UK Penny Stocks To Watch In December 2025

The United Kingdom's FTSE 100 index has recently experienced a downturn, influenced by weak trade data from China, which continues to struggle with its post-pandemic recovery. Despite these broader market challenges, there remains potential within the realm of penny stocks—an area often overlooked but still relevant for investors seeking opportunities in smaller or newer companies. These stocks can offer both affordability and growth potential when backed by strong financials, making them an intriguing option for those looking to uncover hidden value in today's market landscape.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.185 | £480.11M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.28 | £330.38M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.835 | £12.61M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.37 | £30.07M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6075 | $353.16M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.442 | £177.56M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.445 | £69.78M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.495 | £42.67M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £177.02M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 309 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

DSW Capital (AIM:DSW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DSW Capital plc offers professional services in the United Kingdom and has a market capitalization of £15.33 million.

Operations: The company generates £6.56 million in revenue from its Business Services segment.

Market Cap: £15.33M

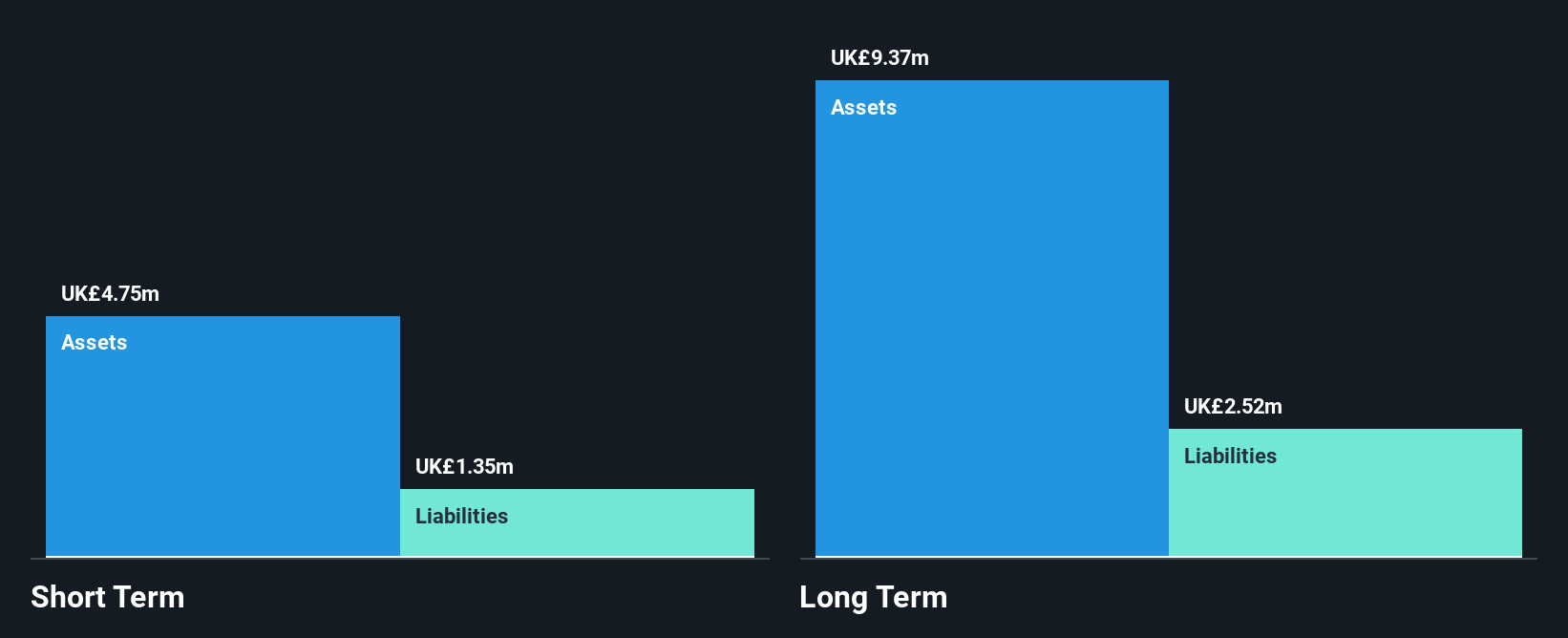

DSW Capital plc, with a market cap of £15.33 million, has demonstrated significant earnings growth of 318.2% over the past year, surpassing industry averages. Despite this growth, its share price remains highly volatile and trades below estimated fair value by 47.6%. The company's short-term assets exceed both its short and long-term liabilities, indicating financial stability. However, the management team and board are relatively inexperienced with average tenures under two years. Recently announced half-year results show revenue increased to £2.79 million from £1.09 million year-on-year, alongside an interim dividend declaration of 1.2p per share for shareholders registered on December 12, 2025.

- Take a closer look at DSW Capital's potential here in our financial health report.

- Examine DSW Capital's earnings growth report to understand how analysts expect it to perform.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Netcall plc is a company that designs, develops, sells, and supports software products and services in the United Kingdom with a market capitalization of £188.83 million.

