Has Micron’s 176% AI Fueled Surge Already Priced In Its Growth Potential?

- If you are wondering whether Micron Technology is still a smart buy after its massive run up, or if the easy money has already been made, you are in the right place.

- The stock has surged 176.1% year to date and 136.2% over the last year. This comes even with a small 1.5% pullback in the past month and a 1.7% gain over the last week, which hints that investor expectations and perceived risk are shifting fast.

- Recent headlines have zeroed in on Micron as a key beneficiary of demand for high bandwidth memory and AI data center infrastructure, placing it at the center of the AI hardware narrative. At the same time, policy moves around chip export controls and ongoing supply chain investment plans have kept sentiment lively, as investors weigh structural demand against cyclical risks.

- In our framework, Micron scores a 3/6 valuation check score, suggesting it looks undervalued on some metrics but not others. Next we unpack the standard valuation approaches before closing with a more powerful way to think about what the stock is really worth.

Approach 1: Micron Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, using a required rate of return. For Micron Technology, we use a 2 Stage Free Cash Flow to Equity model based on cash flow projections in $.

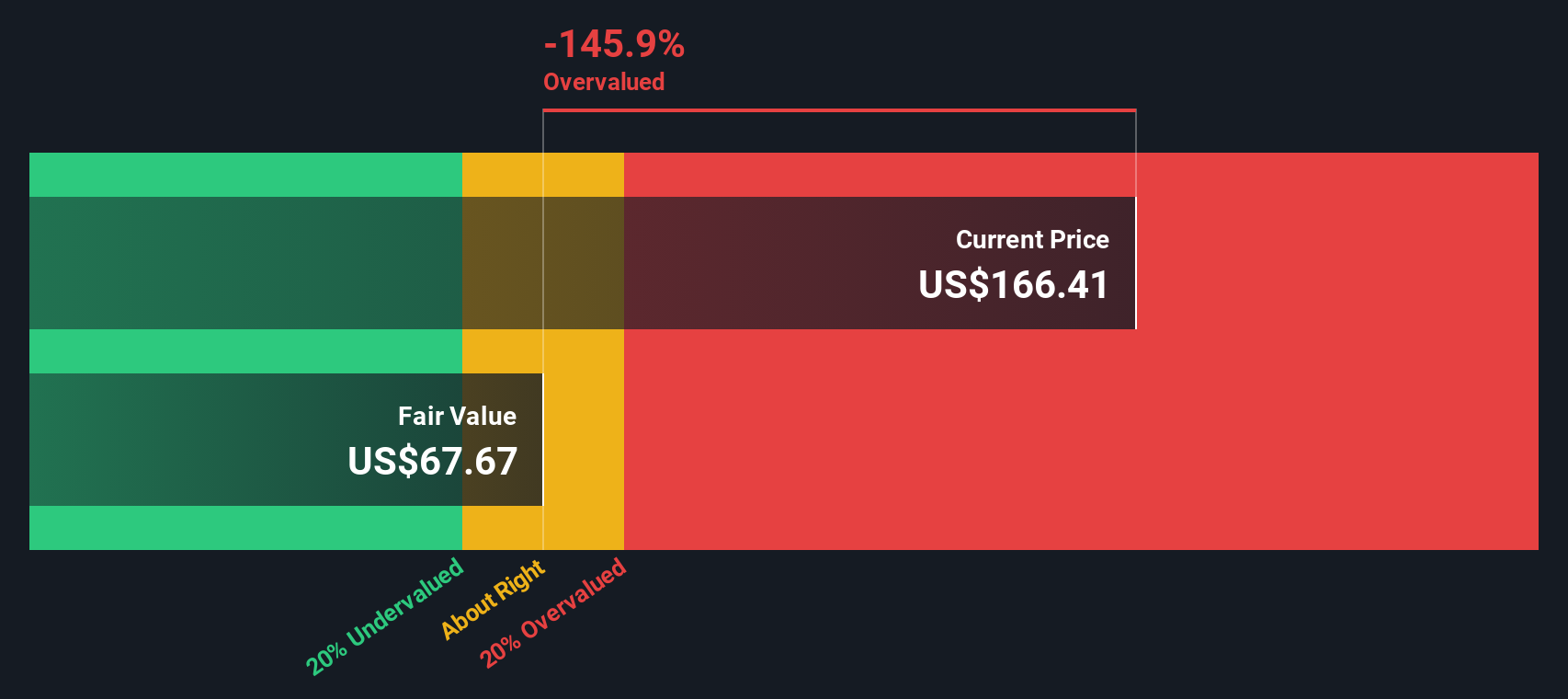

Micron generated roughly $2.2 billion in free cash flow over the last twelve months. Analyst forecasts, extended by Simply Wall St s own extrapolations beyond the typical five year window, see free cash flow rising into the mid to high single digit billions, reaching about $10.6 billion by 2030. These ten year cash flow projections are then discounted back to arrive at an intrinsic value per share.

