Peabody Energy (BTU): Revisiting Valuation After a 58% Three-Month Share Price Rebound

Why Peabody Energy is Back on Watchlists

Peabody Energy (BTU) has quietly turned into a strong performer over the past 3 months, with the stock up roughly 58%, even as its latest annual results still show a small net loss.

See our latest analysis for Peabody Energy.

Zooming out, that recent strength comes after a choppy year. Peabody’s share price is now at $29.15, with momentum clearly rebuilding following a strong 90 day share price return alongside a solid five year total shareholder return.

If Peabody’s rebound has you curious about what else is working in the market, this could be a good time to explore fast growing stocks with high insider ownership for more high conviction ideas.

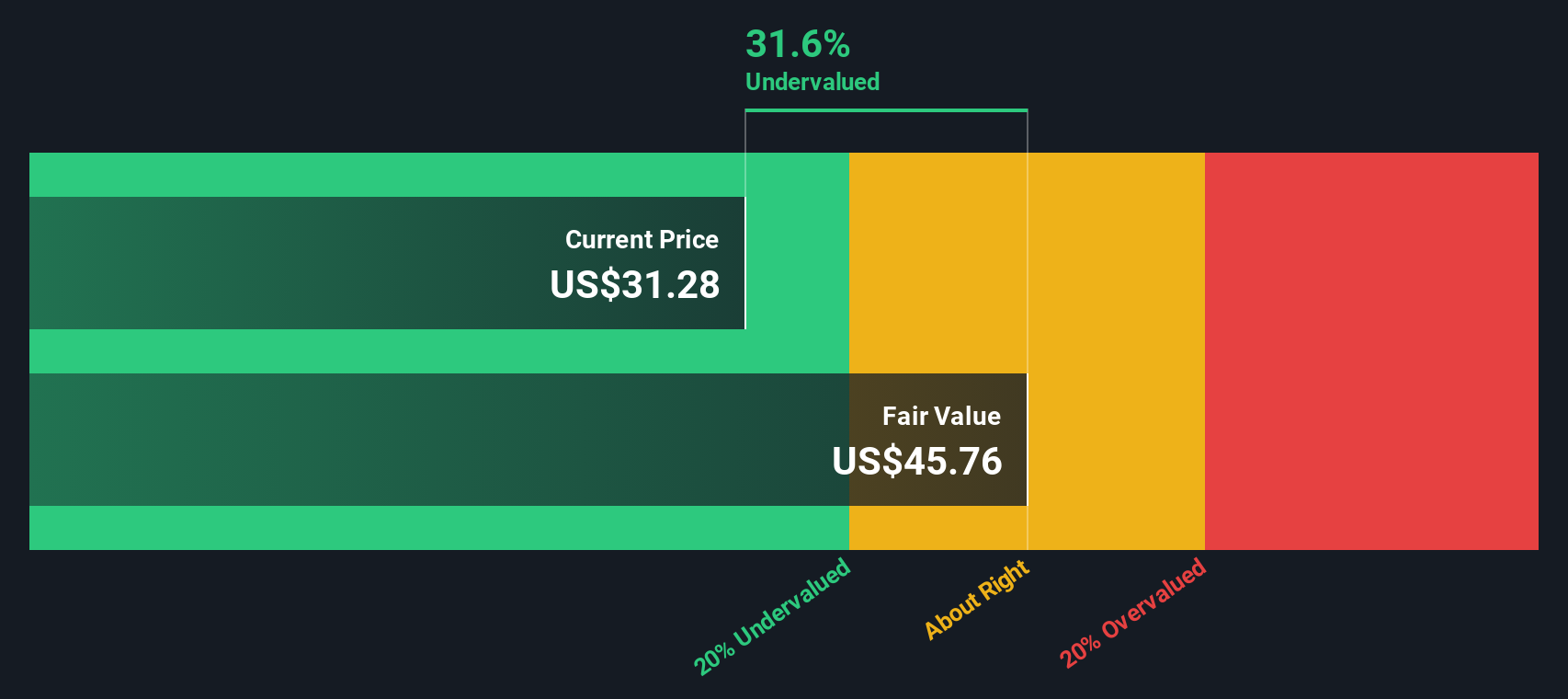

With shares trading below analyst targets but still reflecting hefty recent gains, the key question now is whether Peabody remains undervalued on future cash flows or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 15.4% Undervalued

With Peabody Energy last closing at $29.15 against a narrative fair value near the mid thirties, the storyline leans toward upside if projections land.

Company wide investments in cost control, operational efficiency, and asset optimization are consistently driving costs per ton below guidance while maintaining robust liquidity, supporting EBITDA resilience and providing flexibility for shareholder returns through dividends and buybacks, which in turn are expected to drive EPS growth.

Curious how steady revenue growth, rising margins and a lower future earnings multiple can still point to upside? The full narrative reveals the math behind that confidence.

Result: Fair Value of $34.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the long term shift toward renewables and tighter environmental regulation could still pressure coal demand and margins, which would challenge this undervaluation thesis.

Find out about the key risks to this Peabody Energy narrative.

Another Lens on Value

While the narrative fair value suggests modest upside, Peabody’s share price of $29.15 looks far cheaper against our DCF estimate of about $86.10. Our DCF model therefore flags BTU as deeply undervalued, raising the question of whether the market is over discounting coal risk.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peabody Energy Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Peabody Energy.

Ready for more high potential ideas?

Do not stop at a single opportunity; use the Simply Wall Street Screener to uncover targeted stock ideas that could sharpen your next move and strengthen your portfolio.

- Capture potential multi baggers early by scanning these 3606 penny stocks with strong financials that already show improving fundamentals and financial discipline.

- Position yourself ahead of the next technology wave by focusing on these 26 AI penny stocks shaping automation, data intelligence, and productivity breakthroughs.

- Lock in higher income potential by targeting these 13 dividend stocks with yields > 3% that combine solid balance sheets with reliable, above market yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com