Operations: The company's revenue of £47.96 million is derived from its activities in designing, developing, selling, and supporting software products and services.

Market Cap: £188.83M

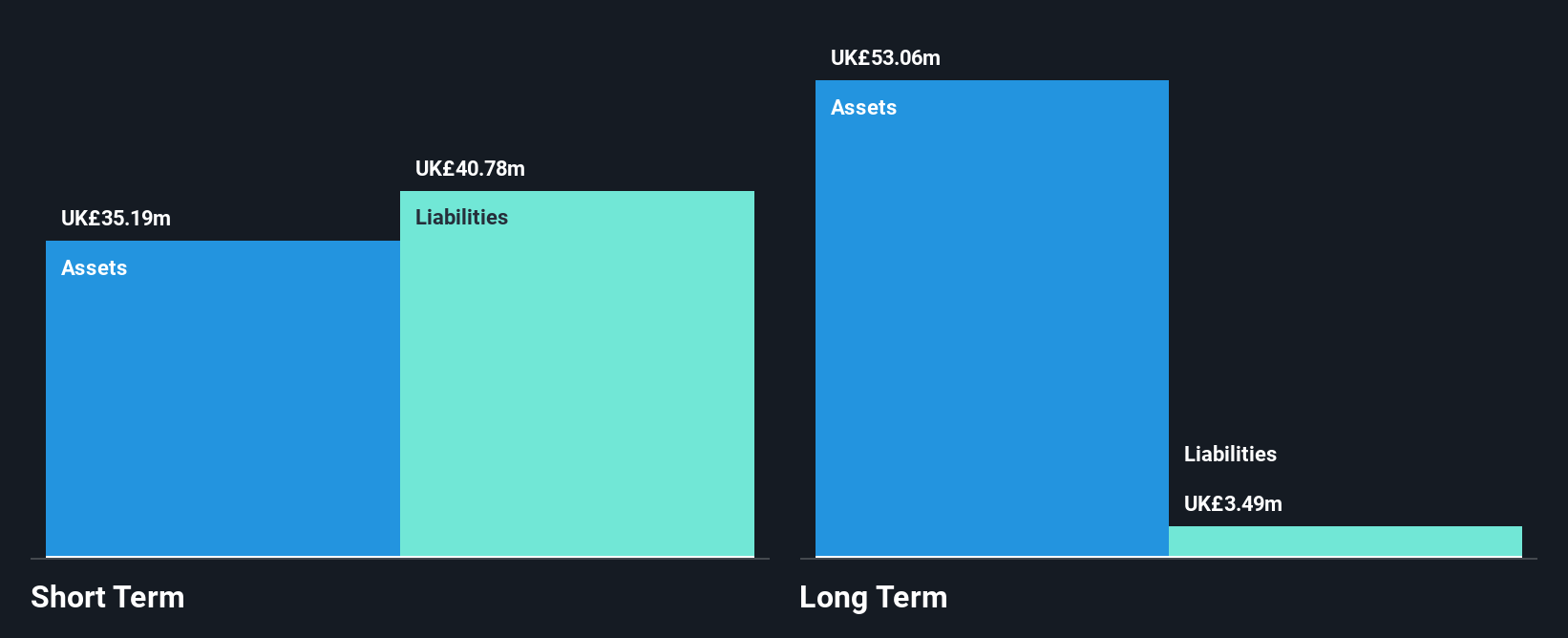

Netcall plc, with a market cap of £188.83 million, has shown substantial revenue growth from £39.06 million to £47.96 million year-on-year but faces challenges such as declining net income and profit margins, which have dropped from 15% to 8.4%. Despite having no debt and an experienced management team, the company struggles with short-term liabilities exceeding assets by £5.6M and negative earnings growth over the past year (-30.8%). Recent auditor concerns about its ability to continue as a going concern add uncertainty, though analysts expect stock price appreciation of 46.3%.

- Dive into the specifics of Netcall here with our thorough balance sheet health report.

- Learn about Netcall's future growth trajectory here.

Time Finance (AIM:TIME)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Time Finance plc, along with its subsidiaries, offers financial products and services to consumers and businesses in the United Kingdom, with a market cap of £49.51 million.

Operations: The company's revenue is primarily generated through its Asset Finance segment, which accounts for £20.94 million, and its Invoice Finance segment, contributing £15.77 million.

Market Cap: £49.51M

Time Finance plc, with a market cap of £49.51 million, has demonstrated solid financial health and growth potential. The company's revenue for the year ended May 31, 2025, increased to £37.12 million from £33.23 million the previous year, while net income rose to £5.86 million. Its asset finance and invoice finance segments are key revenue drivers. The firm maintains strong liquidity with short-term assets significantly exceeding liabilities and debt well-covered by cash flow (1737.8%). Despite a relatively inexperienced management team, Time Finance's earnings have grown consistently over five years at an impressive rate of 37.3% annually.

- Unlock comprehensive insights into our analysis of Time Finance stock in this financial health report.

- Gain insights into Time Finance's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Gain an insight into the universe of 309 UK Penny Stocks by clicking here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com