Investors Continue Waiting On Sidelines For Enviro Energy International Holdings Limited (HKG:1102)

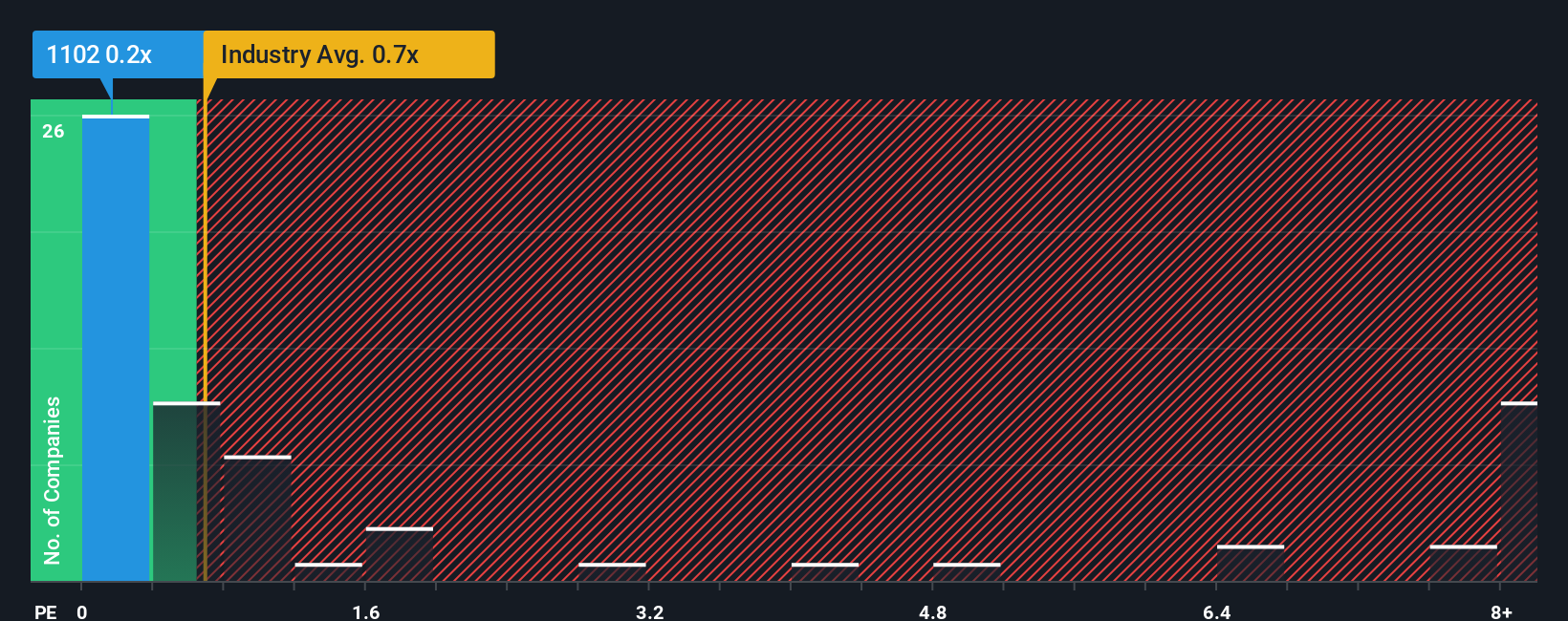

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Enviro Energy International Holdings Limited (HKG:1102) is a stock worth checking out, seeing as almost half of all the Trade Distributors companies in Hong Kong have P/S ratios greater than 0.7x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Enviro Energy International Holdings

How Enviro Energy International Holdings Has Been Performing

As an illustration, revenue has deteriorated at Enviro Energy International Holdings over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Enviro Energy International Holdings will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Enviro Energy International Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Enviro Energy International Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Comparing that to the industry, which is only predicted to deliver 5.1% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that Enviro Energy International Holdings is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Enviro Energy International Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Enviro Energy International Holdings that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.