Risks Still Elevated At These Prices As Shirble Department Store Holdings (China) Limited (HKG:312) Shares Dive 29%

Unfortunately for some shareholders, the Shirble Department Store Holdings (China) Limited (HKG:312) share price has dived 29% in the last thirty days, prolonging recent pain. Longer-term, the stock has been solid despite a difficult 30 days, gaining 20% in the last year.

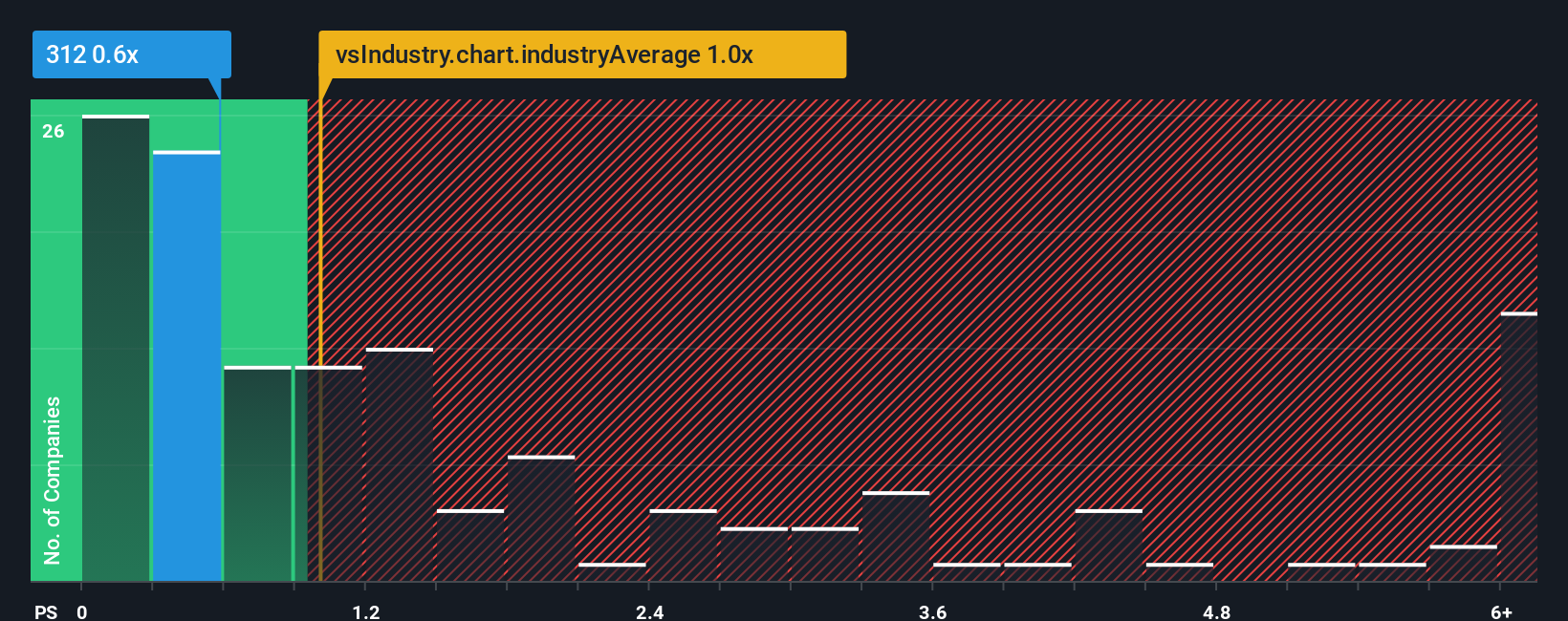

In spite of the heavy fall in price, there still wouldn't be many who think Shirble Department Store Holdings (China)'s price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Hong Kong's Multiline Retail industry is similar at about 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Shirble Department Store Holdings (China)

How Shirble Department Store Holdings (China) Has Been Performing

The recent revenue growth at Shirble Department Store Holdings (China) would have to be considered satisfactory if not spectacular. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Shirble Department Store Holdings (China), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shirble Department Store Holdings (China)?

The only time you'd be comfortable seeing a P/S like Shirble Department Store Holdings (China)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 3.3% gain to the company's revenues. Still, lamentably revenue has fallen 1.9% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.2% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Shirble Department Store Holdings (China)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Shirble Department Store Holdings (China)'s P/S?

With its share price dropping off a cliff, the P/S for Shirble Department Store Holdings (China) looks to be in line with the rest of the Multiline Retail industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Shirble Department Store Holdings (China) currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shirble Department Store Holdings (China) (1 is concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Shirble Department Store Holdings (China), explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.