Is American Water Works (AWK) Undervalued After Its Recent Steady Share Price Climb?

American Water Works Company (AWK) has quietly edged higher over the past week, adding about 2% and extending modest gains for the month, even as the past 3 months remain slightly negative.

See our latest analysis for American Water Works Company.

Zooming out, that steady 7 day share price return sits alongside a year to date share price gain of 6.2%, while the 1 year total shareholder return of 4.0% shows momentum tentatively rebuilding after a weak multi year picture.

If American Water Works steady climb has you thinking more broadly about defensiveness and income, it could be worth exploring other regulated healthcare stocks as potential complements in your portfolio.

With earnings still growing and the share price lagging its pre pandemic highs, investors are left with a familiar puzzle: is American Water Works quietly undervalued here, or are markets already pricing in its next chapter of regulated growth?

Most Popular Narrative Narrative: 8.5% Undervalued

With the most widely followed fair value sitting meaningfully above the last close at $131.55, the narrative leans toward a supportive long term setup.

Persistent population growth and urbanization across key U.S. states are fueling organic customer additions (e.g., 2% customer growth target and multiple acquisitions adding ~87,000 connections). This underpins long-term revenue growth as American Water expands its service footprint and taps into rising water demand.

Heightened regulatory and societal focus on water quality and infrastructure modernization is accelerating rate case approvals and driving significant capital investment (e.g., $3.3 billion capital spend in 2025, requests for $111 million cumulative rate increases in CA by 2029). These factors enable predictable, above-inflation rate increases and support sustainable earnings expansion.

Want to see the math behind this calm looking utility call? From earnings power to future margins and valuation multiples, the narrative reveals the full pricing blueprint.

Result: Fair Value of $143.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and higher interest expenses could squeeze margins and limit the upside implied by those optimistic long term growth assumptions.

Find out about the key risks to this American Water Works Company narrative.

Another Angle on Valuation

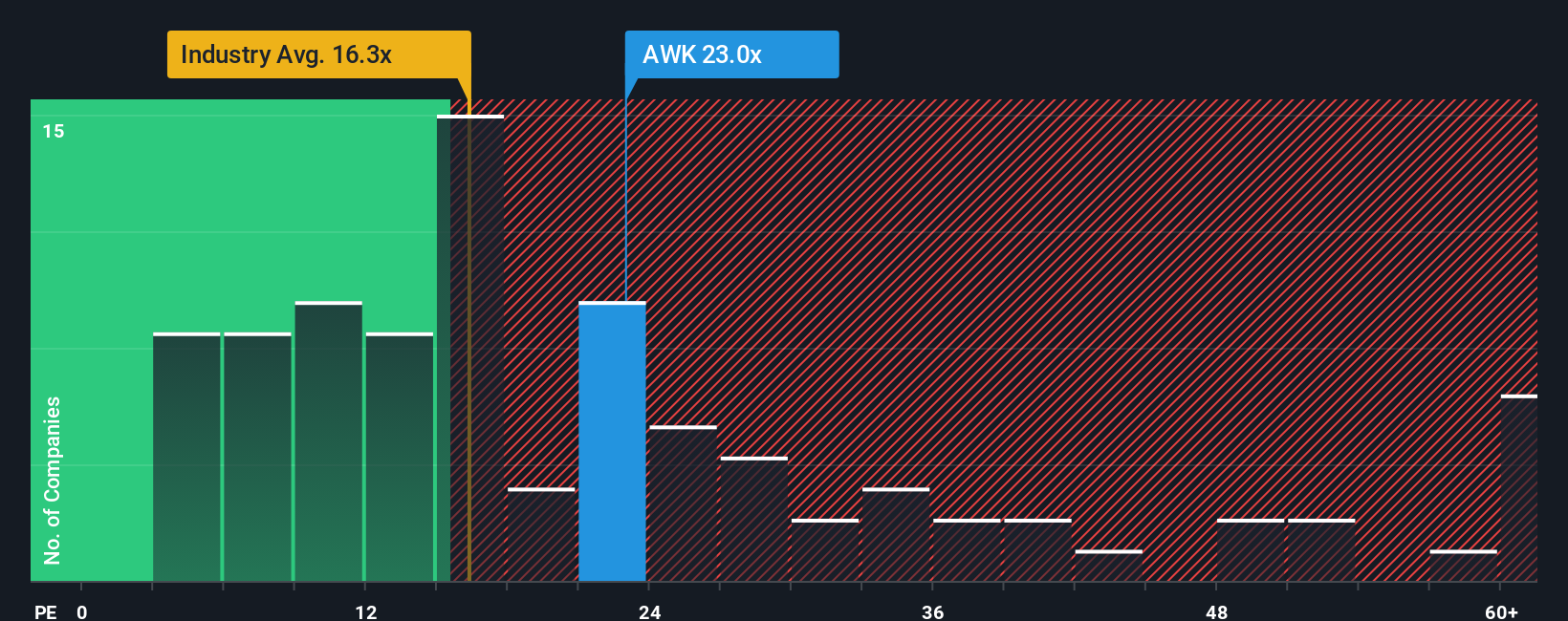

On earnings, American Water Works looks anything but cheap, trading at about 23.1 times profit versus 18.4 times for peers and 16.2 times for the global water utilities group, even though our fair ratio points to only 23.6 times. That narrow gap leaves little margin for disappointment if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Water Works Company Narrative

If you see things differently or simply prefer to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your American Water Works Company research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Before you move on, lock in your edge by scanning fresh stock ideas on Simply Wall Street, so the next wave of opportunities does not pass you by.

- Turn market volatility into potential upside by targeting companies trading below their estimated worth through these 907 undervalued stocks based on cash flows, grounded in long term cash flow potential.

- Harness powerful growth themes by focusing on innovation leaders with these 26 AI penny stocks that may reshape everything from automation to real time data intelligence.

- Strengthen your income strategy with dependable cash generators using these 13 dividend stocks with yields > 3%, designed to highlight yields that can help support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com