Chewy (CHWY) Q3 2026: Margin Compression Tests High-Growth Valuation Narrative

Chewy (CHWY) just posted its Q3 2026 numbers, with revenue of about $3.1 billion and net income of $59.2 million translating into basic EPS of roughly $0.14 as investors parse how the pet retailer is holding up in a tougher consumer backdrop. The company has seen quarterly revenue move from $2.88 billion in Q3 2025 to around $3.1 billion across 2026 so far, while basic EPS shifted from $0.01 a year ago to roughly the mid-$0.14 range in each quarter, setting up this print as a test of how durable its profitability and margin story really is.

See our full analysis for Chewy.With the latest figures on the table, the next step is to stack these results against the prevailing narratives about Chewy’s growth, margins, and staying power to see which stories hold up and which ones start to crack.

See what the community is saying about Chewy

Margins Thin at 1.6 percent Despite Five Year Profit Ramp

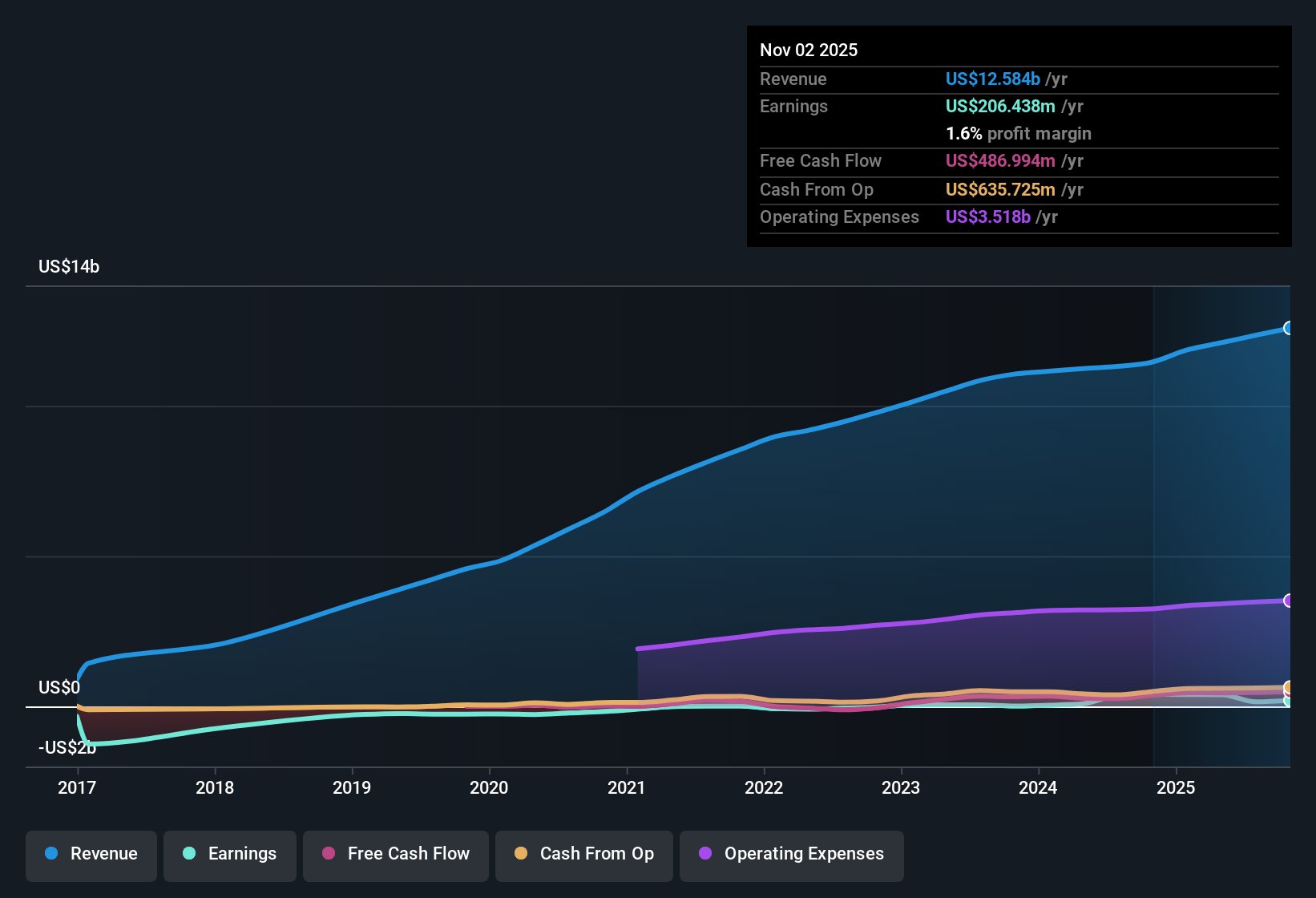

- Over the last 12 months, Chewy earned about $206 million of net income on roughly $12.6 billion of revenue, which works out to a 1.6 percent net margin versus 3.5 percent a year ago.

- Consensus narrative points to long term margin expansion, including a path toward a 10 percent adjusted EBITDA margin, yet the current 1.6 percent net margin and the step down from 3.5 percent mean:

- Recent profitability is much thinner than the longer term goal, so the ramp the consensus narrative expects has not shown up in trailing numbers yet.

- At the same time, Chewy has stayed in the black, with Q3 2026 net income of about $59 million versus just under $23 million in Q4 2025, which still gives bulls some numerical support for a profitable platform to build from.

Revenue Growth Around 7 percent vs Autoship Reliance

- Analysts expect Chewy’s revenue to grow about 7.4 percent per year, and over the last year the company generated around $12.6 billion of sales compared with $11.3 billion in the prior trailing period.

- Bears focus on Chewy’s heavy reliance on Autoship, which makes up over 80 percent of sales, and on modest active customer growth, and the numbers give both support and pushback to that cautious view:

- The forecast 7.4 percent annual revenue growth is slower than the US market’s 10.7 percent, which lines up with worries that customer growth and spend per customer may not accelerate quickly.

- However, revenue has still climbed from about $2.9 billion in Q3 2025 to a little over $3.1 billion in Q3 2026, which suggests that even with Autoship concentration, the top line has continued to move up rather than stall.

High P E at 68.7x Versus Mixed Upside Signals

- Chewy trades on a trailing P E of about 68.7 times, well above peers at roughly 24.6 times and the broader US specialty retail group at about 20.2 times, even though trailing net margin is only 1.6 percent.

- Bullish investors argue that strong forward earnings growth and valuation models justify that rich multiple, and the data show both upside and tension in that thesis:

- Earnings are forecast to grow roughly 29.3 percent per year and the DCF fair value of about $57 is well above the current $34.17 share price, while an analyst target of around $45.52 also sits meaningfully higher.

- On the other hand, earnings over the last year actually declined compared with Chewy’s 69.5 percent five year growth rate and margins compressed from 3.5 percent to 1.6 percent, so the high 68.7 times multiple is being asked to look through weaker recent profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Chewy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in another light and think the story should read differently? Take a few minutes to shape your own view, Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

Chewy’s thin margins, slowing revenue momentum and premium valuation multiple highlight real tension between its ambitious growth story and the more fragile recent financial delivery.

If you want steadier performance without paying up for uncertain margin expansion, use our stable growth stocks screener (2092 results) to quickly zero in on companies already compounding earnings and revenue more predictably.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com