US stock outlook | Futures of the three major stock indexes had mixed ups and downs, and Broadcom's earnings report failed to boost technology stocks

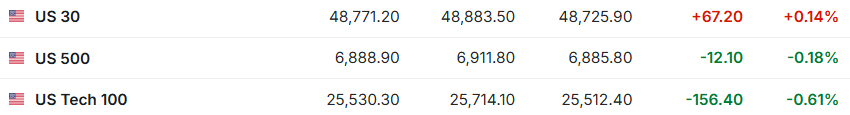

1. Before the US stock market on December 12 (Friday), futures for the three major US stock indexes had mixed ups and downs. As of press release, Dow futures were up 0.14%, S&P 500 futures were down 0.18%, and NASDAQ futures were down 0.61%.

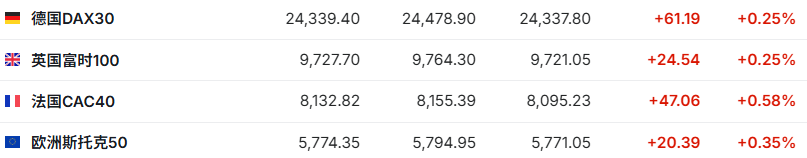

2. As of press release, the German DAX index rose 0.25%, the UK FTSE 100 index rose 0.25%, the French CAC40 index rose 0.58%, and the European Stoxx 50 index rose 0.35%.

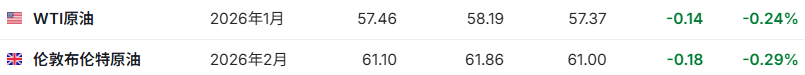

3. As of press release, WTI crude oil fell 0.24% to $57.46 per barrel. Brent crude oil fell 0.29% to $61.10 per barrel.

Market news

“Untie” AI giants! Trump signed an executive order restricting the supervisory powers of each state and pushing for a federal “single rule.” US President Trump signed an executive order on Thursday evening local time to limit states' ability to regulate artificial intelligence (AI) and try to block some existing state laws. According to the text published on the White House website, the executive order aims to “maintain and enhance America's dominant position in the global AI field through a national-level AI policy framework with the least burden.” Trump said AI companies “want to grow in the US, they want to grow here, and we have huge investments coming soon. But if they have to get 50 approvals from each of the 50 states, then you can forget about it”. The executive order instructs Attorney General Pam Bundy to set up an “AI Litigation Task Force” within 30 days, and its “sole responsibility will be to challenge state-level AI laws that conflict with the Trump administration's vision of light regulation.”

Will it be difficult to cut interest rates next year? “Silent objections” abound within the Federal Reserve, and serious differences among officials affect the prospects for easing. Federal Reserve Chairman Powell downplayed the opposition to Wednesday's decision to cut interest rates again, but a series of details of the meeting showed that differences within the Federal Reserve were already very serious. Powell backed up the public debate and forcibly passed a resolution to cut interest rates by 25 basis points. A number of regional Federal Reserve chairmen who participated in discussions but were not members of this year's voting committee also expressed opposition to interest rate cuts. Only Kansas City Federal Reserve Chairman Jeff Schmid and Chicago Federal Reserve Chairman Austin Goulsby have officially expressed their opposition and supported keeping interest rates unchanged. The 2026 FOMC voting committee, Philadelphia Federal Reserve Chairman Paulson, and Cleveland Fed Chairman Hamack will deliver speeches tonight. The statements made by these two voting officials at a critical moment are critical for investors to judge the future direction of the Fed's monetary policy.

Powell warned that employment data is “systematically overestimated,” and that the dovish path may continue until 2026. In the Federal Reserve's dilemma between fighting inflation and limiting unemployment, the latter had the upper hand at Wednesday's meeting. If the weakness of the labor market becomes more evident through a clear overestimation of employment data, this side is likely to maintain its advantage as it enters 2026. In the short term, concerns about employment conditions prompted the FOMC to decide to cut the central bank's key interest rate by 25 basis points with a 9-3 vote. Looking ahead, there are signs that if the labor market continues to weaken, policymakers will be more inclined to cut interest rates further. Federal Reserve Chairman Jerome Powell mentioned many times at a press conference on Wednesday that employment growth in recent months is likely to have been negative, and this situation will provide a reason for implementing a more relaxed monetary policy.

“Trump Gold Card” visas are officially on sale. Experts throw cold water: economic benefits should be “put a question mark” on them. US President Trump announced on Wednesday that the US government will officially accept applications for the “Trump Gold Card” visa program starting the same day. The plan requires individuals to pay $1 million and businesses to pay $2 million to obtain an individual's US residency status and rapid naturalization path. Additionally, applicants are required to pay an additional $15,000 in processing and review fees. However, experts have questioned its effectiveness. In September, Trump signed an executive order officially announcing the project. The program is intended to replace the EB-5 investment immigration program, which requires a minimum investment of $1.8 million in the US or more of $900,000 in economically difficult regions. Trump said the proceeds, which he estimates are up to several billion dollars, will go directly to the US Treasury to “do positive things for the country.”

