Heavy truck sales surged 65% year on year in November and gained “8 consecutive increases” year over year

The Zhitong Finance App learned that on December 12, First Commercial Vehicle Network was released. In November 2025, heavy truck sales surged 65% year on year. While reaping “8 consecutive increases” over the same period, it also created the highest monthly sales volume in the heavy truck market this year. It can be said that the heavy truck market in November was even more prosperous than the “Golden Nine Silver Ten” peak season.

Heavy truck sales surged 65% year on year to 113,000 units in November, setting a new high in monthly sales during the year

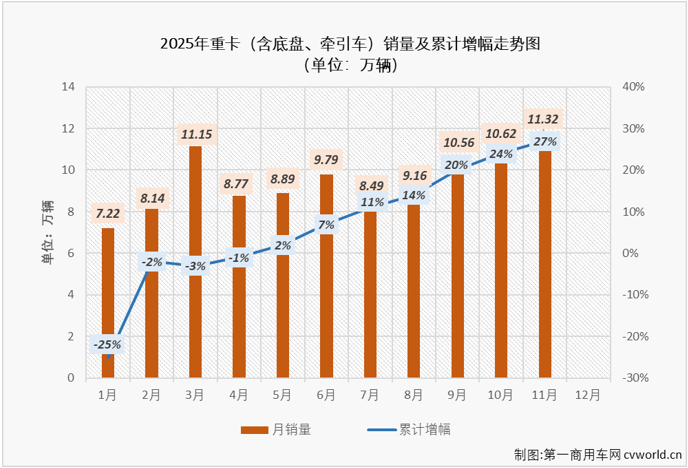

First Commercial Vehicle Network recently learned that according to China Automobile Association data (enterprise billing volume, non-terminal actual sales volume, same below), in November 2025, China's truck market (including chassis and tractors) sold a total of 338,400 vehicles, an increase of 9% over October and a year-on-year increase of 26%. Among these, the heavy truck market (including chassis and tractors) sold 113,200 vehicles in November, up 7% month-on-month and 65% year-on-year. The year-on-year increase was 5 percentage points higher than the previous month (the heavy truck market increased 60% year on year in October 2025), and the continuous growth trend of the heavy truck market expanded to “8 consecutive increases.”

113,200 vehicles, what level of performance can it be considered in the heavy truck market? In the past ten years (excluding 2025), the average sales volume of heavy trucks in November was about 78,700 units. Of these, the sales volume exceeded 80,000 units in November 5, and only 2 times in the year when it exceeded 100,000 units. Therefore, 113,200 vehicles in November 2025 should be considered a very good performance.

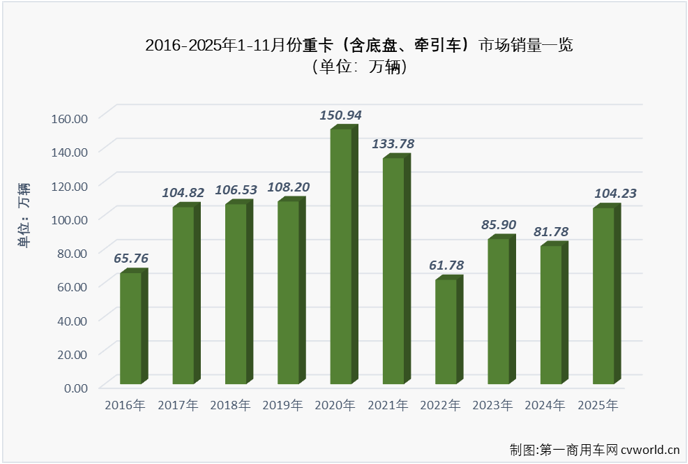

As can be seen from the heavy truck sales trend chart for the past 10 years and 11 months, the heavy truck market has grown quite a few times (6 times in total), including November 2025. Heavy truck sales in November 2025 not only once again surpassed 100,000 units, but 113,200 units ranked the second highest in the last ten years (after 135,600 units in November 2020), but the highest in the last five years.

Judging from the cumulative sales volume, from January to November 2025, the heavy truck market sold a total of 1.042,300 vehicles, ranking second highest in the past five years, and only ranked sixth in the past ten years. This is a 27% increase over 817,800 vehicles in the same period last year, with a net increase of more than 220,000 units. The cumulative sales increase in recent months has been expanding month by month (figure below). Judging from the monthly sales volume, the sales volume of 113,200 vehicles in the heavy truck market in November was the highest monthly sales volume this year, which is higher than the “Golden Three Silver Four” and “Gold Nine Silver Ten” peak season sales. From January to November of this year, the average monthly sales volume of the heavy truck market was about 94,600 units, which is significantly higher than the average monthly sales level of 2024 and 2023 (the average monthly sales volume of the heavy truck market in 2024 and 2023 is about 75,000 units and 76,000 units, respectively). From this perspective, the heavy truck market showed clear signs of recovery in 2025. After November, the cumulative sales volume in the heavy truck market in 2025 has broken through the 1 million vehicle mark, reaching 1.042,000 units, a cumulative increase of 27% over the previous year. There is no doubt that the annual sales volume will exceed 1.1 million vehicles.

More than 20,000 vehicles from Sinotruk and Jiefang competed for the championship, and Radz/Sanhuan ranked in the top ten of the monthly list

The heavy truck market grew 65% year on year in November 2025. The year-on-year increase was 5 percentage points higher than the previous month (+60%), and sales increased by about 45,000 vehicles compared to November 2024.

