Procter & Gamble (PG): Has the 14% Share Price Slide Opened a Valuation Opportunity?

Procter & Gamble (PG) shares have slid about 14 % over the past year, leaving some long term holders uneasy and value oriented investors wondering whether this household staples giant is quietly slipping into bargain territory.

See our latest analysis for Procter & Gamble.

That slide reflects a reset in expectations after strong post pandemic demand and some input cost relief, with a roughly 14 percent 1 year total shareholder return decline contrasting with still positive 5 year total shareholder returns. This suggests that long term compounding has slowed but not broken.

If PG has you rethinking your staples exposure, it could be a useful moment to explore other defensive ideas across healthcare stocks that might offer steadier growth or income potential.

With earnings still growing modestly and the shares trading at a noticeable discount to analyst targets, investors now face a key question: is Procter & Gamble a defensive blue chip on sale, or is future growth already priced in?

Most Popular Narrative: 19.2% Overvalued

According to andre_santos, the narrative fair value of 119.81 dollars sits well below Procter & Gamble's last close at 142.84 dollars, setting up a clear valuation gap worth unpacking.

Given the company maturity and stage of its lifecycle, growth is expected to remain modest at the rate of inflation and the risk free rate, so it will float around 2 to 4% over the next years.

Curious how steady, low single digit growth assumptions, disciplined margins, and dividend math can still argue for a lower fair value than today? The full narrative spells out the tension between slow compounding, rich cash flow forecasts, and what that implies for long run valuation.

Result: Fair Value of $119.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in consumer preferences or sharper than expected competitive pressure could sustain volume growth, support higher margins, and challenge the cautious valuation narrative.

Find out about the key risks to this Procter & Gamble narrative.

Another Lens on Valuation

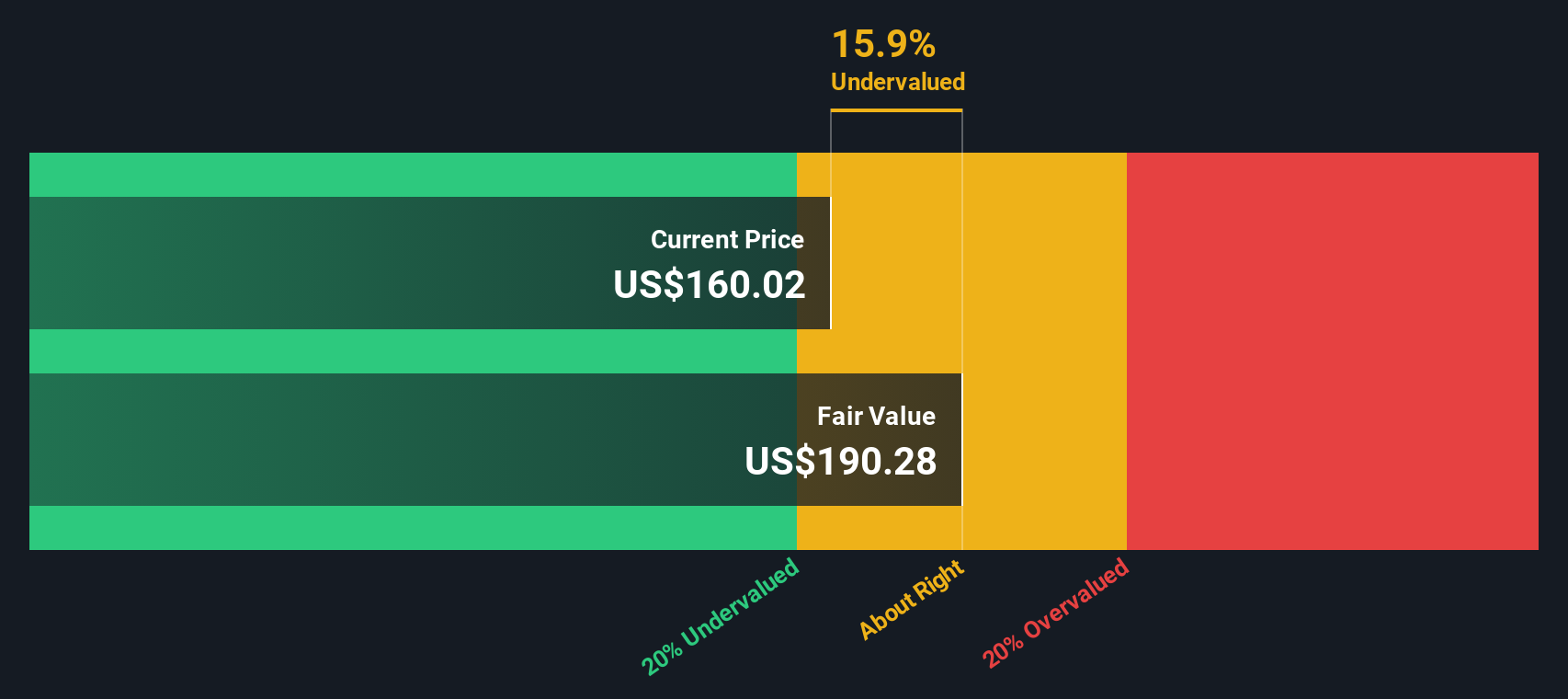

Simply Wall St’s DCF model paints a very different picture, suggesting Procter & Gamble is trading about 26 percent below its estimated fair value of 194.19 dollars. Instead of a fully priced defensive, the cash flow math hints at a discount that could tempt patient buyers, or it may raise the question of whether the model is too optimistic about durability and growth.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Procter & Gamble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Procter & Gamble Narrative

If you are not persuaded by these views or would rather dig into the numbers yourself, you can build a personalized narrative in just a few minutes, Do it your way.

A great starting point for your Procter & Gamble research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, make sure you tap into fresh opportunities using the Simply Wall St Screener, or you could miss stocks quietly setting up their next move.

- Capture potential mispricings by targeting these 907 undervalued stocks based on cash flows that pair strong cash flows with attractive entry points before the crowd catches on.

- Capitalize on innovation momentum by focusing on these 26 AI penny stocks positioned at the center of real world artificial intelligence adoption.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that combine reliable payouts with balanced financial profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com