Has Badger Meter’s 20% Share Price Slide Opened a Long Term Opportunity for 2025?

- If you have been wondering whether Badger Meter is still worth the price tag at around $182 per share, you are not alone. This article is designed to unpack that question clearly.

- The stock is down about 20.3% over the past year and 13.8% year to date, even though it is still up 65.2% over three years and 112.2% over five years. This combination often signals shifting expectations rather than a broken business.

- Recent attention on smart water infrastructure, sustainability initiatives, and utility digitization has kept Badger Meter on the radar of investors who care about long term structural themes. At the same time, broader market rotations away from high quality growth names have added volatility to shares that were previously priced for near perfection.

- On our framework, Badger Meter scores just 1 out of 6 on traditional undervaluation checks. This begs a deeper look at whether classic ratios, discounted cash flow models, and peer comparisons are really telling the full story. We will end by exploring a more nuanced way to think about what this business is actually worth.

Badger Meter scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Badger Meter Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting those back to today in dollar terms. For Badger Meter, the starting point is last twelve month Free Cash Flow of about $167.3 million, which analysts expect to grow steadily over the next decade as the company expands its smart water and metering footprint.

Analyst forecasts and Simply Wall St extrapolations point to Free Cash Flow of roughly $318.1 million by 2035. Those yearly cash flows are discounted to reflect risk and the time value of money, using a 2 stage Free Cash Flow to Equity framework that assumes faster growth in the near term and slower, more mature growth later on.

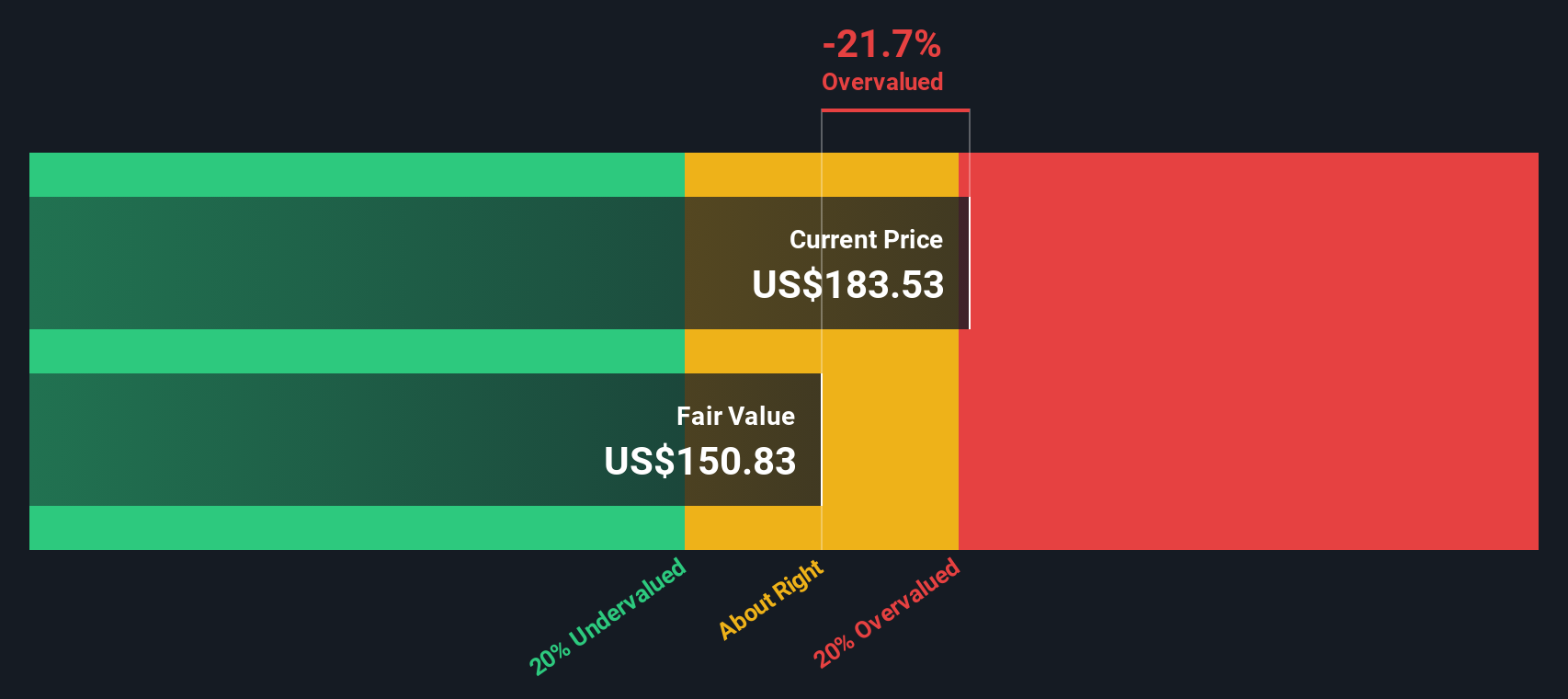

Adding up these discounted cash flows produces an estimated intrinsic value of about $150.18 per share, compared with a current share price around $182. That implies Badger Meter is about 21.4% overvalued on this DCF view.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Badger Meter may be overvalued by 21.4%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Badger Meter Price vs Earnings

