December 2025 Penny Stocks Worth Watching

As the U.S. stock market navigates a complex landscape with tech stocks under pressure and indices like the Dow Jones Industrial Average experiencing fluctuations, investors are increasingly exploring diverse opportunities. Penny stocks, often associated with smaller or newer companies, remain an intriguing segment for those willing to look beyond established giants. While the term may seem outdated, these stocks can still offer surprising value and growth potential when backed by strong financials. In this article, we explore several penny stocks that stand out for their financial resilience and potential for long-term success amidst current market conditions.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.05 | $450.04M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.82 | $632.91M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.93 | $152.12M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.25 | $545.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.37B | ✅ 5 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.51 | $586.77M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.53 | $369.07M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.8977 | $6.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.20 | $100.14M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Allogene Therapeutics (ALLO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Allogene Therapeutics, Inc. is a clinical-stage immuno-oncology company focused on developing and commercializing genetically engineered allogeneic T cell therapies for cancer and autoimmune diseases, with a market cap of approximately $332.60 million.

Operations: Allogene Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $332.6M

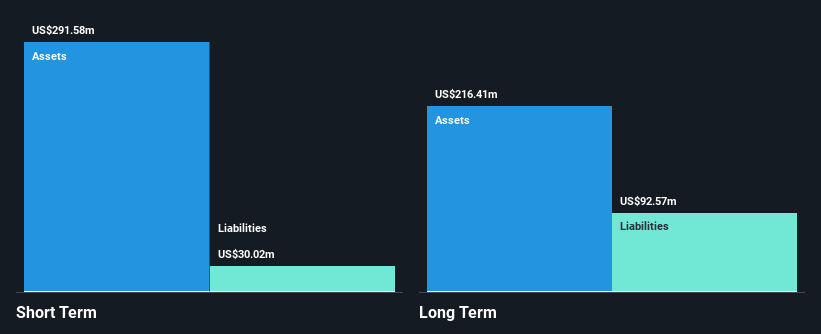

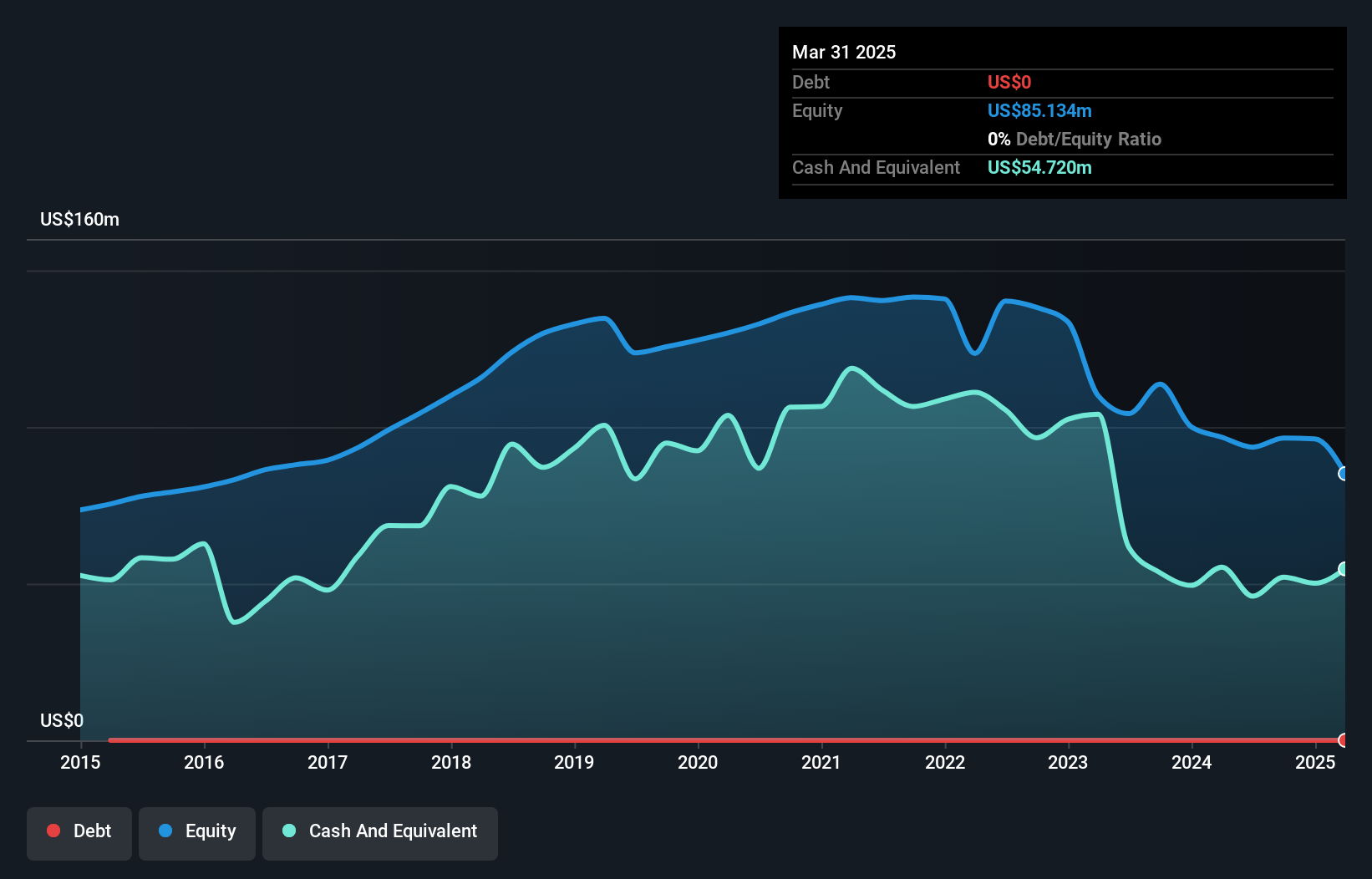

Allogene Therapeutics, Inc., with a market cap of approximately US$332.60 million, is a pre-revenue clinical-stage biotech company focused on pioneering allogeneic CAR T therapies. Despite its unprofitable status and negative return on equity, the company has no debt and sufficient cash runway for over a year. Recent advancements include the pivotal Phase 2 ALPHA3 trial aiming to expand CAR T therapy access in LBCL and the Phase 1 RESOLUTION trial exploring dual CD19/CD70 CAR technology for autoimmune diseases. These initiatives could position Allogene at the forefront of innovative cell therapy solutions if successful outcomes are achieved in upcoming trials.

- Navigate through the intricacies of Allogene Therapeutics with our comprehensive balance sheet health report here.

- Evaluate Allogene Therapeutics' prospects by accessing our earnings growth report.

