Expeditors (EXPD): Reassessing Valuation After Better‑Than‑Expected Q3 Results and Strong Share Price Momentum

Expeditors International of Washington (EXPD) heads into its December 8 Virtual Access Day following a stronger than expected Q3, where both revenue and earnings topped forecasts and pushed the stock sharply higher.

See our latest analysis for Expeditors International of Washington.

That upside surprise has capped a strong run, with the share price now at $153.02 and a roughly 24% 3 month share price return, signalling that momentum has been building on top of a solid 1 year total shareholder return of about 29%.

If this kind of steady rerating catches your eye, it could be a good moment to see what else is working in transportation and logistics alongside fast growing stocks with high insider ownership

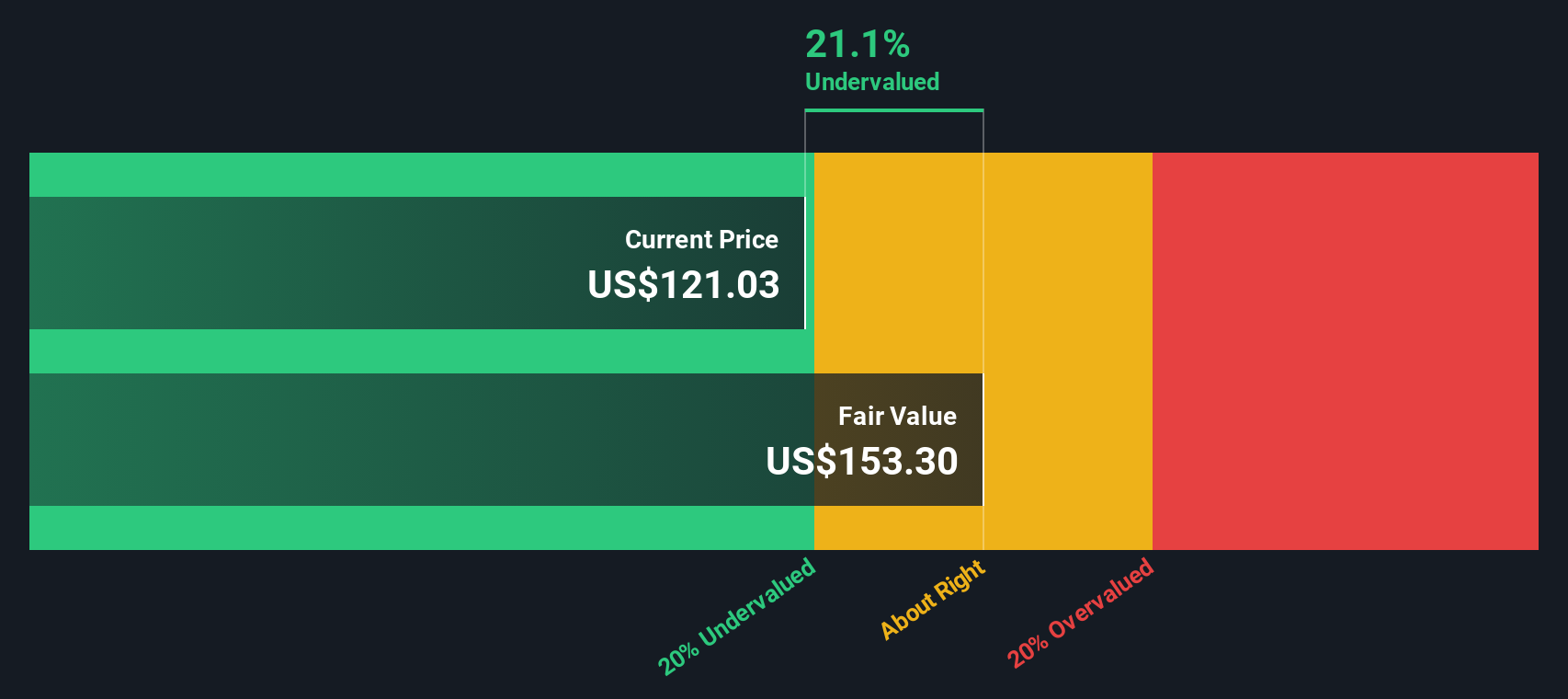

With the share price now sitting well above analyst targets but still showing an intrinsic discount, the key question is whether Expeditors remains undervalued or if the market is already pricing in its next leg of growth.

Price-to-Earnings of 24.3x: Is it justified?

On a price-to-earnings ratio of 24.3x against a last close of $153.02, Expeditors looks richly valued relative to both peers and its wider industry.

The price-to-earnings multiple compares what investors are paying today for each dollar of current earnings, which is a core yardstick for established, profitable logistics companies like Expeditors.

Here, the market is assigning Expeditors a noticeably higher valuation, with its 24.3x multiple standing above the peer average of 19.1x and well clear of the global logistics industry at 16x. This suggests investors are paying a substantial premium for its earnings power and future prospects.

This premium also stretches beyond the estimated fair price-to-earnings ratio of 13.9x. That highlights a gap that the market could eventually narrow if sentiment or growth expectations cool.

Explore the SWS fair ratio for Expeditors International of Washington

Result: Price-to-Earnings of 24.3x (OVERVALUED)

However, slowing revenue and earnings growth, coupled with the shares trading above analyst targets, could quickly unwind sentiment if macro or freight markets soften.

Find out about the key risks to this Expeditors International of Washington narrative.

Another View: What Does Our DCF Say?

While the price to earnings metric flags Expeditors as expensive, our DCF model paints a different picture, suggesting the stock is trading about 18.2% below its fair value of roughly $187 per share. If cash flows are right, is the market underestimating its staying power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expeditors International of Washington for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expeditors International of Washington Narrative

If our view does not quite fit your own, you can dive into the numbers yourself and craft a custom narrative in minutes, Do it your way

A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to spot fresh, data led ideas that could upgrade your returns and sharpen your strategy.

- Capitalize on mispriced opportunities by steering your attention toward these 903 undervalued stocks based on cash flows that may offer stronger upside than the broader market.

- Ride powerful thematic growth by focusing on these 25 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can potentially boost total returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com