Hensoldt (XTRA:HAG) Valuation Check as PEGASUS Surveillance Aircraft Reaches Key Integration Milestone

The latest leg of Hensoldt (XTRA:HAG) story is being driven by hardware, not headlines, as the first PEGASUS surveillance aircraft has landed in Germany, kicking off the mission system integration phase.

See our latest analysis for Hensoldt.

That milestone lands against a sharp pullback in the 1 month share price return of 18.09% and 3 month share price return of 23.58%, even though the year to date share price return still exceeds 100%. The momentum looks more like a healthy cooldown than a broken story.

If PEGASUS has put defense technology back on your radar, it could be a good moment to explore other aerospace and security names through aerospace and defense stocks.

Yet with earnings still growing double digit and the share price retreating from recent highs, investors are now asking: does the current valuation still underestimate Hensoldt potential, or is the market already pricing in years of future growth?

Most Popular Narrative: 23.6% Undervalued

With the most followed narrative putting Hensoldt fair value well above the last close of €71.30, the gap rests on ambitious growth and margin upgrades.

The analysts have a consensus price target of €96.182 for Hensoldt based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €120.0, and the most bearish reporting a price target of just €70.0.

Want to know what kind of revenue ramp, margin lift and future earnings multiple have to line up to keep that upside case intact? The playbook behind this narrative leans on rapid earnings compounding, a step change in profitability and a valuation profile that echoes market darlings in faster growing sectors. Curious which specific assumptions have to hold for that fair value to stick? Dive in to see the exact numbers driving this call.

Result: Fair Value of €93.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer than expected European defense budgets or execution missteps in integrating ESG and scaling new facilities could quickly challenge that upbeat valuation story.

Find out about the key risks to this Hensoldt narrative.

Another Angle on Valuation

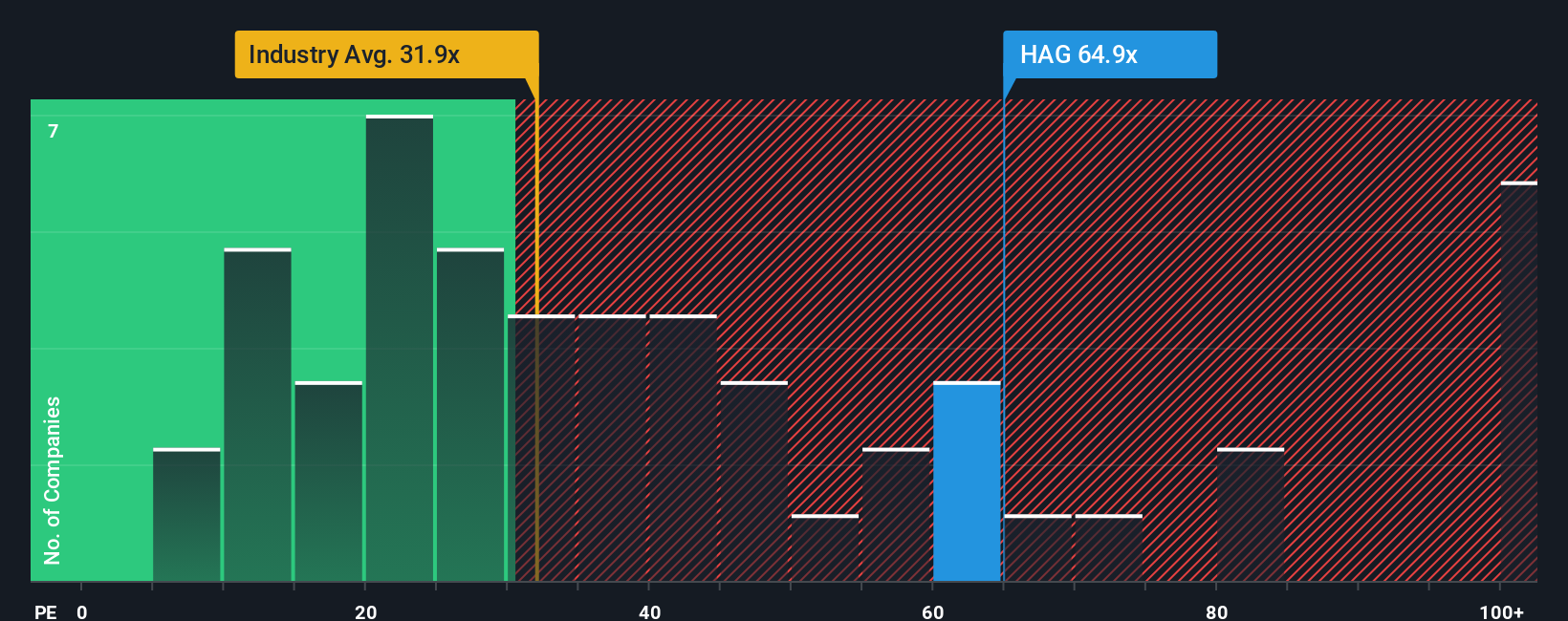

Analysts see upside to around €96, but earnings multiples paint a tougher picture. Hensoldt trades on a P/E of 66.4x versus 29.8x for the European Aerospace and Defense group and a 36.4x fair ratio, suggesting the market may be paying a hefty premium for the growth story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hensoldt Narrative

If you want to stress test these assumptions yourself and draw your own conclusions, you can build a fresh narrative in under three minutes, Do it your way.

A great starting point for your Hensoldt research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Hensoldt, you could miss other powerful setups, so broaden your watchlist now with targeted screens built around clear, data backed criteria.

- Target high potential underpriced opportunities by scanning these 903 undervalued stocks based on cash flows that pair solid fundamentals with meaningful upside based on discounted cash flows.

- Capitalize on fast moving innovation by focusing on these 25 AI penny stocks positioned to benefit from surging demand for artificial intelligence solutions.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com