In November, the sales volume of 5 companies in the heavy truck market exceeded 10,000, and the number of companies selling more than 10,000 vehicles per month was the same as last month. Among them, the top two companies, Sinotruk and Jiefang continued to maintain the level of over 20,000 vehicles, selling 28,800 vehicles and 23,800 vehicles respectively; Dongfeng, Shaanxi Automobile, and Foton sold 17,200 vehicles, 161,000, and 13,600 vehicles respectively. In November, the total share of the top ten sales companies in the heavy truck market reached 96.43%. Among them, the total share of the top five companies in the industry reached 87.78%. The TOP5 companies all had a share of over 10% in November, reaching 25.46%, 20.99%, 15.17%, 14.19%, and 11.97% respectively. Other companies all had a monthly share of less than 4% (XCMG, Yuancheng, BAIC Heavy Truck, Hubei Sanhuan, and Shandong Regis ranked 6-10, selling 4,500, 1996, 1,374, 992 and 932 vehicles, respectively, with a monthly share of 0.8-4%).

Judging from the year-on-year increase, the top ten heavy truck market sales companies all achieved growth in November, and the year-on-year growth rate reached at least double digits (Shandong Leitz was a net increase). Foton, Xugong, Remote, and Sanhuan surged 139%, 150%, 235%, and 227%, respectively, to achieve double growth; Jiefang and Dongfeng surged 87% and 77%, respectively. The growth rate was higher than the overall growth rate of the market, outperforming the “big market” of the heavy truck market in November; Sinotruk, Shaanxi Automobile, and BAIC Heavy Truck also increased by at least 20% year on year. It is worth mentioning that companies such as Foton, Xugong, and BAIC Heavy Truck achieved “11 consecutive increases” from January to November this year. Among them, Foton has doubled its growth for six consecutive months, and its performance is very impressive.

Judging from the industry pattern, Shandong Regis once again in the top ten of the monthly list, ranking 10th in the November monthly list (Lechs ranked 11th in October); Hubei Third Ring Road ranked in the top ten of the monthly list with 992 vehicles. This is the first time in a long period of time that Sanhuan has entered the top ten of the monthly heavy truck list, which is quite a “rejuvenating” flavor. The top 8 companies, such as Sinotruk, Jiefang, Dongfeng, Shaanxi Automobile, Foton, Xugong, Yuancheng, and BAIC Heavy Truck remained unchanged in October.

Cumulative sales of 1.04 million vehicles increased 27% from January to November, and Fotin/Chery maintained double growth

In terms of cumulative sales volume, from January to November 2025, China's heavy truck market sold a total of 1.042,300 vehicles, a cumulative increase of 27% over the previous year. The cumulative increase was 3 percentage points higher than after October (+24%), and the cumulative sales volume increased by about 224,500 vehicles over the same period last year, which is about 1.27 times the sales volume for the same period last year.

Specifically, looking at the top ten companies with cumulative sales volume, Sinotruk ranked first with a cumulative sales of 282,100 vehicles, with a market share of 27.06%; Jiefang, Shaanxi Automobile, Dongfeng and Foton achieved cumulative sales volume of 199,900 units, 164,200 units, 163,500 units and 131,400 units respectively, with market shares of 19.18%, 15.76%, 15.69% and 12.61% respectively; XCMG ranked 6th with a cumulative sales share of 3.32%; Yuancheng, JAC, BAIC Heavy Duty Truck and Chery ranked 7-1.10, respectively. 280,000 vehicles, 12,000 vehicles, 9,454 vehicles, and 6,660 vehicles, with a market share between 0.6-1.3%.

Judging from the cumulative sales growth rate, the top ten companies in sales increased by 9 and 1. Among them, the cumulative sales volume of the three companies, Chery, Foton, and Xugong surged 143%, 103%, and 94%, respectively. The cumulative sales volume of Yuancheng, BAIC Heavy Truck and Dongfeng increased 66%, 53%, and 28% year-on-year respectively, also outperforming the “big market” of the heavy truck market in January-November; Sinotruk, Jiefang, and Shaanxi Automobile all achieved double-digit year-on-year growth.

From January to November 2025, the total share of the top ten heavy truck sales companies reached 97.54%, and the total share of the top five companies in the industry reached 90.30% (up quite a bit from 87.85% in the same period last year, further strengthening industry concentration). The TOP5 companies had a huge advantage. The share of companies ranked 5 was less than 3.5%, and the market share of companies after 6 was even less than 1.5%. Compared with the same period last year, the market share of companies such as Foton, Xugong, Yuancheng, BAIC Heavy Truck, Chery, and Dongfeng increased. Among them, Foton's cumulative share from January to November increased by 4.71 percentage points over the same period last year, the most obvious increase. Xugong increased 1.14 percentage points, second only to Futian.

After November 2025, the top ten members of the heavy truck industry and the top ten members and rankings at the end of last year have changed quite a bit: the top 5 Sinotruk, Jiefang, Shaanxi Automobile, Dongfeng, and Foton have not changed their rankings; XCMG has risen one place, from 7th place at the end of last year to the current 6th place in the industry; remote has risen 3 places, from 10th place at the end of last year to current 7th place in the industry; Chery has risen 5 places at the end of last year to currently number 9 in the industry. It is temporarily ranked 10th in the heavy truck industry.

Conclusions

In November 2025, the heavy truck market sold 113,200 vehicles, a sharp increase of 65% over the previous year. The performance was even more impressive than the “Gold Nine Silver Ten”. 2025 is still one month away, and there is no doubt that the annual sales volume will exceed 1.1 million units. How much will it reach in the end?