Should You Buy Micron Technology Stock Before Dec. 17?

Key Points

Micron Technology is likely to deliver a big earnings beat and solid guidance.

That's thanks to the favorable demand-supply dynamics in the memory market.

Micron's valuation and earnings potential suggest that it can continue to soar in 2026.

Micron Technology (NASDAQ: MU) has been on fire in 2025, rising an impressive 200% thanks to the outstanding growth in the company's revenue and earnings. Investors may now be wondering if it is a good idea to buy shares of this memory specialist in anticipation of more upside.

The company will release its fiscal 2026 first-quarter results on Dec. 17. Micron's quarterly report is going to play a central role in determining if the stock can sustain its rally in the future. The good part is that Micron stock still seems to be in a buying zone even after its stunning surge this year thanks to its valuation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Does this mean investors should start buying this growth stock before Dec. 17? Let's find out.

Image source: Micron Technology.

Favorable market dynamics should give Micron a nice shot in the arm

Demand for memory chips is outpacing supply, primarily driven by artificial intelligence (AI). The contract prices of dynamic random access memory (DRAM) and NAND flash storage memory have shot up by 80% to 100% this month already, according to Chinese memory company TeamGroup. The company adds that the shortage is likely to continue until 2028.

Meanwhile, Counterpoint Research is forecasting that the prices of server memory chips will double next year despite memory manufacturers such as Micron rushing to boost the supply of high-bandwidth memory (HBM) that goes into AI chips.

This is great news for Micron investors. The company is already experiencing remarkable growth in revenue and earnings thanks to the favorable demand-supply environment in the memory chip market. The end market developments suggest that the trend is likely to continue in 2026.

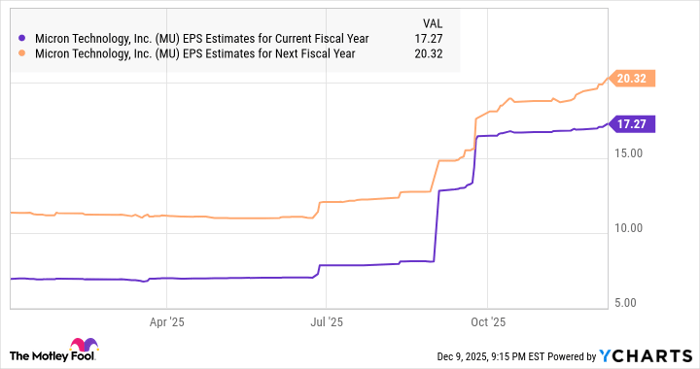

The company's non-GAAP operating profit margin jumped by almost 4x in the previous fiscal year to 29%. As a result, its earnings jumped by a whopping 537% last year to $8.29 per share. Analysts are expecting Micron's earnings to double in the current fiscal year, followed by another double-digit increase in the next fiscal year.

MU EPS Estimates for Current Fiscal Year data by YCharts.

Micron, however, could do better than that owing to the favorable pricing environment and its improving share of the memory market. Market research firm TrendForce points out that Micron's share of the DRAM market increased by 3.7 percentage points year over year in 2025's Q3 to 25.7%. The company can continue to corner a bigger share of the memory market in 2026 as well, driven by its focus on adding more capacity to support the fast-growing demand for HBM.

It is worth noting that the data center segment accounted for 56% of Micron's revenue in the previous fiscal year with a gross margin of 52%. That was higher than the company's overall non-GAAP gross margin of 41%. Micron management believes that its "HBM share is on track to grow again," and that should pave the way for further margin improvements.

So, there is a strong possibility of Micron's earnings turning out to be better than expectations once again. At the same time, the favorable demand-supply environment in the memory industry should allow the company to deliver an upbeat guidance, fueling the possibility of more stock price upside.

The valuation makes it a no-brainer buy

Micron stock is trading at 32 times earnings right now. That's a slight discount to the tech-laden Nasdaq-100 index's average price-to-earnings (P/E) ratio of 34 (using the index as a proxy for tech stocks). The stock's forward earnings multiple of 15 is even more attractive, considering the big bottom-line jump that it is expected to deliver.

If Micron indeed achieves $17.27 per share in earnings in the current fiscal year (as per consensus estimates) and trades at even 25 times earnings after a year, its stock price could hit $432. That suggests a potential increase of 71% from current levels. In all, there is a solid probability of Micron delivering a beat-and-raise report, which can send this AI stock higher after Dec. 17.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.