Has the 600% Five Year Surge in Commerzbank Already Gone Too Far?

- Wondering if Commerzbank’s massive run up has already priced in the upside, or if there is still value on the table? This breakdown is for you.

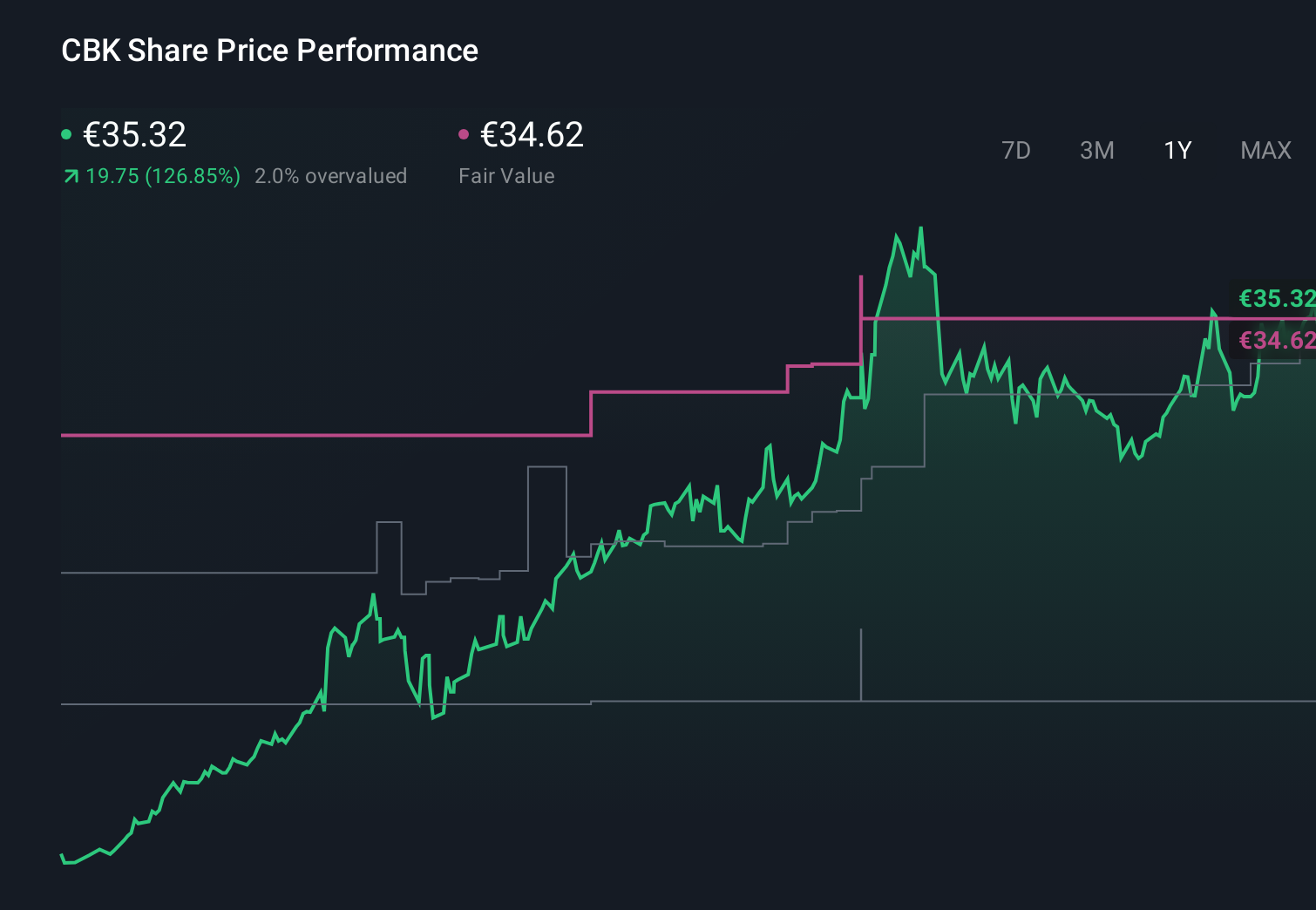

- The stock has pulled back slightly over the last month, down 1.3%, but that comes after a huge 121.3% gain year to date and a staggering 600.6% rise over five years, which naturally raises questions about what is driving this rally.

- Recent headlines have focused on Commerzbank’s push to streamline its business, strengthen its capital position, and refocus on core German and European banking operations. Markets tend to reward these moves when they are done credibly. At the same time, ongoing discussions around European interest rate paths, banking sector consolidation, and regulatory shifts have created a backdrop where investors are rethinking both the risks and the long term earnings power of traditional lenders like Commerzbank.

