Clean Harbors (CLH): Valuation Check After $110 Million PFAS Water Filtration Win at Pearl Harbor-Hickam

Clean Harbors (CLH) just landed a meaningful operational win, securing $110 million in PFAS water filtration contracts at Joint Base Pearl Harbor Hickam, where it will now treat roughly 4.2 million gallons daily.

See our latest analysis for Clean Harbors.

The deal slots neatly into a solid year for Clean Harbors, with a 16.6% 1 month share price return helping lift the stock to $241.7, while a 3 year total shareholder return above 100% suggests momentum is still broadly intact despite a softer 1 year total shareholder return.

If this water treatment win has you thinking about structural growth themes, it might be a good moment to explore healthcare stocks that could benefit from similar long term demand tailwinds.

Yet with shares hovering near record highs and analysts mostly neutral despite a modest discount to intrinsic value, the real question is whether Clean Harbors is still attractive at current levels or if the market already anticipates its next leg of growth.

Most Popular Narrative: 3.4% Undervalued

With Clean Harbors last closing at $241.7 against a narrative fair value of about $250.33, the story leans toward modest upside fueled by structural demand.

The growing urgency and evolving regulatory landscape around PFAS and hazardous waste management is expected to create a multibillion-dollar opportunity, and Clean Harbors' unique position as the only company with end to end PFAS destruction capabilities positions it to capture significant long term revenue and margin growth as new government and corporate standards take effect.

Want to see what kind of revenue engine and profit profile this thesis is really betting on? The projections lean on an ambitious growth runway and a premium future earnings multiple that most investors would not associate with a traditional industrial services name. Curious which specific long term assumptions have to click for that valuation to hold up? Dive in to see the numbers behind the narrative.

Result: Fair Value of $250.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could crack if zero waste initiatives curb hazardous volumes, or if new remediation technology undercuts demand for incineration focused PFAS solutions.

Find out about the key risks to this Clean Harbors narrative.

Another View, What Multiples Are Saying

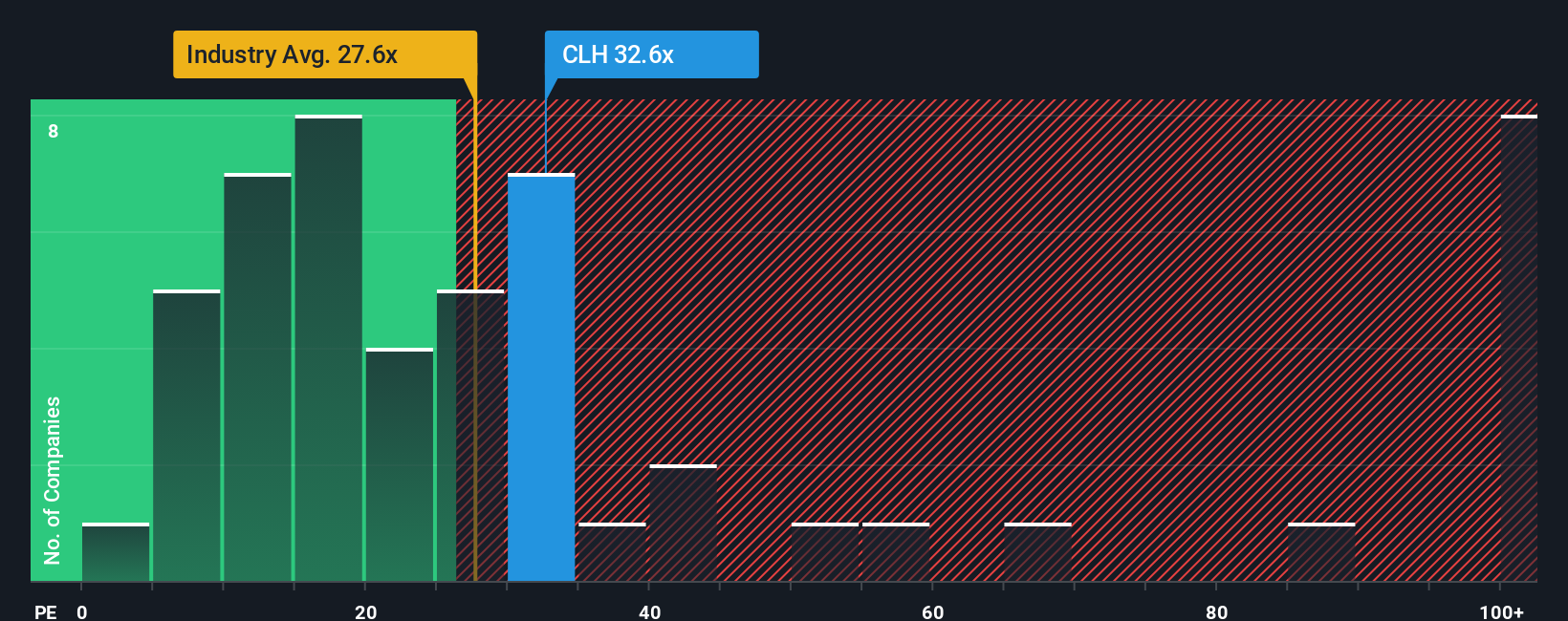

While the narrative and intrinsic value work point to upside, the market's current pricing paints a tougher picture. Clean Harbors trades on a P/E of 33.3 times versus a fair ratio of 26.1 times and a US Commercial Services average of 24.3 times. This suggests investors are paying up for its PFAS and growth story and leaving less room for error if execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Clean Harbors Narrative

If you see things differently or simply want to test your own assumptions against the numbers, you can create a personalized narrative in under three minutes: Do it your way.

A great starting point for your Clean Harbors research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity; put Simply Wall St's powerful screener to work and uncover fresh, data backed ideas before the crowd moves in.

- Capitalize on mispriced businesses by using these 903 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride breakthrough innovation by targeting these 25 AI penny stocks at the heart of real world artificial intelligence adoption.

- Lock in reliable income streams with these 12 dividend stocks with yields > 3% that can strengthen your portfolio's cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com