PetMed Express (PETS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PetMed Express, Inc., operating as a pet pharmacy in the United States, has a market cap of $37.17 million.

Operations: The company's revenue primarily comes from its online retail operations, totaling $226.97 million.

Market Cap: $37.17M

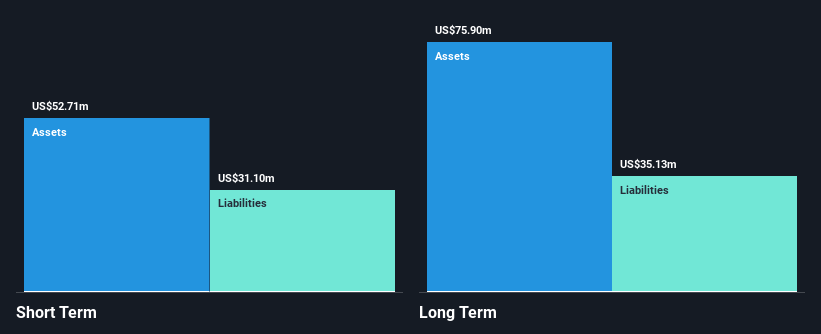

PetMed Express, Inc., with a market cap of US$37.17 million, is navigating challenges as it faces non-compliance issues with Nasdaq due to delayed SEC filings. The company remains unprofitable and has experienced increased share price volatility over the past year. However, it operates without debt and has short-term assets of US$78.9 million exceeding its liabilities, suggesting some financial stability. Recent strategic moves include introducing a holiday product line focusing on pet health and wellness, while SilverCape Investments Limited's proposal to acquire the remaining stake in PetMed highlights potential changes in ownership structure pending due diligence completion.

- Click here to discover the nuances of PetMed Express with our detailed analytical financial health report.

- Explore PetMed Express' analyst forecasts in our growth report.

Butler National (BUKS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Butler National Corporation is involved in the design, engineering, manufacturing, sales, integration, installation, repair, modification, overhaul, servicing, and distribution of aerostructures and aircraft components with a market cap of $159.03 million.

Operations: The company's revenue is primarily derived from its Gaming segment at $37.84 million, followed by Aircraft Modifications at $28.12 million, Special Mission Electronics generating $13.95 million, and Aircraft Avionics contributing $4.35 million.

Market Cap: $159.03M

Butler National Corporation, with a market cap of US$159.03 million, is showing mixed performance indicators typical of penny stocks. The company has experienced a significant earnings growth rate of 32.5% annually over the past five years, although recent earnings growth has been negative at -0.3%. Its Return on Equity stands high at 21.4%, and its debt is well covered by operating cash flow (89.1%). Recent financial results show revenue for the second quarter increased to US$23.25 million from US$21.36 million last year, with net income rising to US$5.99 million from US$3.6 million previously, indicating improved profitability despite some volatility in profit margins and management inexperience concerns.

- Dive into the specifics of Butler National here with our thorough balance sheet health report.

- Evaluate Butler National's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Gain an insight into the universe of 343 US Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com