Ciena (CIEN) Margin Drag Persists in Q4 FY2025, Testing AI‑Driven Bullish Narratives

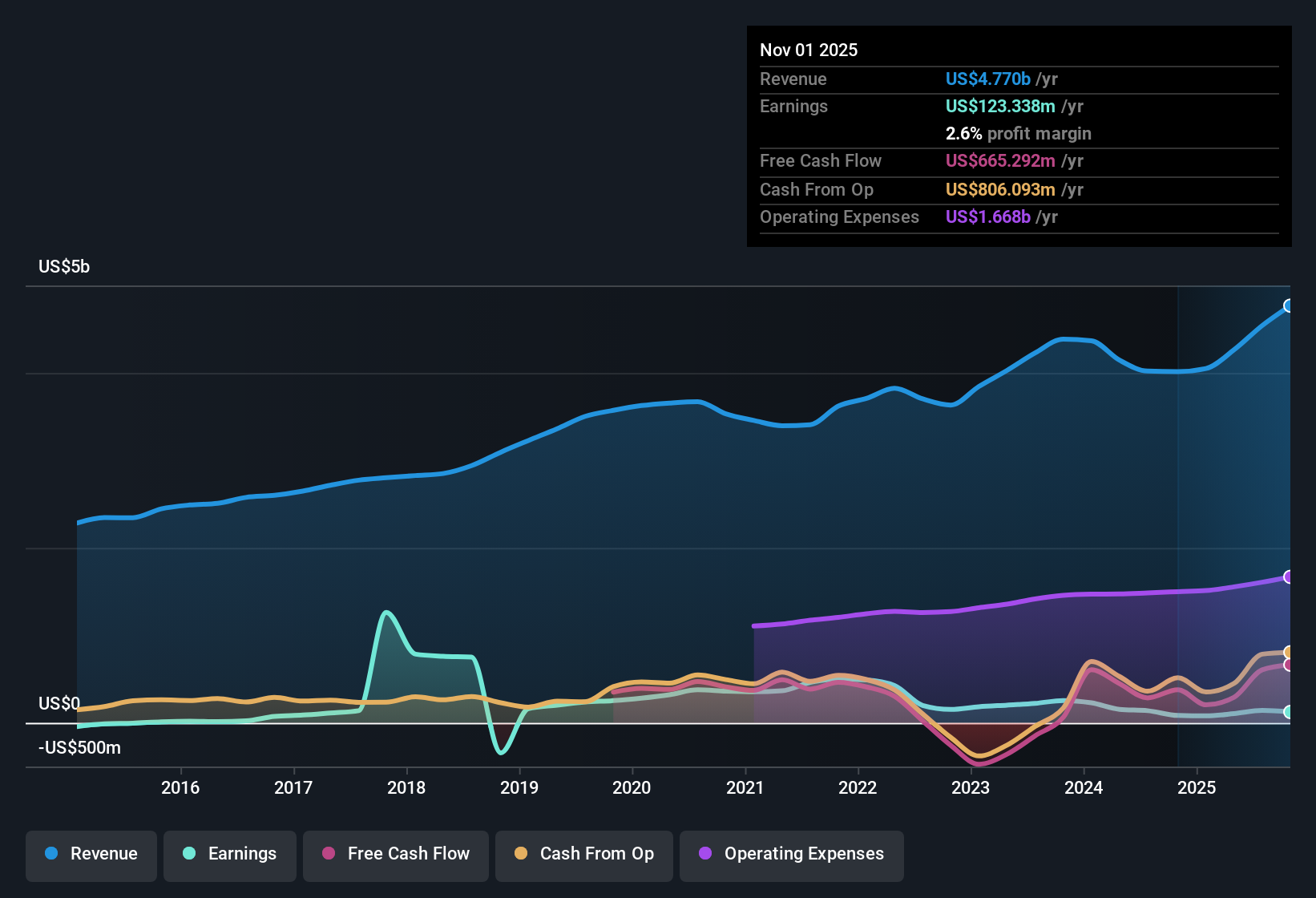

Ciena (CIEN) just wrapped up FY 2025 with fourth quarter revenue of about $1.4 billion and basic EPS of $0.14, alongside trailing twelve month revenue of roughly $4.8 billion and EPS of $0.87. The company has seen revenue move from $1.1 billion and EPS of $0.26 in Q4 2024 to the latest $1.4 billion and $0.14. On a trailing basis, revenue has stepped up from about $4.0 billion and EPS of $0.58 to $4.8 billion and $0.87, setting the stage for investors to weigh modest net margins against the growth narrative embedded in these results.

See our full analysis for Ciena.With the headline numbers on the table, the next step is to see how this mix of top line expansion and slim margins lines up with the dominant narratives around Ciena's growth outlook and earnings power.

See what the community is saying about Ciena

Trailing Net Margin Sits Around 2.6%

- On a trailing twelve month basis, Ciena earned $123.3 million of net income on $4.8 billion of revenue, which works out to a net margin of about 2.6% compared with 2.1% a year earlier.

- Bulls point to AI driven demand and higher margin products as future margin drivers, yet the current 2.6% margin shows that story is still early in the numbers.

- The consensus narrative highlights record orders and a shift toward higher margin optical and automation solutions, but that mix has not yet translated into mid single digit or higher net margins in the trailing results.

- At the same time, analysts expect margins to rise meaningfully over the next few years, so investors watching the bullish case will be looking for this 2.6% margin to move closer to those targets in future periods.

Bulls argue that today's thin margins could be the base for a much more profitable AI networking leader once its record order book converts to higher margin revenue. 🐂 Ciena Bull Case

One Off $114M Loss Distorts Profit Picture

- The trailing 12 month figures include a one off loss of $114.0 million, which weighs on the $123.3 million of net income and keeps the net margin at 2.6% instead of a cleaner run rate.

- Skeptics who worry about structurally weak profitability may want to separate this large non recurring item from underlying operations to see how much of the low margin profile is really due to ongoing business performance.

- Over the past year, earnings actually grew 45.9% even with the one off loss included, suggesting underlying profitability improved versus the prior 12 months despite the drag.

- However, bears can reasonably point to the five year annualized earnings decline of 29.4% as evidence that occasional charges are not the only factor behind historically choppy profit trends.

Skeptics warn that even once the $114 million one off is stripped out, Ciena still has to prove it can sustain higher quality earnings through an entire cycle. 🐻 Ciena Bear Case

Revenue Growth Forecast Around 13.6% Annually

- Analysts forecast Ciena's revenue to grow by roughly 13.6% per year, ahead of a 10.6% growth rate cited for the broader US market, after trailing 12 month revenue stepped up from about $4.0 billion to $4.8 billion.

- The consensus narrative that cloud and AI investments will drive multiyear network build outs lines up with these double digit revenue expectations, but investors should match that growth story against how quickly margins and earnings actually scale.

- Record orders and deeper partnerships with hyperscalers support the idea of sustained top line expansion, which is consistent with the 13.6% annual revenue growth forecast.

- Yet with net income at $123.3 million on $4.8 billion of sales today, the path from strong revenue growth to the much higher earnings levels embedded in longer term forecasts still depends on significant margin improvement.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ciena on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers pointing in another direction? In just a few minutes, you can turn that viewpoint into your own structured story: Do it your way.

A great starting point for your Ciena research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Ciena's thin net margins, one off loss and historically uneven earnings growth raise questions about the durability and consistency of its profit trajectory.

If you want more predictable compounding instead, use our stable growth stocks screener (2103 results) to focus on businesses already delivering steady revenue and earnings progress through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com