Frontier (ULCC) Valuation Check After CEO Barry Biffle’s Large Scheduled Insider Share Sale

Frontier Group Holdings (ULCC) is back on traders radar after CEO Barry Biffle sold more than 200,000 shares under a pre-set Rule 10b5-1 plan, continuing a year of steady insider selling.

See our latest analysis for Frontier Group Holdings.

That selling comes as Frontier’s 30 day share price return has surged 52.77 percent and the 7 day move is up double digits, yet the one year total shareholder return is still negative at 10.65 percent. This suggests momentum is improving, but long term holders remain underwater.

If this insider activity has you reassessing your watchlist, it could be a good moment to scout other airlines and travel names via aerospace and defense stocks.

With shares still down sharply over three years despite recent momentum and solid revenue growth, is Frontier now trading below its long term potential, or is the market already pricing in any turnaround and future growth?

Most Popular Narrative: 2.2% Overvalued

With Frontier Group Holdings last closing at $5.79 against a narrative fair value of about $5.67, expectations and price are almost perfectly aligned.

The analysts have a consensus price target of $5.389 for Frontier Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $3.0.

Want to see what turns today’s losses into tomorrow’s profits, and why a modest earnings multiple suddenly looks so powerful? The specific growth, margin, and valuation assumptions behind this fair value might surprise you.

Result: Fair Value of $5.67 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if domestic capacity remains oversupplied or if Frontier’s leisure focused network struggles to absorb fixed costs and sustain margins.

Find out about the key risks to this Frontier Group Holdings narrative.

Another View: Market Ratios Point to Value

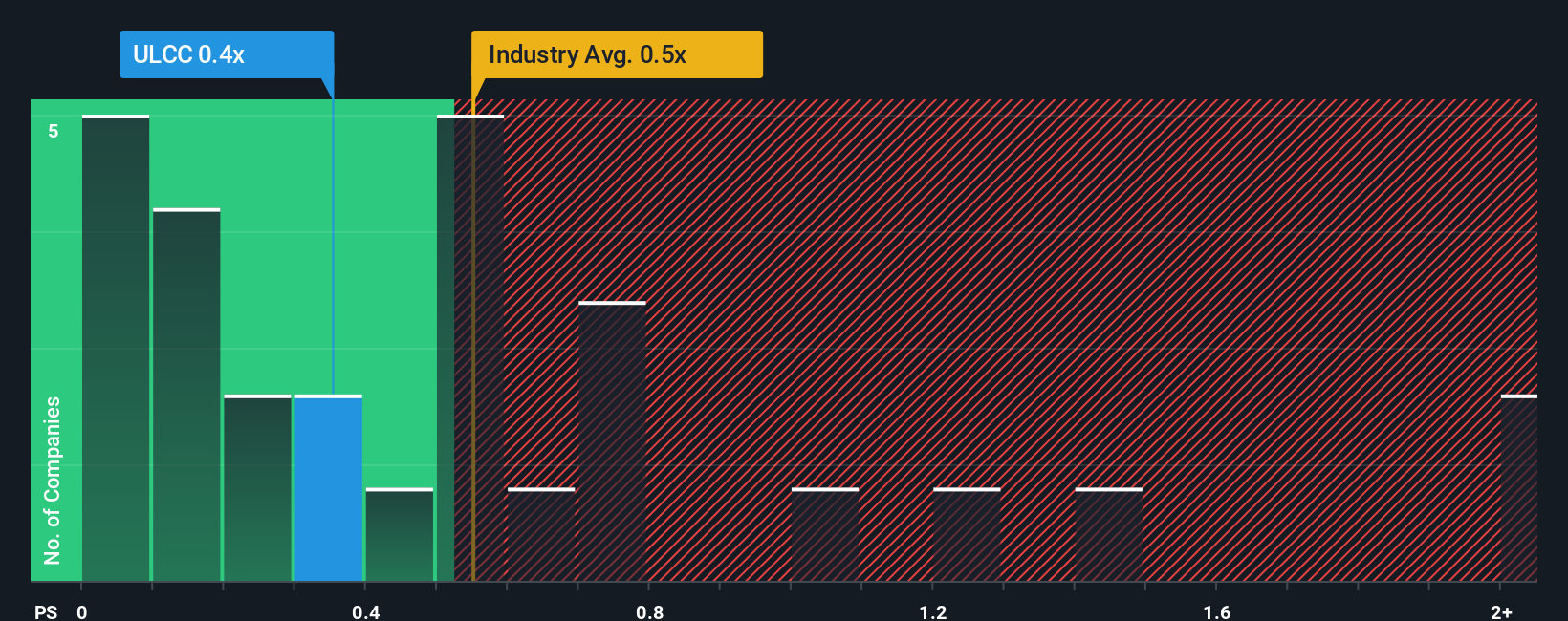

Analysts call Frontier slightly overvalued against their fair value, but on sales the stock looks cheap. It trades at about 0.4 times revenue versus roughly 0.5 times for peers and a fair ratio of 0.5, which suggests there may be room for re rating if the turnaround sticks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Frontier Group Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Frontier Group Holdings.

Looking for your next investing edge

Before you log off, lock in an edge by using the Simply Wall St Screener to uncover focused stock ideas that match your strategy and risk appetite.

- Capture potential bargains by checking out these 904 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Tap into cutting edge innovation with these 26 AI penny stocks positioned to benefit from accelerating demand for artificial intelligence solutions.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% that can help support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com