Evaluating Pinnacle Financial Partners (PNFP) Valuation After Recent Share Price Strength

Pinnacle Financial Partners (PNFP) has quietly outperformed many regional peers, with the stock up about 6% this week and roughly 16% over the past month, drawing fresh attention to its valuation.

See our latest analysis for Pinnacle Financial Partners.

Zooming out, that short burst of strength comes after a tougher stretch, with the share price still showing a negative year to date share price return, while the five year total shareholder return near 70% hints at longer term compounding and suggests recent momentum may be rebuilding rather than fading.

If PNFP’s move has you rethinking what else could be working in financials, it might be a good moment to scan for fast growing stocks with high insider ownership that could be setting up for the next leg higher.

With robust double digit revenue and earnings growth but a share price still lagging its long term return profile, is Pinnacle trading at an appealing discount, or has the market already priced in its next chapter of expansion?

Most Popular Narrative: 6.3% Undervalued

With the narrative fair value sitting modestly above Pinnacle Financial Partners’ last close at $101.06, the story hinges on sustained hypergrowth meeting a compressed future earnings multiple.

The increasing formation of small and mid-sized businesses in the region is increasing demand for relationship-based, customized banking. Pinnacle's high-touch model successfully captures this, which should fuel sustained commercial loan and fee income growth.

Curious how rapid top line expansion can coexist with shrinking margins, yet still point to a sizable upside? The narrative leans on unusually aggressive revenue and earnings compounding, then applies a surprisingly low future earnings multiple to justify today’s fair value. Want to see how those moving parts lock together into a single target price path? Dive in to uncover the full playbook behind this valuation.

Result: Fair Value of $107.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to Southeast markets and execution risks around the Synovus merger could quickly undermine those upbeat growth and valuation assumptions.

Find out about the key risks to this Pinnacle Financial Partners narrative.

Another Lens on Value

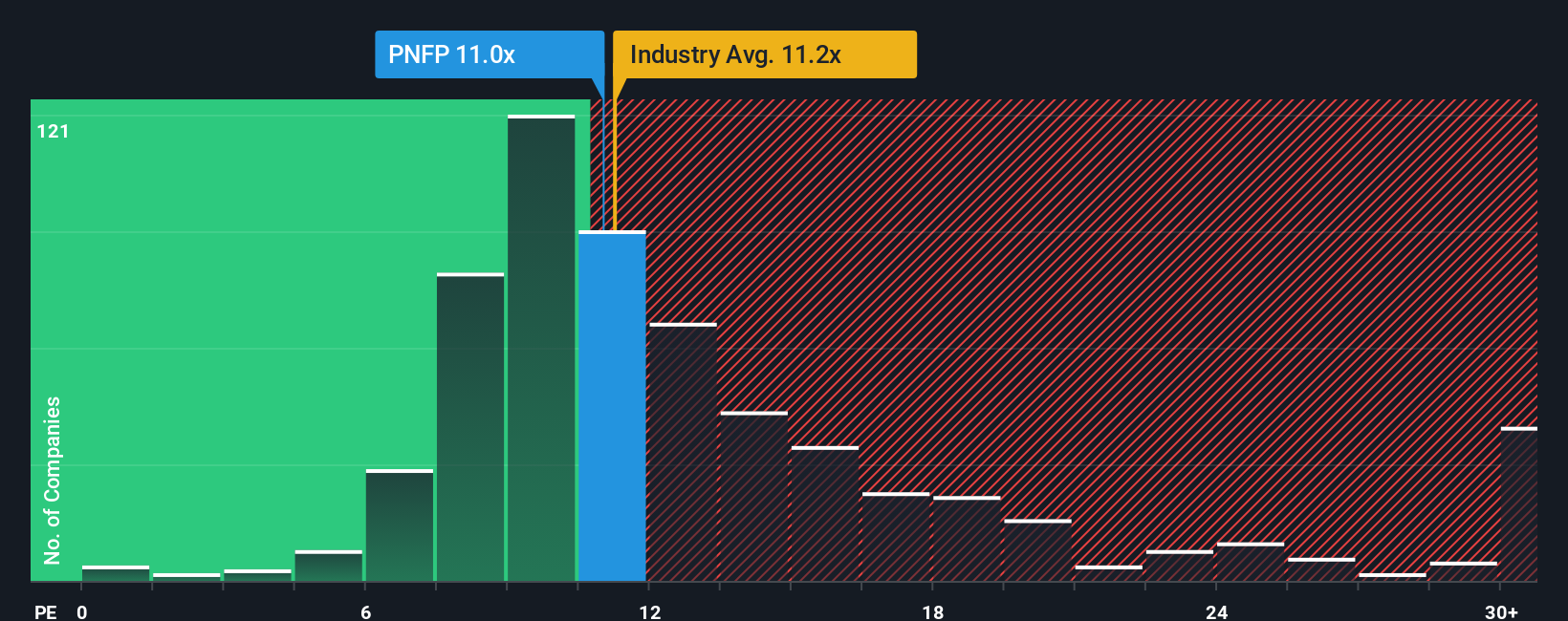

Looked at through earnings, Pinnacle trades on a 12.8x price to earnings ratio, slightly richer than the US banks average of 12x but well below its 24.8x fair ratio and 14.2x peer average. That mix of modest premium and big fair ratio gap hints at upside, but how much risk are you willing to take that the market actually closes it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pinnacle Financial Partners Narrative

If you see the numbers differently or prefer to dig into the details yourself, you can build a personalized Pinnacle story in minutes: Do it your way.

A great starting point for your Pinnacle Financial Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to spot focused opportunities across growth, income, and innovation themes today.

- Enhance your small-cap strategy by targeting higher quality names through these 3604 penny stocks with strong financials that already show financial strength instead of just headline-grabbing volatility.

- Explore potential future growth drivers by focusing on these 25 AI penny stocks associated with automation, data intelligence, and scalable digital platforms.

- Seek more stable cash flow in your portfolio by searching for income opportunities with these 12 dividend stocks with yields > 3% that may help offset market swings over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com