Natural Grocers (NGVC) Earnings: Margin Improvement Challenges Cautious Profitability Narratives

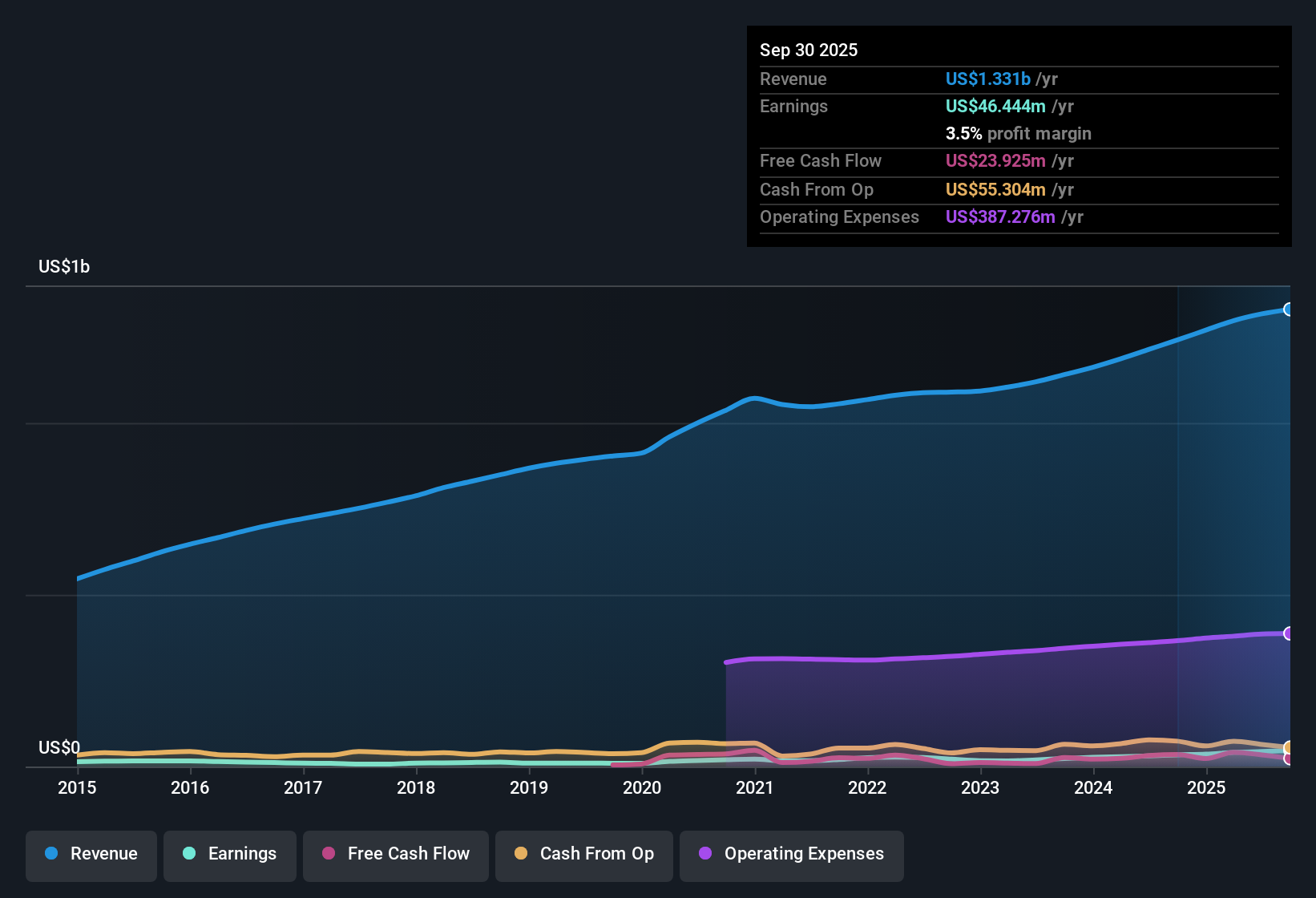

Natural Grocers by Vitamin Cottage (NGVC) has wrapped up FY 2025 with fourth quarter revenue of $336.1 million and basic EPS of $0.51, alongside trailing twelve month revenue of about $1.3 billion and EPS of $2.02. Over the last few quarters the company has seen revenue move from $322.7 million in Q4 2024 to $336.1 million in Q4 2025, while quarterly EPS stepped up from $0.40 to roughly the low $0.50s as net income climbed from $9.0 million to $11.8 million. With net margin rising from 2.7% to 3.5% over the past year, this latest release puts the spotlight firmly on how much of the story is now about profitability rather than just sales growth.

See our full analysis for Natural Grocers by Vitamin Cottage.With the numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around Natural Grocers, and where the fresh data may start to shift investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

36.9% Earnings Growth Outpaces 6.2% Sales Lift

- Over the last 12 months, revenue rose about 6.2% to roughly $1.33 billion while net income climbed 36.9% to $46.4 million, so profit grew much faster than sales.

- What stands out for bullish investors is that this profit surge lines up with steadily rising EPS, from $1.49 to $2.02 on a trailing basis.

- This heavily supports the view that the business is getting more efficient at turning each dollar of sales into bottom line.

- At the same time, quarterly EPS has stayed in the low to mid $0.50 range through FY 2025, suggesting that this improvement is not just a one quarter spike.

Net Margin Steps Up To 3.5%

- Net margin on a trailing basis improved from 2.7% to 3.5%, helped by net income rising from $33.9 million to $46.4 million over about $1.33 billion of revenue.

- Supporters who focus on profitability will point out that this margin shift means each dollar of revenue now leaves more cents in profit.

- This lines up with the move in trailing EPS from $1.49 to $2.02 even though same store sales growth was running at a mid single digit to high single digit pace between 7.0% and 8.9% in recent quarters.

- Critics, however, may note that this margin level is still built on revenue growth that trails the wider US market’s 10.7% rate, so the story leans more on efficiency than rapid expansion.

Cheap On P/E, But Above DCF Fair Value

- On valuation, the stock trades at 12.6 times trailing earnings, below both the US market at 19.1 times and the US consumer retailing average at 22.9 times, yet the $25.46 share price sits well above the $8.80 DCF fair value estimate.

- What is interesting for more cautious investors is how this mix of signals cuts both ways.

- The lower P/E versus peers matches up with earnings growth of 36.9%, which can look appealing if you focus on multiples.

- At the same time, the gap between the current price of $25.46 and the $8.80 DCF fair value shows why some might question how much upside is already reflected in the market.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Natural Grocers by Vitamin Cottage's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Natural Grocers is improving profitability, its modest mid single digit sales growth and valuation premium to DCF suggest limited upside compared to more compelling opportunities.

If that cautious setup makes you uneasy, consider shifting your attention to these 907 undervalued stocks based on cash flows instead, where you can quickly pinpoint stocks with stronger value upside and more attractive risk reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com