SIG Group (SWX:SIGN) Is Up 5.0% After UBS Takes 10.3% Stake And New CEO Installed

- UBS Fund Management has recently disclosed that it acquired 10.3% of the voting rights in SIG Group, following a period that saw a profit warning in September and the appointment of new chief executive Mikko Keto in November.

- This combination of a large institutional investor increasing its influence and fresh leadership at the top could meaningfully reshape expectations for how SIG Group is governed and positioned within global packaging markets.

- We’ll now examine how UBS Fund Management’s new 10.3% voting stake may influence SIG Group’s investment narrative and future corporate decisions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

SIG Group Investment Narrative Recap

To own SIG Group, you need to believe that aseptic packaging and related systems can keep growing despite recent operational and financing headwinds, and that management can turn weaker recent performance into durable earnings progress. UBS Fund Management’s new 10.3% voting stake does not alter the most immediate catalyst, which is management’s ability to stabilise profitability after the profit warning, nor does it remove the key risk around high leverage and variable rate debt.

The most relevant recent announcement here is SIG’s decision in September to pause the 2025 cash dividend to prioritise debt reduction and capital discipline. For shareholders, this moves balance sheet repair to the foreground as a short term catalyst, while underlining how interest rate exposure and high leverage remain central to the investment case as UBS Fund Management increases its influence.

Yet while fresh leadership and a major new shareholder may signal change, investors still need to be aware of the interest rate risk that...

Read the full narrative on SIG Group (it's free!)

SIG Group's narrative projects €3.7 billion revenue and €338.7 million earnings by 2028. This requires 3.6% yearly revenue growth and about a €138 million earnings increase from €200.6 million today.

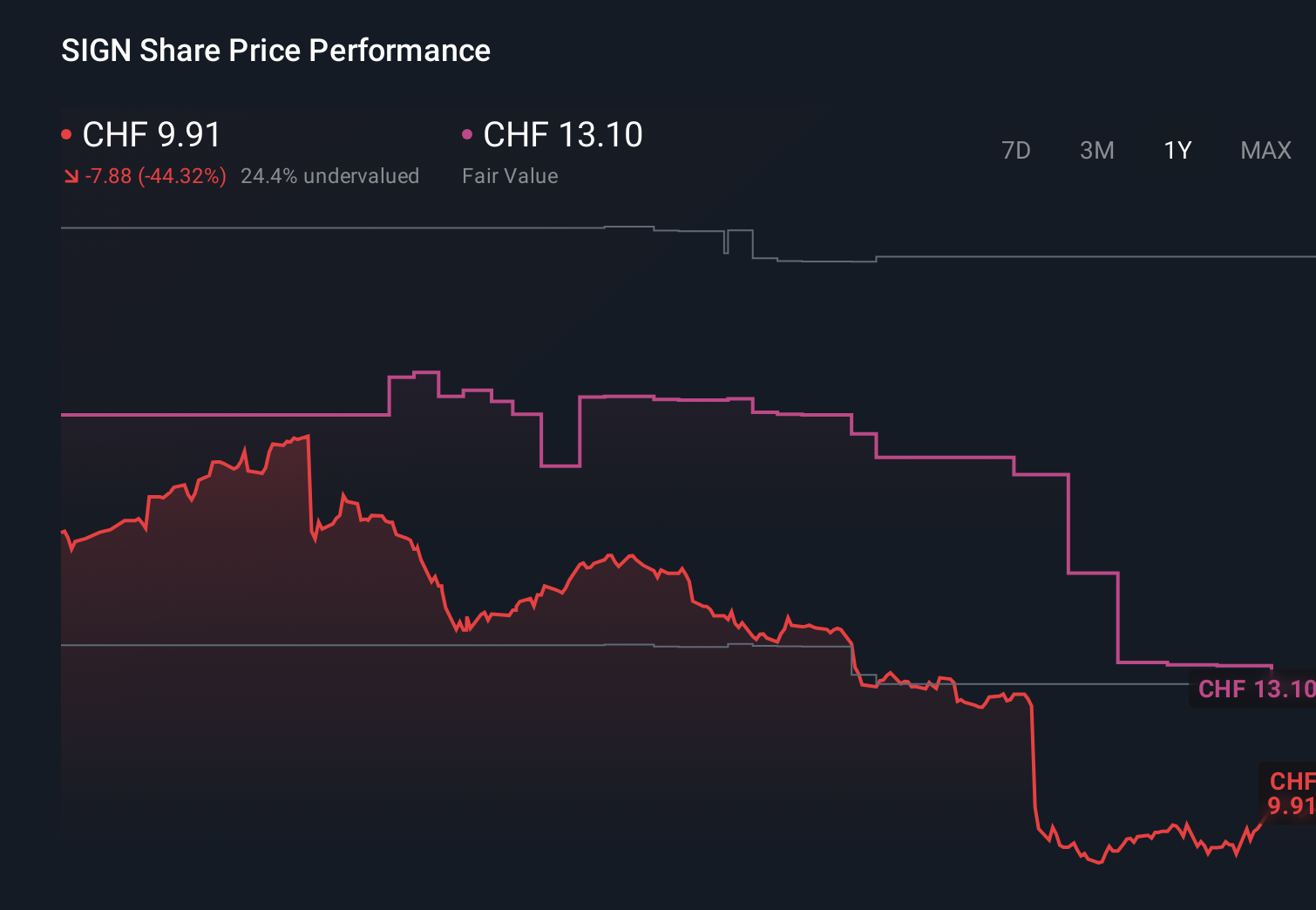

Uncover how SIG Group's forecasts yield a CHF13.10 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly CHF9.88 to CHF26.22, showing how far apart views on SIG Group can be. You can weigh these against the company’s high leverage and paused dividend, which put balance sheet strength and interest costs at the centre of SIG’s near term performance story.

Explore 8 other fair value estimates on SIG Group - why the stock might be worth just CHF9.88!

Build Your Own SIG Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SIG Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free SIG Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SIG Group's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com