Wall Street reviews “40 billion debt purchases”: the Federal Reserve returns to the “number one buyer” of US bonds to ease financing pressure, and transactions such as swapping interest spreads have ushered in a smooth trend. The Federal Reserve's plan to buy $40 billion in treasury bonds each month triggered Wall Street Bank revisions to its 2026 debt issuance forecast and drove borrowing costs down. The Federal Reserve will begin purchasing treasury bonds to ease short-term interest rate pressure by rebuilding the financial system's reserves. Some banks estimate that the Federal Reserve may buy nearly $525 billion in treasury bonds in 2026. Strategists expect that these purchases will help ease market pressure and have a beneficial effect on swap spreads and SOFR-federal funds rate base transactions, but they may not completely eliminate market fluctuations, especially around the end of the year.

Individual stock news

Broadcom (AVGO.US) did not meet the market's “strict high expectations”: the Q4 performance was impressive and still declined, and the backlog of AI chip orders failed to keep up with high valuations. After announcing the fourth fiscal quarter results, Broadcom's stock price fell in after-hours trading, after the chipmaker previously announced a slightly poor backlog of artificial intelligence orders. For the fourth fiscal quarter ending November 2, Broadcom reported sales of $18 billion, up 28% year over year, and analysts expected $17.5 billion. Excluding some projects, earnings per share increased to $1.95, and analysts expected $1.87. Among them, semiconductor business revenue was US$11.07 billion, up 34.5% year on year; infrastructure business revenue increased 19% to US$6.94 billion. Looking ahead, the company said sales for the first fiscal quarter ending February 1 were approximately $19.1 billion, with analysts expecting an average of $18.5 billion. The stock fell 6% in the premarket, and most of the other big tech stocks weakened.

COST.US (COST.US)'s Q1 performance exceeded expectations, but the market reaction was lackluster. Continued slowdown in membership renewal rates and high valuations raised concerns. Market Opener's Q1 revenue was US$67.31 billion, up 6.4% year over year, better than market expectations of US$67.14 billion. Among them, net sales were US$65.98 billion, up 8.2% year on year; membership fees were US$1.33 billion, up 14.0% year over year. Net profit was $2.0 billion, up 11.3% year over year; diluted earnings per share were $4.50, better than market expectations of $4.27. Same-store sales increased 6.4% in Q1, better than market expectations. Among them, same-store sales in the US increased by 5.9%. E-commerce sales increased 20.5%.

Keep up with the fresh air! The Coinbase (COIN.US) tokenized stock and prediction market feature may launch next week. According to a source familiar with the matter, Coinbase Global plans to announce the launch of prediction markets and tokenized stocks next week, which are two of the hottest products in the financial market. Coinbase, the largest cryptocurrency exchange in the US, will publicly launch these products at a showcase event on December 17, according to people familiar with the matter. They said their tokenized shares will be launched internally rather than through partners. Coinbase executives have previously expressed their desire to enter these lines of business, but they have yet to officially announce their plans. Screenshots of the app hinting at these features have been circulating for weeks on social network X. A Coinbase spokesperson declined to comment on the company's specific plans, but said: “Please lock down the December 17th livestream to see what new products Coinbase will launch.”

The evaporation of a market value of 40 billion US dollars will not frighten retail investors! Netflix (NFLX.US) has hit rock bottom frenzy. Market concerns about Netflix's proposed acquisition of Warner Bros. Discovery (WBD.US) caused Netflix's market value to evaporate $40 billion in just six trading days. For retail investors, however, this is a strong buying signal. Netflix was the third most actively traded stock on the Yingtou Securities platform in the week ending Monday. On the Fidelity platform, the number of purchase orders exceeds the number of sales orders, with a ratio of more than three to one. J.P. Morgan's data also showed strong retail buying power.

Apple (AAPL.US) and Epic's tug-of-war appeal failed, banning 27% commissions but allowing intellectual property fees. Apple failed to challenge the judge's reprimand for disobeying the order, but was given a new opportunity to defend charging developers for transactions outside the app store. In a long-standing dispute with Epic Games Inc., a federal appeals court on Thursday rejected the iPhone manufacturer's challenge to an April ruling. The ruling found that Apple had deliberately disobeyed the judge's order. The judge previously ruled that Apple had engaged in monopoly practices in violation of California law. However, in this 54-page ruling, the US Ninth Circuit Court of Appeals directed US District Judge Yvonne Gonzalez Rogers to consider allowing Apple to charge developers a commission for the use of its intellectual property — just not at the level of 27% initially set by the company.

CoreWeave (CRWV.US) powered Runway with the Nvidia GB300 chip, and the video AI engine was replaced with a “super heart.” CoreWeave announced on Thursday that it has signed an agreement with AI startup Runway to bring its AI cloud solution to Runway's video generation model. Runway will use the Nvidia (NVDA.US) GB300NVL72 system provided by CoreWeave for large-scale training and inference, and use W&B Models to achieve full observability of the workload.

Key economic data and event forecasts

02:00 a.m. Beijing time the next day: The total number of US drills (ports) for the week ending December 12.

21:00 Beijing time: 2026 FOMC voting committee and Philadelphia Federal Reserve Chairman Paulson delivered a speech on the economic outlook.

21:30 Beijing time: 2026 FOMC voting committee and Cleveland Federal Reserve Chairman Hamak delivered a speech.

23:35 Beijing time: Chicago Federal Reserve Chairman Goulsby attended the moderator's conversation before the 39th Chicago Federal Reserve Annual Economic Outlook Seminar.

The next day at 04:30 a.m. Beijing time: The CFTC released the weekly position report.