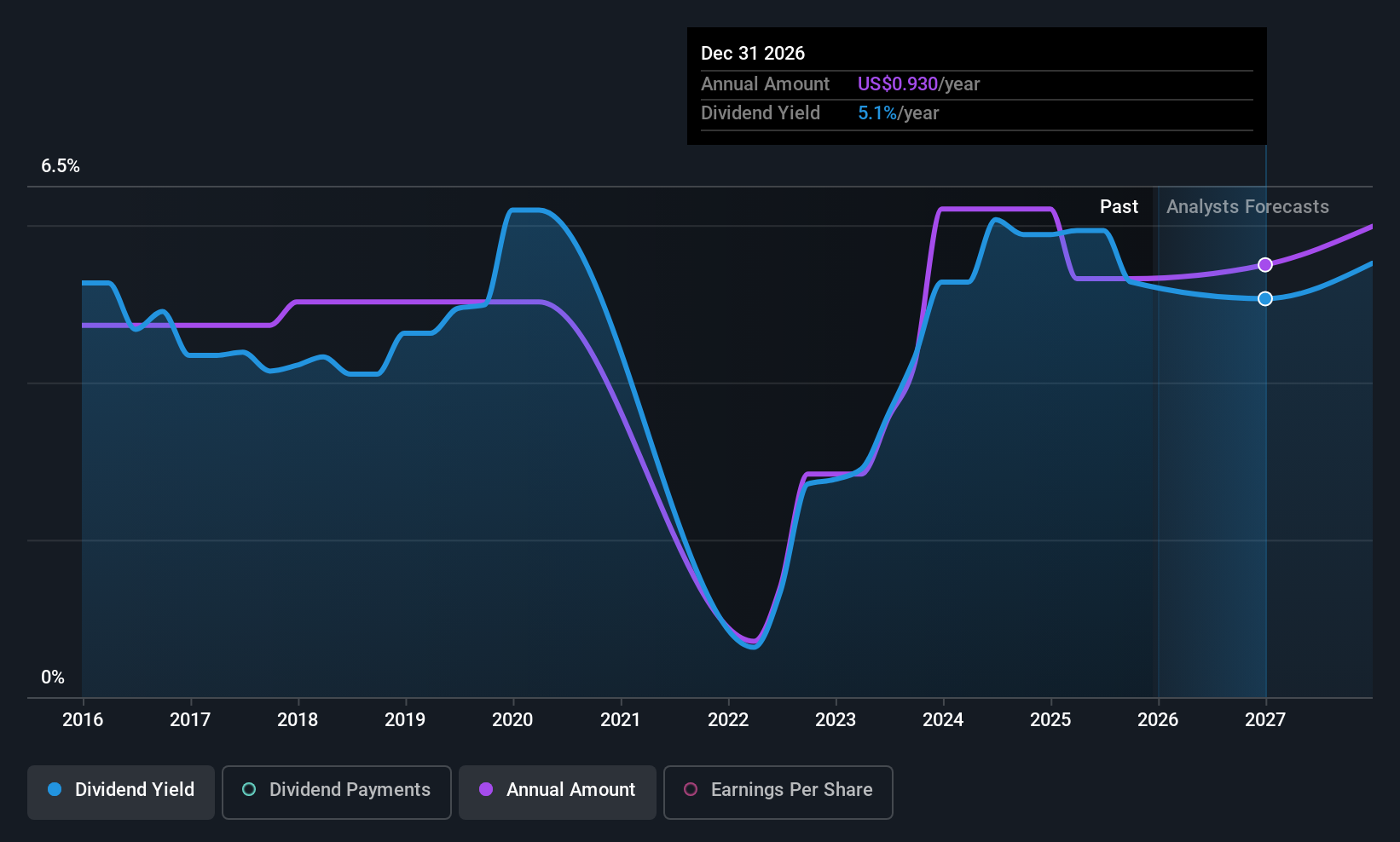

Host Hotels & Resorts (HST)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Host Hotels & Resorts, Inc. is the largest lodging real estate investment trust in the S&P 500 and owns a significant portfolio of luxury and upper-upscale hotels, with a market cap of approximately $12.42 billion.

Operations: Host Hotels & Resorts, Inc. generates its revenue primarily from hotel ownership, amounting to $5.95 billion.

Dividend Yield: 5%

Host Hotels & Resorts has a dividend yield in the top 25% of US market payers, with dividends well-covered by earnings and cash flows due to low payout ratios. However, its dividend history is volatile, with past payments being unreliable. Recent financial performance shows modest growth in revenue and net income, but the company carries a high debt level. Notably, Host Hotels was removed from the FTSE All-World Index recently.

- Dive into the specifics of Host Hotels & Resorts here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Host Hotels & Resorts shares in the market.

