Advance Auto Parts (AAP): Valuation Check After Fed Rate Cut Fuels Retail Rally

The latest move in Advance Auto Parts (AAP) came right after the Federal Reserve cut rates again and signaled ongoing support for the economy, which sparked a broad retail rally that pulled the stock higher.

See our latest analysis for Advance Auto Parts.

That macro driven bounce comes after a choppy stretch, with a 90 day share price return of minus 20.95% but a 12.14% one year total shareholder return, which hints that early turnaround believers are being rewarded while short term momentum is still fragile.

If this kind of volatile turnaround story has your attention, it might be worth seeing how steadier names in the sector stack up. You could start with auto manufacturers.

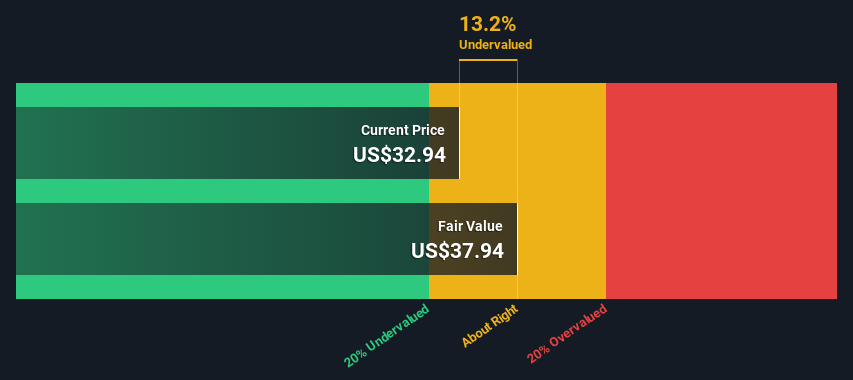

With shares still below analysts’ targets despite early signs of a turnaround, investors now face a key question: is Advance Auto Parts a discounted recovery story, or has the market already priced in the next leg of growth?

Most Popular Narrative: 11.1% Undervalued

With Advance Auto Parts closing at $48.29 versus a narrative fair value of $54.30, the valuation case leans on a significant medium term margin reset.

The consolidation of distribution centers (DCs) from 38 to 12 by 2026 aims to enhance supply chain efficiency. This reorganization, along with new market hub stores, is projected to reduce supply chain costs and improve gross margins, impacting earnings positively.

Want to see what kind of profit rebound those efficiency moves are banking on? The narrative maps out a margin and earnings climb that rivals far faster growing retailers.

Result: Fair Value of $54.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, those plans still hinge on smoother store closures and better early 2025 sales, and setbacks in these areas could quickly erode the margin recovery story.

Find out about the key risks to this Advance Auto Parts narrative.

Another View: Cash Flow Signals A Very Different Story

While the narrative fair value suggests upside, our DCF model points the other way. On this view, AAP trades far above an estimated fair value of $6.94, framing the stock as sharply overvalued and raising a tougher question: are projected margin gains really worth paying up for today?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Auto Parts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Auto Parts Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a personalized view in minutes: Do it your way.

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Broaden your edge by scanning market leading themes on Simply Wall Street before the next wave of winners runs away from you.

- Target income potential with steady cash returns by reviewing these 12 dividend stocks with yields > 3%. This may strengthen your portfolio’s yield without stretching for risky bets.

- Capitalize on structural growth in automation and machine learning through these 25 AI penny stocks, which are positioned to benefit as businesses upgrade to smarter, data driven systems.

- Secure potential bargains ahead of the crowd by focusing on these 904 undervalued stocks based on cash flows, where prices still trail underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com