Rent the Runway (RENT) Q3 Profit Swing Challenges Slow-Margin-Turnaround Narrative

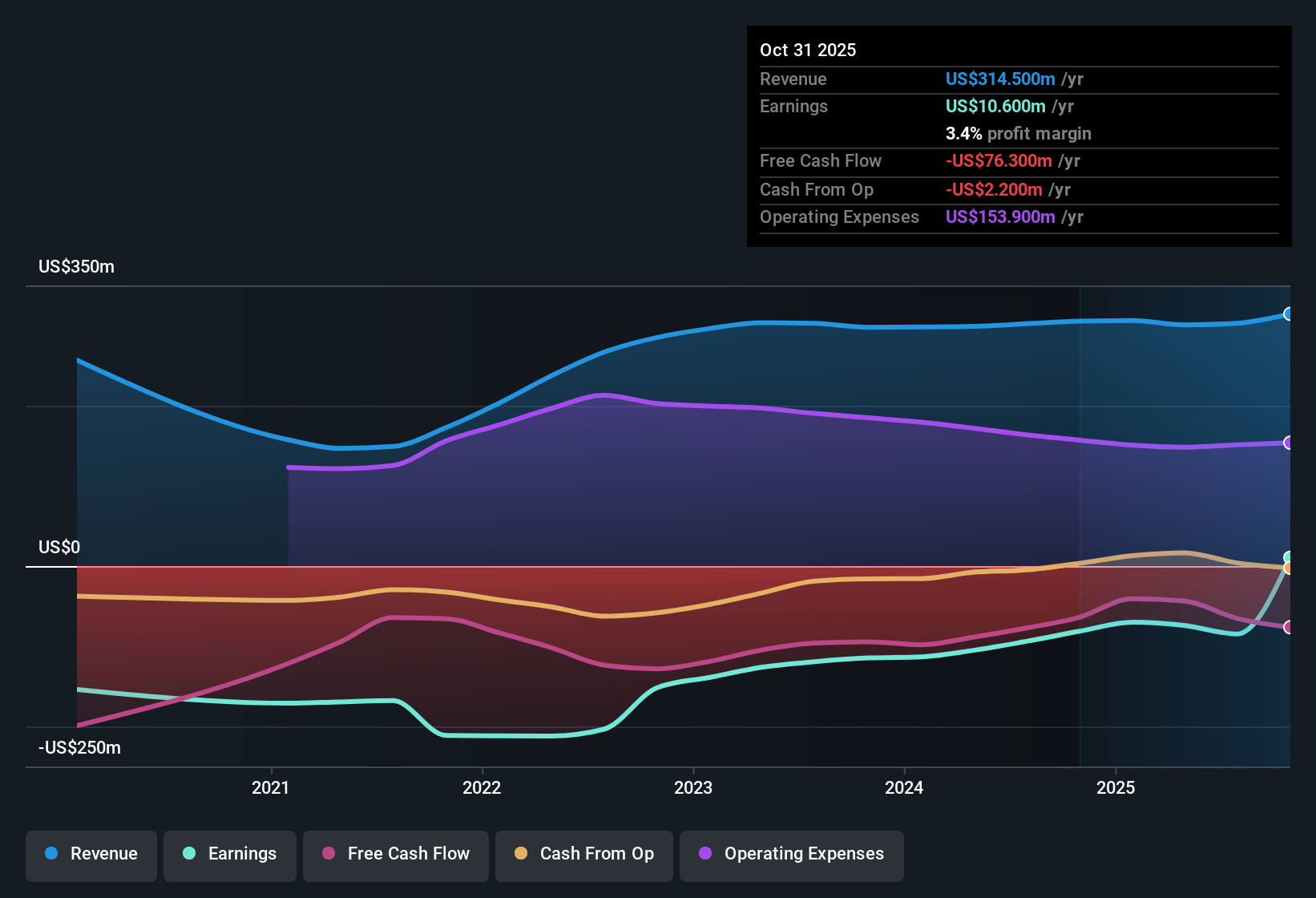

Rent the Runway (RENT) just posted a sharp swing into profitability for Q3 2026, with revenue of about $87.6 million and net income of roughly $76.5 million translating to EPS of around $13.69, while its trailing twelve month figures show revenue of about $314.5 million and net income of roughly $10.6 million, or EPS of about $2.45. Over recent quarters the company has seen revenue move from about $75.9 million in Q3 2025 to $87.6 million in Q3 2026, alongside a turn from a net loss of roughly $18.9 million and EPS of about negative $4.94 to the latest quarter's positive results. This sets up a story that is increasingly about how durable these margins and profitability gains might be.

See our full analysis for Rent the Runway.With the headline numbers laid out, the next step is to test them against the most widely held narratives about Rent the Runway, highlighting where the latest earnings back up the prevailing story and where they start to push back against it.

See what the community is saying about Rent the Runway

TTM profit flips from loss to $10.6 million

- On a trailing twelve month basis, net income moved from a loss of $84.8 million in Q2 2026 to a profit of $10.6 million in Q3 2026, while revenue over the same span edged up from $302.8 million to $314.5 million.

- Analysts' consensus view expects a much slower path, with revenue projected to grow only 1.7% annually and earnings reaching $14.2 million by about April 2028,

- Compared with that $14.2 million target, the latest trailing twelve month profit of $10.6 million already sits much closer than the earlier loss of $81.3 million in Q3 2025.

- This faster shift into profit than the consensus narrative assumed puts extra focus on whether subscriber growth and cost controls can keep the business around or above breakeven instead of sliding back into losses.

Volatile EPS swing versus steady revenue trend

- Quarterly revenue has stayed in a relatively tight band between $69.6 million and $87.6 million from Q2 2025 through Q3 2026, but basic EPS has swung from losses of between $3.44 and $6.58 per share in the five prior quarters to a positive $13.69 in Q3 2026.

- Consensus narrative highlights operational fixes like marketing efficiencies and better inventory as gradual margin drivers,

- Yet the jump from a trailing twelve month EPS of negative $21.57 in Q2 2026 to positive $2.45 in Q3 2026 suggests a much sharper profitability change than the slow margin convergence toward the 4.4% industry level that analysts modeled.

- This gap between the smoother consensus path and the actual EPS volatility means investors need to pay close attention to what portion of this improvement is repeatable versus tied to one off factors that may not show up again.

Turnaround narrative meets valuation expectations

- With the stock at $6.65 and analysts assuming earnings of $14.2 million and EPS of $3.55 by around 2028, the implied future price to earnings multiple of 15.6 times sits above the current US Specialty Retail industry level of 13.8 times.

- Consensus narrative leans on drivers like subscriber growth and a push toward free cash flow breakeven to justify that richer multiple,

- The improvement from a trailing twelve month loss of $81.3 million in Q3 2025 to a profit of $10.6 million in Q3 2026 supports the idea that margins can move meaningfully, which is central to the turnaround story.

- At the same time, expectations for the share count to rise 4.31% per year over the next three years remind investors that some of that future earnings growth will be spread over more shares, which can blunt the benefit of the operating improvement for each existing shareholder.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rent the Runway on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can turn that perspective into a full narrative that reflects your own view, Do it your way.

A great starting point for your Rent the Runway research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Rent the Runway’s rapid profit swing rides on volatile earnings, modest top line growth, and questions over how durable its new margins really are.

If you would rather focus on companies with steadier expansion and less earnings whiplash, use our stable growth stocks screener (2103 results) to quickly zero in on businesses built for consistent performance through shifting market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com