How bioMérieux’s New Equine Hormone Tests At bioMérieux (ENXTPA:BIM) Has Changed Its Investment Story

- In early December 2025, bioMérieux launched two equine endocrinology immunoassays, VIDAS Equine INSULIN and VIDAS Equine ACTH, delivering rapid point-of-care hormone testing for Equine Metabolic Syndrome and Cushing’s disease via the VIDAS KUBE platform in the UK and France, with wider rollout planned.

- By bringing laboratory-standard, on-demand diagnostics for common equine endocrine disorders to veterinary practices, bioMérieux is extending its human clinical testing expertise into a higher-value veterinary segment that increasingly demands faster, case-critical decision tools.

- We’ll now examine how expanding rapid equine endocrinology testing at the point of care could reinforce bioMérieux’s investment narrative in veterinary diagnostics.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

bioMérieux Investment Narrative Recap

To invest in bioMérieux, you need to believe its diagnostic platforms can keep expanding into higher-value, faster-turning niches while managing competition and contract churn in core BIOFIRE systems. The equine endocrinology launch modestly supports this by showcasing how the company can reuse human point of care know-how in veterinary markets, but it does not materially change the near term focus on BIOFIRE placement volatility and expiring pandemic era contracts.

The recent FDA 510(k) clearance and CLIA waiver for the BIOFIRE SPOTFIRE R/ST Panel Mini using anterior nasal swabs is more central to the current investment story, because it directly targets the U.S. respiratory segment where competitive pressure and pricing remain key risks. In that context, the new equine tests highlight how bioMérieux is trying to diversify its diagnostic footprint while its flagship point of care platforms continue to face...

Read the full narrative on bioMérieux (it's free!)

bioMérieux's narrative projects €4.9 billion revenue and €648.5 million earnings by 2028. This requires 7.1% yearly revenue growth and a €216.3 million earnings increase from €432.2 million today.

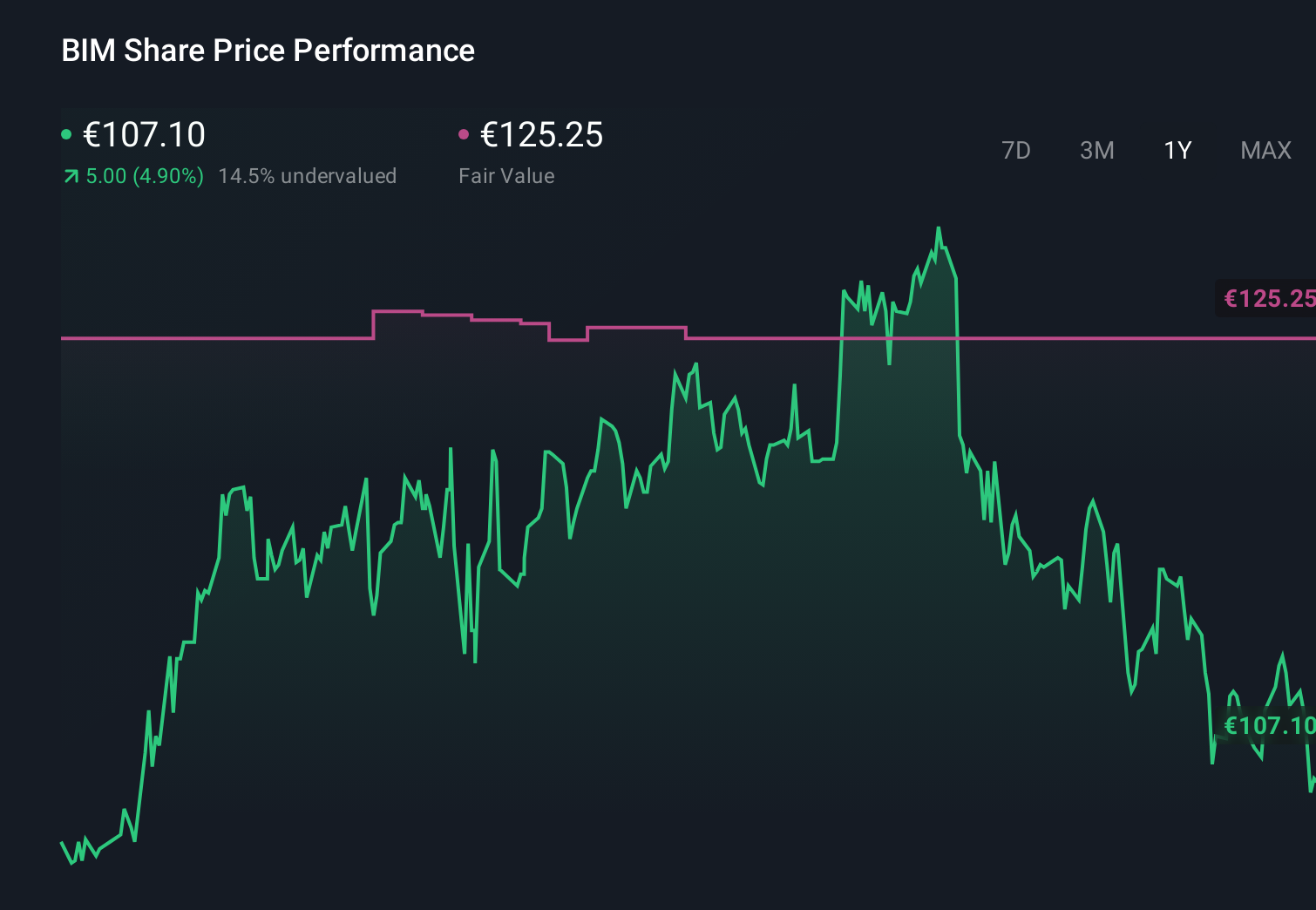

Uncover how bioMérieux's forecasts yield a €125.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently see fair value for bioMérieux between €96.03 and €125.25, underlining how far opinions can diverge. You may want to weigh those views against the risk that heightened competition in U.S. respiratory testing could pressure BIOFIRE margins and influence how the company funds further innovation.

Explore 3 other fair value estimates on bioMérieux - why the stock might be worth as much as 18% more than the current price!

Build Your Own bioMérieux Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your bioMérieux research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free bioMérieux research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate bioMérieux's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com