Pandora’s New Share Buyback and Incentive Plan Could Be A Game Changer For Pandora (CPSE:PNDORA)

- On 5 February 2025, Pandora announced a new share buyback programme, appointing Danske Bank as sole lead manager for a tranche running until 30 January 2026, with the dual aim of reducing share capital and meeting obligations under company incentive schemes.

- This renewed focus on returning capital while supporting employee incentives adds a capital-allocation angle to Pandora's brand and margin-focused transformation story.

- We’ll now examine how Pandora’s decision to shrink its share capital via this new buyback programme could influence the investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Pandora Investment Narrative Recap

To own Pandora, you need to believe that its brand, store network and product innovation can offset pressures on margins, demand and competition. The new DKK 4,000 million buyback, managed by Danske Bank, underlines management’s focus on capital returns but does not materially change the near term earnings catalyst or the key risks around margins and volume growth, especially in weaker markets and categories.

The most relevant recent announcement is Pandora’s decision to maintain its full year 2025 guidance for 7 to 8% organic growth and an EBIT margin around 24%. Against that backdrop, the new buyback sits alongside dividends as part of a broader capital return framework, which may become more or less compelling depending on how Pandora manages external cost pressures and demand trends in core product lines.

But while capital returns are attractive, investors should also be aware of the risk that sustained margin pressure from commodity costs and tariffs could...

Read the full narrative on Pandora (it's free!)

Pandora's narrative projects DKK39.1 billion revenue and DKK6.5 billion earnings by 2028.

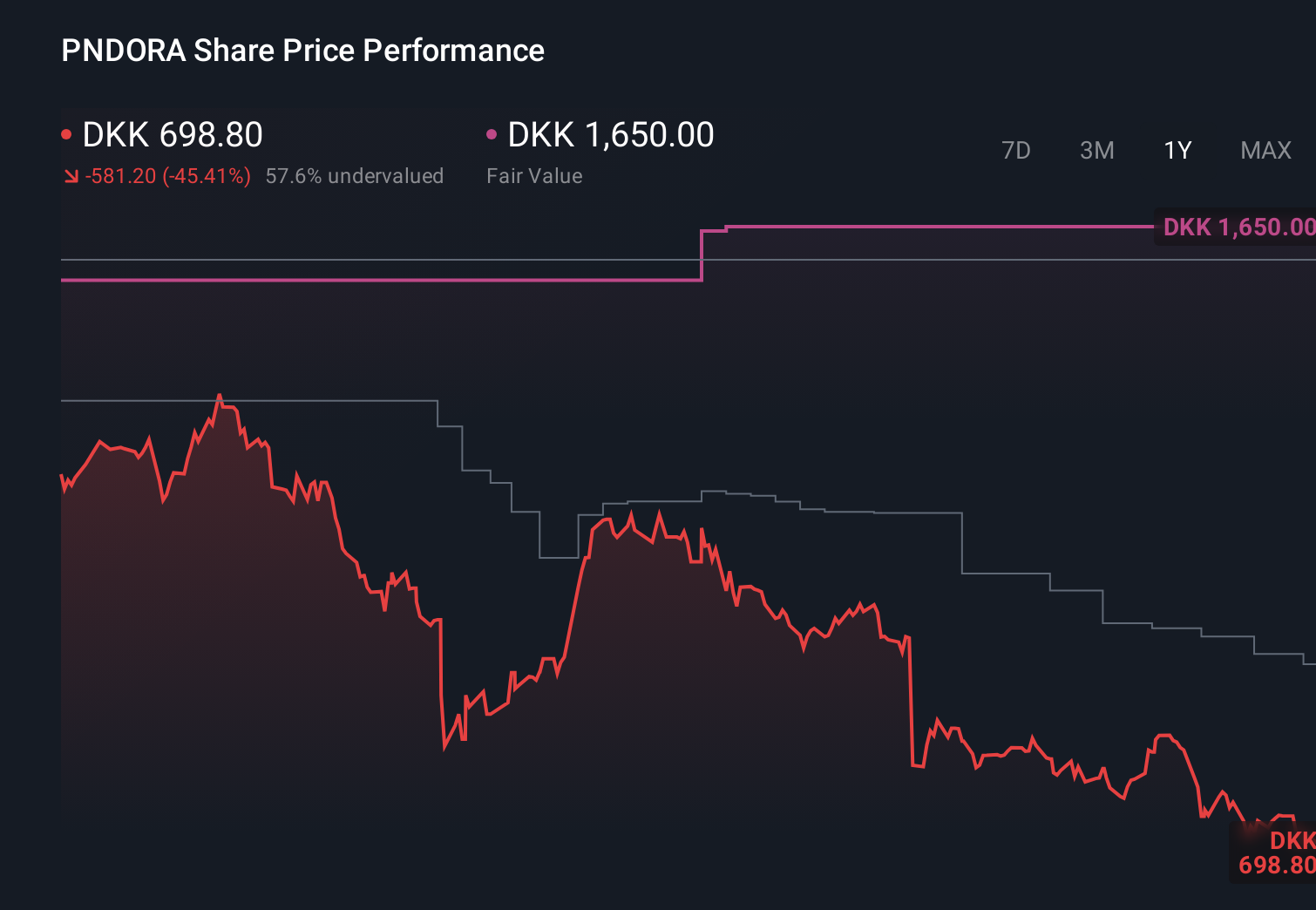

Uncover how Pandora's forecasts yield a DKK995.88 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community sit between DKK 995.88 and DKK 1,600.41, underlining how far opinions can spread. You can weigh those views against the margin headwinds and geographic challenges discussed earlier, and decide which scenarios feel most realistic for Pandora’s future performance.

Explore 7 other fair value estimates on Pandora - why the stock might be worth just DKK995.88!

Build Your Own Pandora Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pandora research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pandora research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pandora's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com