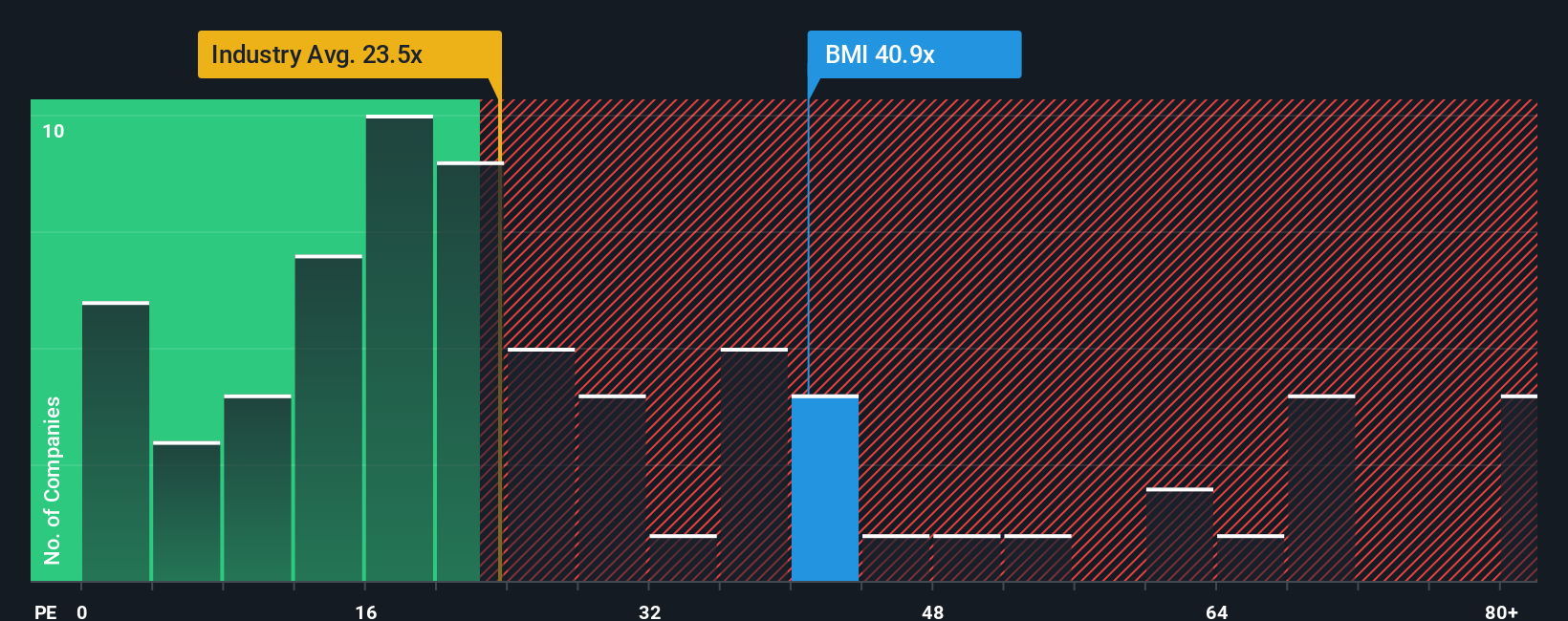

For profitable companies like Badger Meter, the Price to Earnings ratio is a practical way to gauge how much investors are willing to pay for each dollar of current earnings. In general, higher expected growth and lower perceived risk justify a higher PE, while slower or more uncertain growth should pull that multiple down toward a more modest level.

Badger Meter currently trades on about 38.7x earnings, which is noticeably above the electronic industry average of roughly 25.8x and also higher than the peer group average of around 35.4x. To add more nuance, Simply Wall St’s Fair Ratio is 22.8x, a proprietary estimate of what a reasonable PE would be once you factor in the company’s earnings growth outlook, profitability, risk profile, industry context and market cap. That makes it more powerful than a simple peer or industry comparison, which can miss important differences in quality or risk.

Compared with this Fair Ratio of 22.8x, Badger Meter’s actual PE of 38.7x suggests the stock is trading at a substantial premium to what its fundamentals alone would warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Badger Meter Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you describe the story you believe about Badger Meter, plug in your expectations for future revenue, earnings and margins, and link that story to a financial forecast and fair value that automatically updates when new news or earnings arrive. This makes it easy to compare fair value to today’s share price and decide whether to buy, hold or sell, while also seeing how very different views can coexist. For example, one investor may have a cautious narrative that points to a fair value near $219.50 and mid single digit growth, while another may have a more optimistic narrative that leans into stronger demand for smart water infrastructure, higher margin expansion and sustained double digit returns, resulting in a much higher fair value closer to $264 and a greater willingness to own the stock despite its current premium valuation.

Do you think there's more to the story for Badger Meter? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com