B2Gold (TSX:BTO): Rethinking Valuation After Lower Goose Mine 2025 Production Guidance and Analyst Target Cuts

B2Gold (TSX:BTO) is back in focus after trimming its 2025 production guidance for the Goose Mine, as operational delays and higher costs pushed analysts to revisit their models and expectations.

See our latest analysis for B2Gold.

The revised Goose Mine outlook comes after a powerful run, with a year to date share price return of 74.12 percent and a one year total shareholder return of 72.86 percent, suggesting momentum is still broadly intact despite higher perceived risk.

If this kind of rerating has you rethinking your exposure to single names, it could be a smart moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With B2Gold still trading at a sizable discount to analyst targets despite trimmed Goose Mine guidance, the key question now is whether investors are being offered a mispriced value opportunity or whether the market already anticipates future growth.

Most Popular Narrative: 24.9% Undervalued

With B2Gold last closing at CA$6.46 and the most popular narrative pointing to fair value near CA$8.60, the implied upside is hard to ignore.

The successful commissioning of new projects such as Goose Mine and ongoing development studies (e.g., Gramalote) align with rising institutional and portfolio demand for gold as a non-correlated hedge, positioning B2Gold for long-term production growth and margin expansion as industry-wide reserve depletion supports higher gold prices.

Want to see what powers that upside case? The narrative leans on aggressive revenue compounding, sharp margin recovery, and a future earnings multiple that still undercuts sector norms.

Result: Fair Value of $8.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical risk in Mali and potential Goose Mine cost overruns could quickly challenge even the more optimistic upside assumptions.

Find out about the key risks to this B2Gold narrative.

Another Angle on Valuation

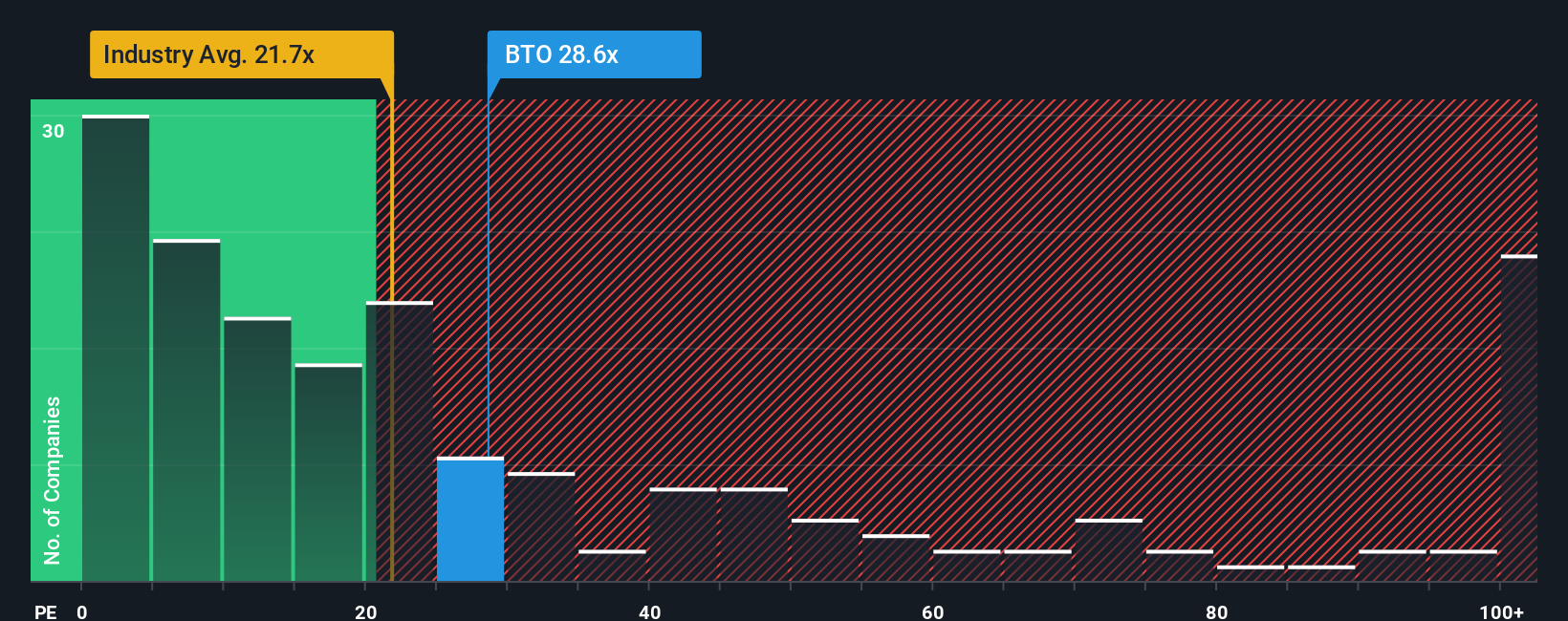

On simple earnings metrics, B2Gold looks far less of a bargain. Its 28.6x price to earnings ratio sits above both the Canadian metals and mining industry at 21.7x and its peer average of 27.7x, even though our fair ratio suggests the market could justify paying up to 45.1x.

That gap cuts both ways. It hints at upside if sentiment tracks the fair ratio, but also flags real downside risk if the market instead pulls the share price back toward sector norms. Which direction do you think investors will move first?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own B2Gold Narrative

If you would rather scrutinize the numbers yourself and lean on your own judgment, you can build a personalised thesis in just minutes: Do it your way.

A great starting point for your B2Gold research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop at B2Gold, give yourself an edge by scanning fresh stock ideas with the Simply Wall Street Screener, so tomorrow’s winners do not slip past you.

- Capitalize on mispriced opportunities by targeting companies trading below intrinsic value through these 904 undervalued stocks based on cash flows, where solid cash flow potential meets attractive entry points.

- Ride powerful income streams by focusing on steady payers using these 12 dividend stocks with yields > 3%, helping you lock in yields above 3 percent while the market looks elsewhere.

- Position ahead of the next digital shift by tracking innovators in decentralized finance and blockchain infrastructure with these 80 cryptocurrency and blockchain stocks, before mainstream enthusiasm catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com