- On our framework, Commerzbank scores a 3 out of 6 on valuation, suggesting there are still pockets of undervaluation, but not across the board. Next, we will unpack what each method is really saying about the stock and close with an even more practical way to think about its true worth.

Approach 1: Commerzbank Excess Returns Analysis

The Excess Returns model looks at how much profit Commerzbank can generate above the return that investors require on its equity, then converts that stream of extra value into an intrinsic share price.

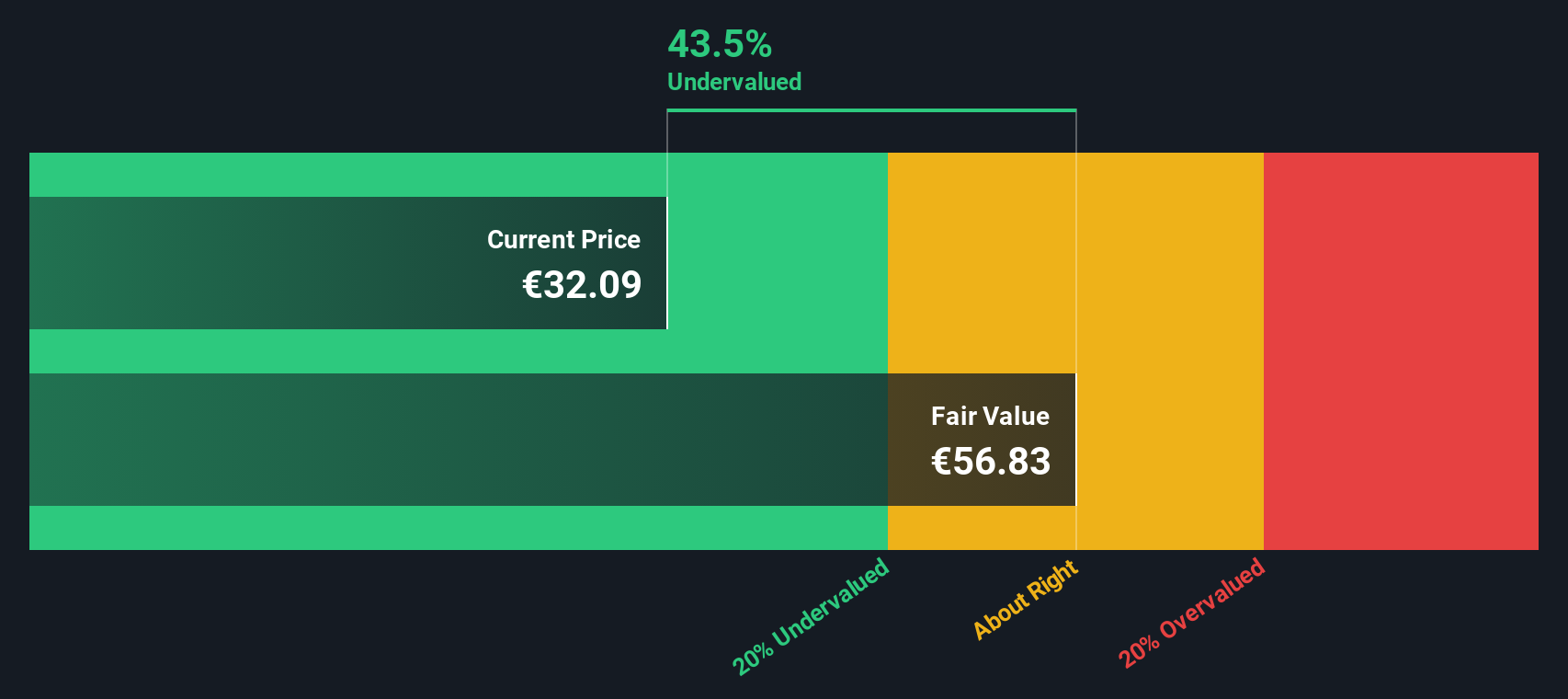

For Commerzbank, the starting point is a Book Value of €20.61 per share and a Stable EPS of €3.15 per share, based on weighted future Return on Equity estimates from 11 analysts. With an Average Return on Equity of 10.60% and a Cost of Equity of €1.80 per share, the bank is expected to generate an Excess Return of €1.35 per share, implying that it can earn meaningfully more than its cost of capital.

