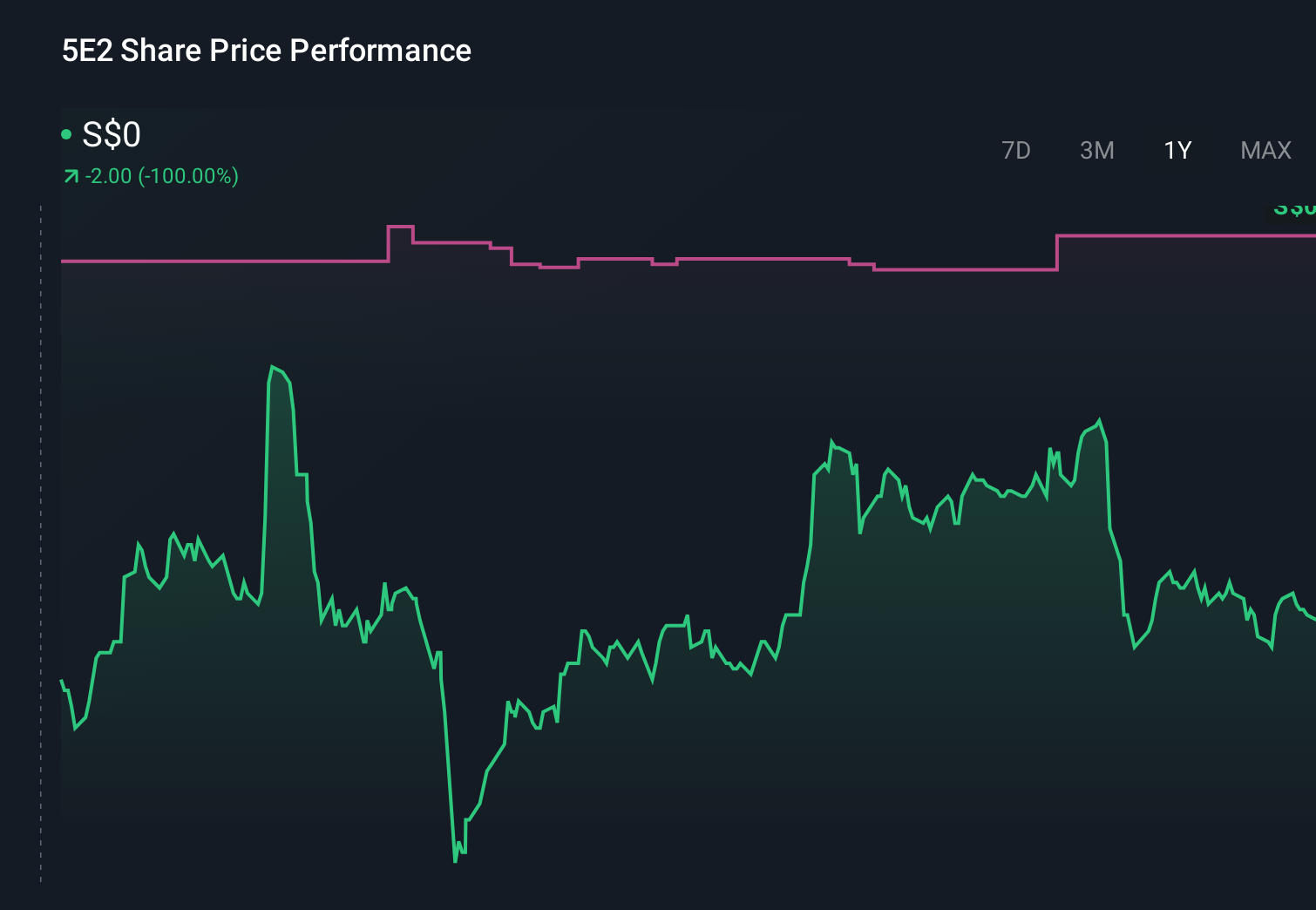

Did Winning TenneT’s BalWin5 HVDC Deal Just Shift Seatrium’s (SGX:5E2) Investment Narrative?

- Seatrium Limited and its consortium partner GE Vernova recently secured a major contract from European grid operator TenneT to deliver the BalWin5 offshore wind HVDC grid connection in Germany, including the design, construction, transportation, and installation of the offshore converter platform from its Singapore and Batam yards starting in 2026.

- This award, under a five-year repeatable framework, reinforces Seatrium’s push into offshore renewables infrastructure and adds further visibility to its longer-term project pipeline.

- We’ll now examine how securing the BalWin5 HVDC platform under TenneT’s five-year framework could reshape Seatrium’s investment narrative.

These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Seatrium Investment Narrative Recap

To own Seatrium, you need to believe it can convert a large, complex order book into steadier earnings, while gradually tilting from oil and gas toward higher value energy transition work. The BalWin5 HVDC award appears supportive of that shift and could aid the near term margin recovery narrative, but it does not remove key risks around execution, competitive pricing pressure and integration of its enlarged yard footprint.

Among recent developments, the Tiber Floating Production Unit award from BP in November 2025 is especially relevant. Together with BalWin5, it highlights Seatrium’s reliance on winning and executing large EPC contracts across both traditional and cleaner energy, which is central to its order book visibility but also heightens exposure to project delivery risk and offshore cycle volatility.

However, investors should also be aware that concentration in large, technically demanding projects can quickly amplify...

Read the full narrative on Seatrium (it's free!)

Seatrium's narrative projects SGD10.1 billion revenue and SGD715.9 million earnings by 2028. This implies a 1.4% annual revenue decline but an earnings increase of about SGD450.7 million from SGD265.2 million today.

Uncover how Seatrium's forecasts yield a SGD2.82 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Seatrium’s fair value between S$2.82 and S$4.50, across 2 independent views, underlining how far opinions can diverge. Set against this, the BalWin5 framework win highlights how future earnings will likely hinge on consistent execution of large, complex offshore contracts, which may not play out evenly across the cycle.

Explore 2 other fair value estimates on Seatrium - why the stock might be worth just SGD2.82!

Build Your Own Seatrium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seatrium research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Seatrium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seatrium's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com