Is Hut 8 (HUT) Quietly Tilting From Infrastructure Provider To Bitcoin Holder Of Size?

- Earlier this month, American Bitcoin Corp. (ABTC), majority owned by Hut 8, added 416 bitcoin to its reserves, bringing its total holdings to 4,783 BTC and signaling a rapid build-up of digital asset exposure.

- This accelerated accumulation at ABTC sharpens Hut 8's indirect bitcoin holdings and could meaningfully influence how investors assess its mix of infrastructure and digital asset exposure.

- Next, we'll examine how ABTC's aggressive bitcoin accumulation shapes Hut 8's investment narrative, particularly its balance between infrastructure stability and crypto exposure.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Hut 8 Investment Narrative Recap

To own Hut 8, you need to believe in its “power first” pivot: using long term energy and infrastructure contracts to support both Bitcoin exposure and data center growth. ABTC’s rapid bitcoin build up reinforces Hut 8’s link to Bitcoin price swings, but it does not change that the key near term catalyst is commercializing new infrastructure like Vega, while the biggest risk remains prolonged Bitcoin volatility pressuring margins and earnings.

The Q3 2025 result, with revenue of US$83.51 million and net income of US$50.11 million, is the most relevant recent data point here, because it shows how Hut 8’s mix of infrastructure and digital asset exposure already flows through to reported earnings. As ABTC grows its holdings alongside Hut 8’s infrastructure rollout and AI/HPC ambitions, the balance between contract backed cash flows and Bitcoin driven results will be central to how investors frame both upside and risk.

Yet this growing Bitcoin linkage also brings a risk that investors should be aware of if prices move against...

Read the full narrative on Hut 8 (it's free!)

Hut 8's narrative projects $767.3 million revenue and $140.6 million earnings by 2028.

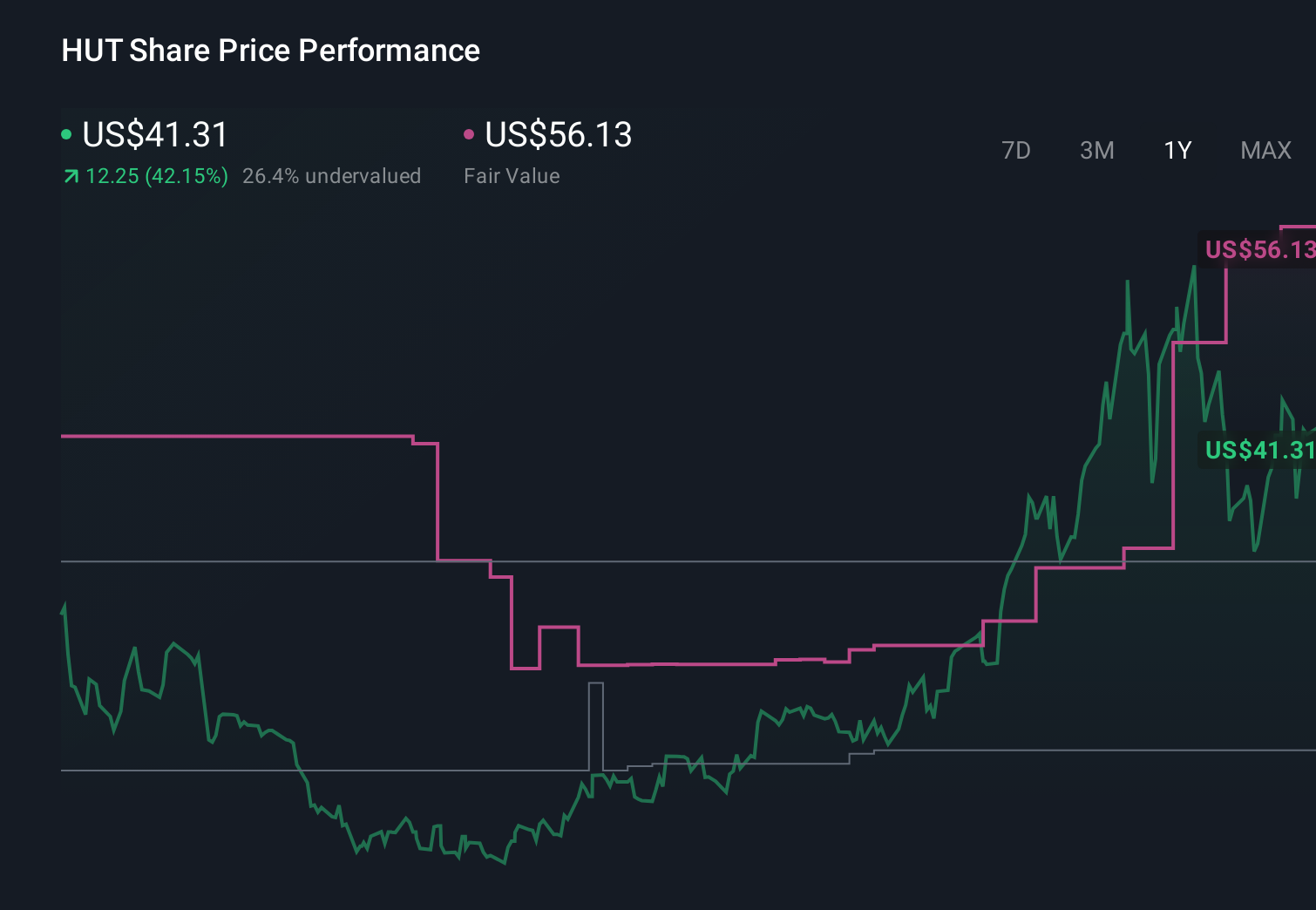

Uncover how Hut 8's forecasts yield a $56.12 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range from US$13 to US$56.13 per share, showing very different expectations. You may want to weigh that spread against Hut 8’s heavy reliance on long term Bitcoin pricing for both American Bitcoin and its own mining operations, and consider how that concentration could affect future earnings resilience.

Explore 6 other fair value estimates on Hut 8 - why the stock might be worth as much as 20% more than the current price!

Build Your Own Hut 8 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hut 8 research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Hut 8 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hut 8's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com