The model also assumes a Stable Book Value of €29.72 per share, using future book value estimates from 7 analysts, and capitalizes these expected excess returns into an intrinsic value of about €59.78 per share. Compared with the current market price, this implies the stock is roughly 42.4% undervalued, suggesting the market is not fully pricing in Commerzbank’s profitability and growth potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Commerzbank is undervalued by 42.4%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Commerzbank Price vs Earnings

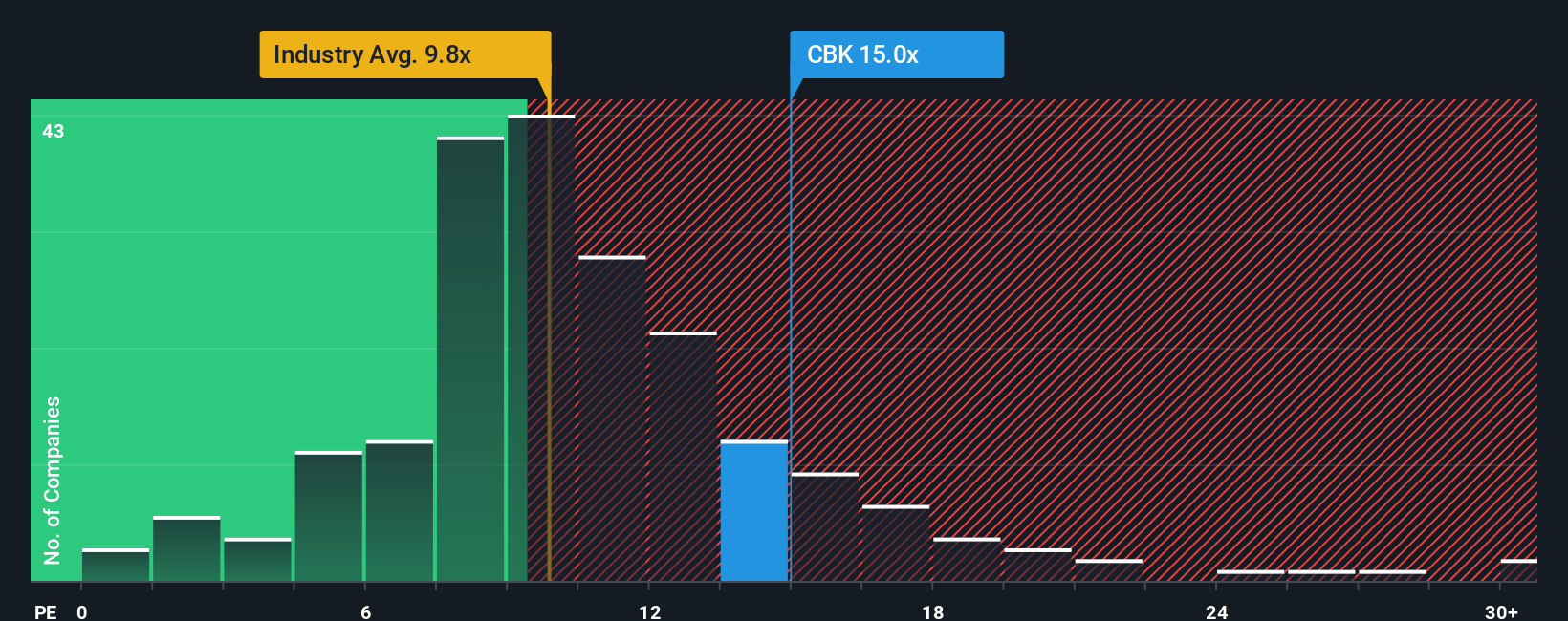

For a profitable bank like Commerzbank, the Price to Earnings, or PE, multiple is a natural way to think about valuation because it links what you pay today directly to the earnings the business is already generating. In general, higher expected growth and lower perceived risk justify a higher PE, while slower growth or greater uncertainty usually mean a lower, more conservative PE is appropriate.

Commerzbank currently trades on a PE of 15.63x, a clear premium to both the Banks industry average of 10.81x and the peer average of 10.25x. On the surface, that might suggest the stock is getting expensive compared with other lenders. However, Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE Commerzbank should reasonably trade at, given its earnings growth outlook, profit margins, risk profile, industry positioning and market cap.

On this basis, Commerzbank’s Fair Ratio comes out at 15.87x, which is very close to the current 15.63x market multiple. That tight gap implies the stock is broadly trading in line with what its fundamentals justify rather than being meaningfully stretched or mispriced.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Commerzbank Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that helps you turn your view of Commerzbank into a structured story. It links what you believe about its digital transformation, margins and growth to a concrete financial forecast and fair value. You can then compare that fair value with today’s price to guide buy or sell decisions, while it automatically updates as new news or earnings arrive. For example, one investor might build a bullish Commerzbank Narrative around earnings rising toward €3.6 billion and fair value in the mid €30s, while another uses more cautious assumptions closer to €2.9 billion of earnings and a fair value near €21. Both are using the same framework but embedding very different perspectives about the bank’s future.

Do you think there's more to the story for Commerzbank? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com