Reassessing Calbee (TSE:2229): Valuation After Goldman Sachs’ Downgrade and Profit Guidance Cut

Goldman Sachs has just cut Calbee (TSE:2229) to Sell after the snack maker trimmed its full year operating profit guidance by 13%, and the move is squarely about margins and returns.

See our latest analysis for Calbee.

The downgrade has landed after a soft patch, with the latest share price of ¥2,871.5 sitting below where it started the year, and a 1 year total shareholder return mildly negative even though the 3 month share price return is still positive. This suggests momentum had been rebuilding before this profit warning clouded the outlook.

If Calbee’s margin squeeze has you reassessing your watchlist, this could be a good moment to discover other fast growing stocks with high insider ownership that the market may be warming up to.

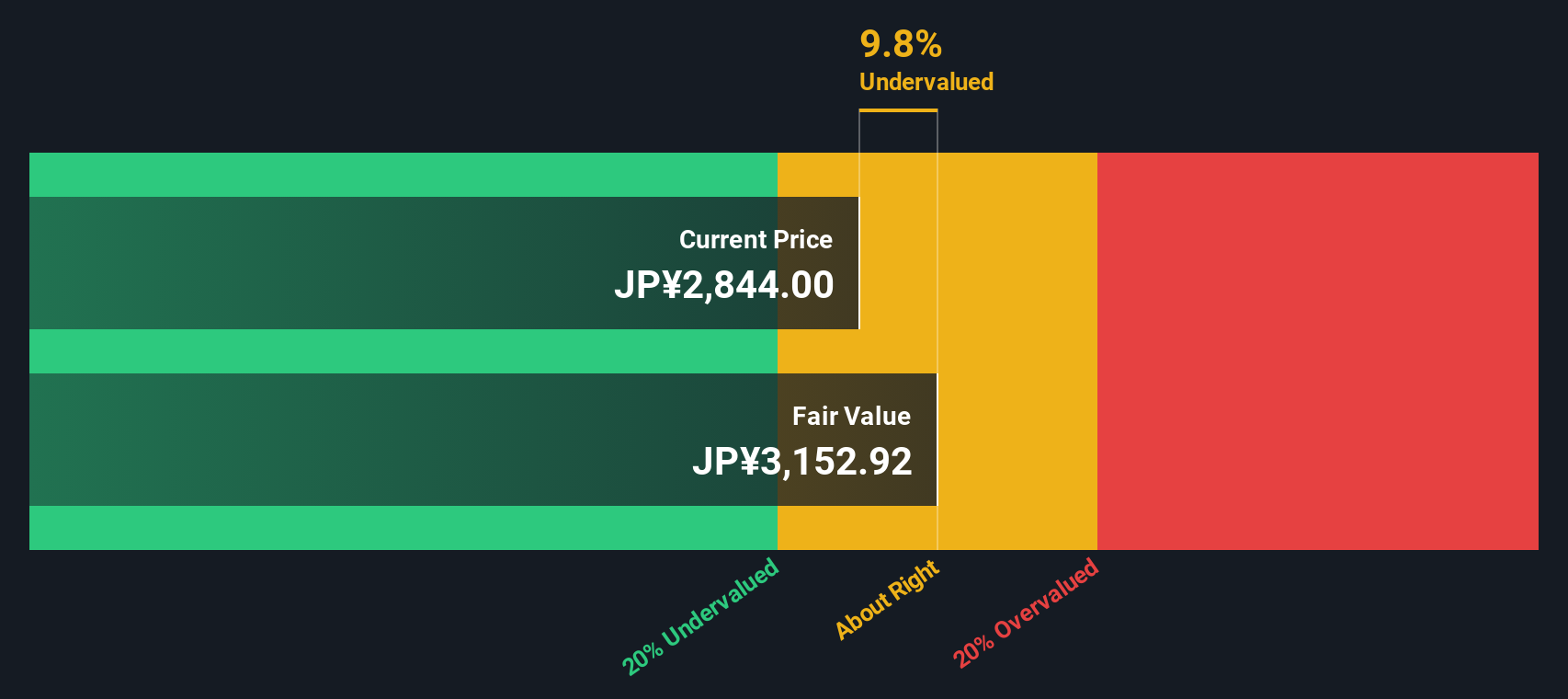

With earnings guidance now reset, investors are left weighing a modest intrinsic discount and improving revenues against rising costs and softer returns, and asking whether Calbee is quietly undervalued or if the market already sees through to future growth.

Price-to-Earnings of 20.5x: Is it justified?

On our numbers, Calbee screens as modestly undervalued on a discounted cash flow basis yet looks expensive on its current 20.5x price-to-earnings multiple versus local food peers.

The price-to-earnings multiple compares the share price with the company’s earnings per share. For a mature snack business like Calbee it effectively captures what investors are willing to pay for today’s profits and steady growth prospects.

Here, the market is asking investors to pay more for each yen of Calbee’s earnings than for the average Japanese food stock, even though its returns on equity are only in the high single digits and earnings growth is expected to trail the broader market. This suggests that expectations baked into the share price may already be quite full.

Compared with the domestic food industry average of 16.2x, Calbee’s 20.5x multiple stands out as distinctly richer. It also sits above our estimated fair price-to-earnings ratio of 19.4x, a level the market could eventually gravitate toward if sentiment cools.

Explore the SWS fair ratio for Calbee

Result: Price-to-Earnings of 20.5x (OVERVALUED)

However, rising input costs and any further guidance cuts could quickly erode that modest discount and push the market to de-rate Calbee’s shares.

Find out about the key risks to this Calbee narrative.

Another View: Our DCF Says the Market Is Too Cautious

Our SWS DCF model presents a different picture. It suggests Calbee is trading about 11% below its fair value, with shares at ¥2,871.5 versus an estimated ¥3,227.53. If cash flows look this supportive while margins wobble, is the market now being overly pessimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Calbee for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Calbee Narrative

If you see the numbers differently or want to stress test your own assumptions using our tools, you can build a custom view in minutes, Do it your way.

A great starting point for your Calbee research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Calbee when the rest of the market is full of opportunity. Use the Simply Wall St Screener to explore other potential investments.

- Target income potential with these 12 dividend stocks with yields > 3% that combine attractive yields with the financial strength to keep paying through different market cycles.

- Capitalize on innovation by reviewing these 26 AI penny stocks that are positioned to benefit from developments in artificial intelligence and data driven business models.

- Strengthen your portfolio foundation with these 904 undervalued stocks based on cash flows that trade below their estimated cash flow value before the broader market reacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com