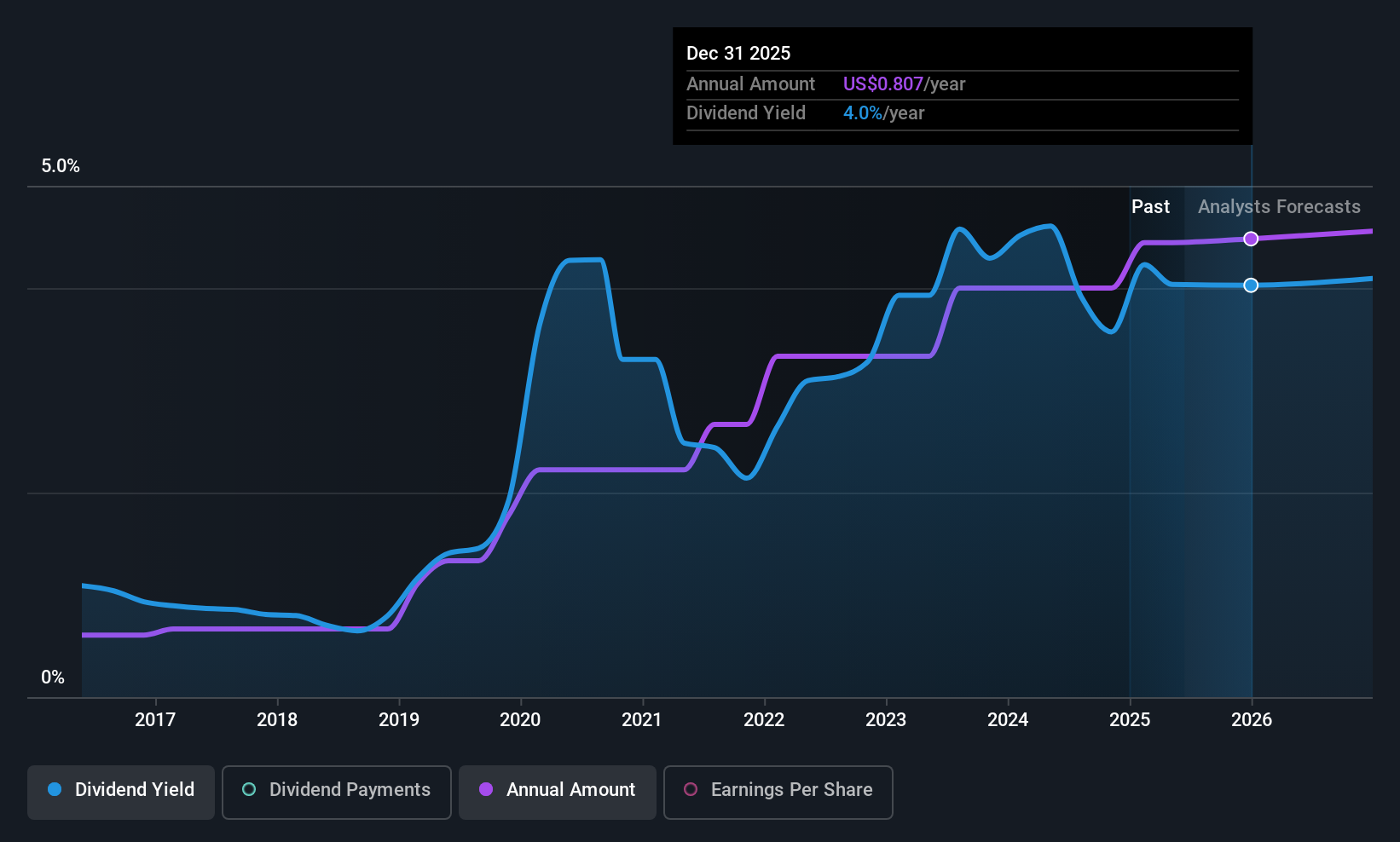

PCB Bancorp (PCB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PCB Bancorp is the bank holding company for PCB Bank, offering a range of banking products and services to small and middle-market businesses and individuals, with a market cap of $322.62 million.

Operations: PCB Bancorp generates its revenue primarily from the banking industry, with a reported revenue of $107.74 million.

Dividend Yield: 3.4%

PCB Bancorp offers a stable dividend yield of 3.45%, supported by a low payout ratio of 32.2%, ensuring coverage by earnings both currently and in the future. The company's dividends have been reliable and stable over the past decade, although not among the highest in the US market. Recently, PCB reported significant growth in net income and earnings per share, alongside declaring a quarterly dividend of $0.20 per share, reflecting its commitment to shareholder returns amidst robust financial performance.

- Get an in-depth perspective on PCB Bancorp's performance by reading our dividend report here.

- According our valuation report, there's an indication that PCB Bancorp's share price might be on the cheaper side.

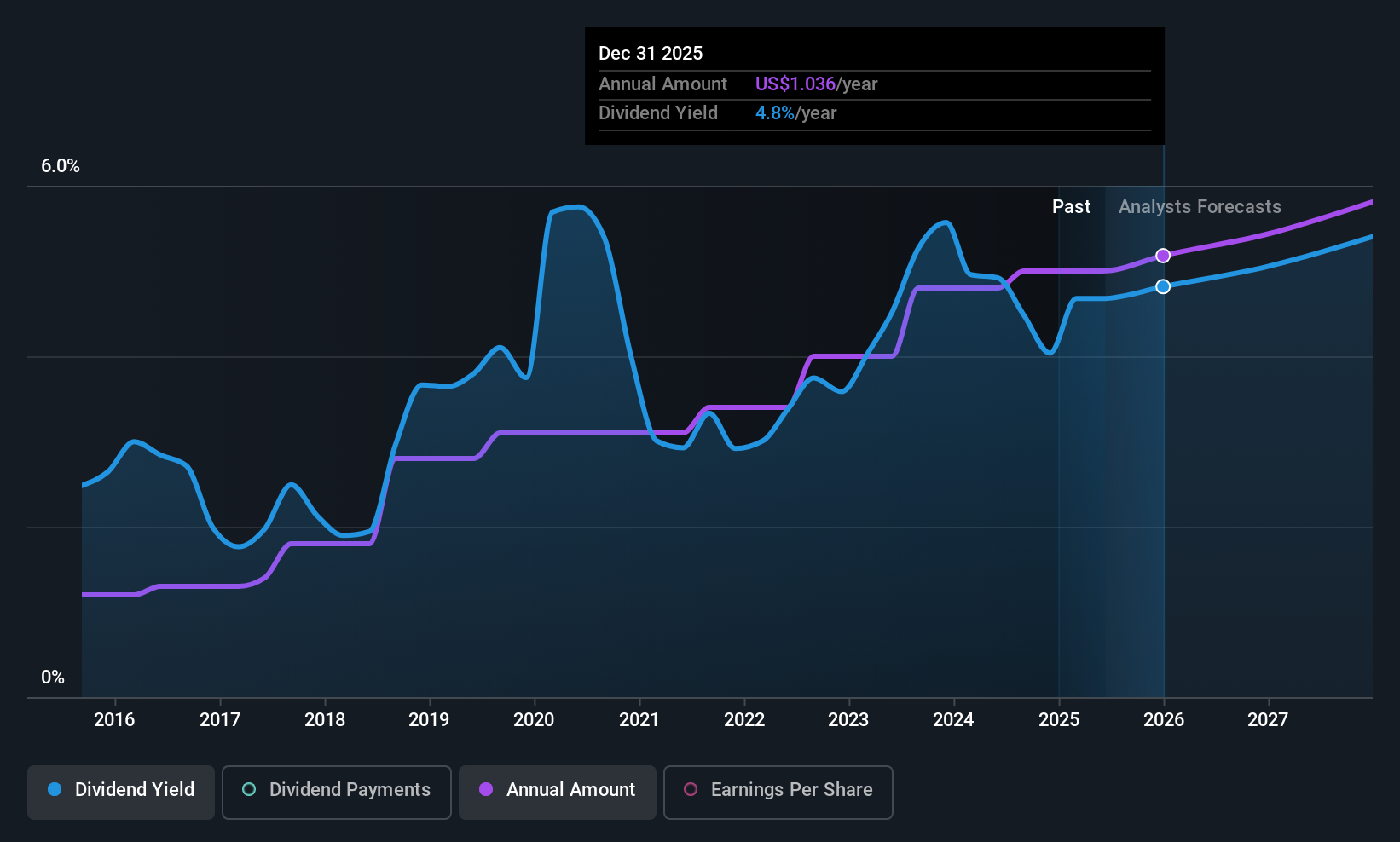

Regions Financial (RF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Regions Financial Corporation is a financial holding company offering a range of banking and related services to individual and corporate clients, with a market cap of approximately $24.01 billion.

Operations: Regions Financial Corporation generates its revenue through three main segments: Consumer Bank ($3.70 billion), Corporate Bank ($2.46 billion), and Wealth Management ($699 million).

Dividend Yield: 3.8%

Regions Financial's dividend yield of 3.81% is supported by a sustainable payout ratio of 44.5%, ensuring coverage by earnings. The company has demonstrated reliable and stable dividend payments over the past decade, with recent growth in net income enhancing its financial stability. A new share repurchase program worth US$3 billion indicates confidence in future performance, while ongoing enhancements in treasury management services for healthcare clients reflect strategic business development efforts supporting long-term growth prospects.

- Unlock comprehensive insights into our analysis of Regions Financial stock in this dividend report.

- Our valuation report unveils the possibility Regions Financial's shares may be trading at a discount.

Turning Ideas Into Actions

- Unlock more gems! Our Top US Dividend Stocks screener has unearthed 110 more companies for you to explore.Click here to unveil our expertly curated list of 113 Top US Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com