On this basis, the model estimates a fair value of about $103.06 per share. Compared with the current share price, the implied DCF discount indicates the stock is roughly 134.0% above this estimate, suggesting Micron is trading well ahead of its modeled cash flow value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Micron Technology may be overvalued by 134.0%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Micron Technology Price vs Earnings

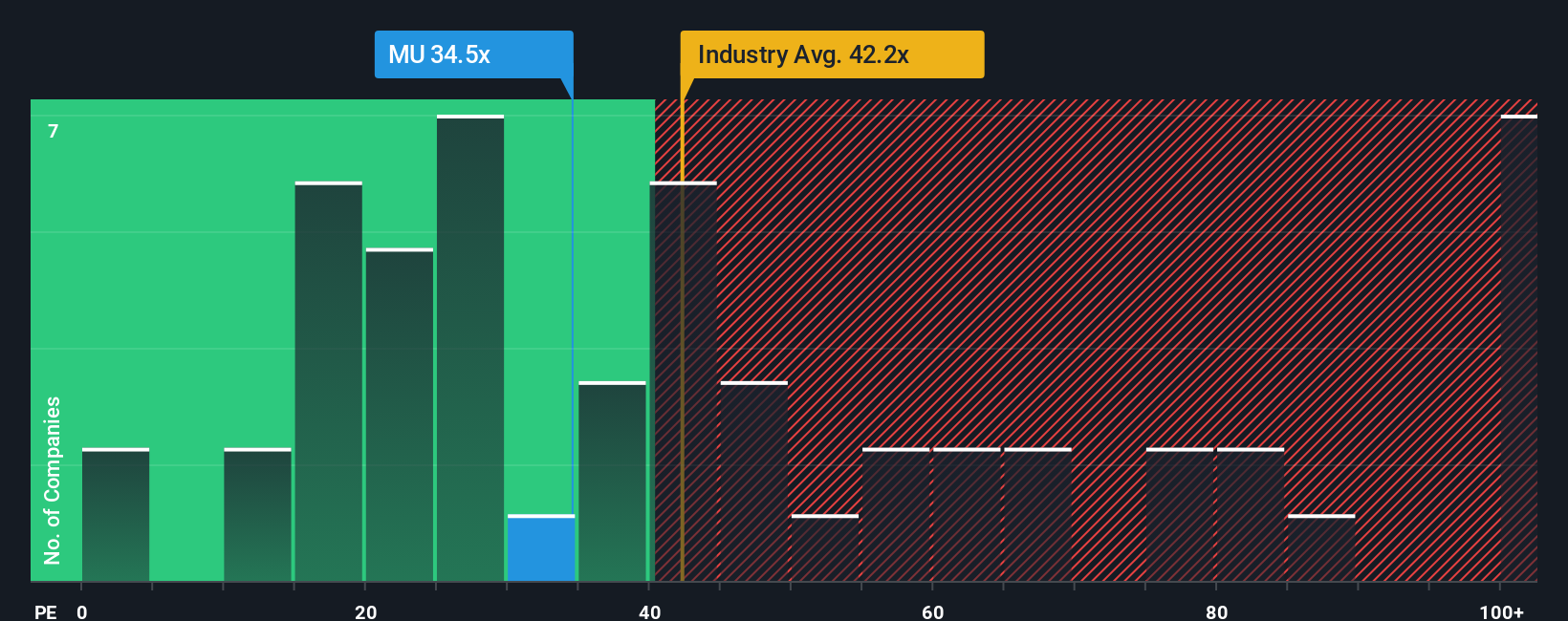

For profitable companies like Micron, the price to earnings (PE) ratio is a practical way to gauge how much investors are willing to pay for each dollar of earnings. A higher PE can be justified when the market expects stronger, more durable growth, while companies facing greater uncertainty or cyclicality typically deserve lower, more conservative multiples.

Micron currently trades on a PE of about 31.7x. That is below the broader semiconductor industry average of roughly 37.0x and well under the peer group average of around 85.9x. At first glance, this suggests the stock is not aggressively priced relative to many AI exposed chip names. However, Simply Wall St also uses a Fair Ratio framework, which estimates what Micron’s PE should be, given its earnings growth outlook, margins, industry, market cap and risk profile.

On this basis, Micron’s Fair PE Ratio is 49.8x, noticeably higher than its current 31.7x. Because this proprietary Fair Ratio adjusts for company specific growth and risk, it is a more tailored benchmark than simple peer or industry comparisons and indicates that the market may still be underappreciating Micron’s earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Micron Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a clear story to your numbers by linking what you believe about Micron’s business to explicit forecasts for its future revenue, earnings and margins, and then to a fair value estimate. A Narrative on Simply Wall St’s Community page lets you quickly capture your view of Micron, whether that is a high growth, AI supercycle path that supports a fair value around $220 per share or a more cautious, cycle aware view closer to $95. It then automatically turns that story into a financial model that you can compare with today’s share price to inform your decision to buy, hold or sell. Because Narratives are updated dynamically as new news, earnings and guidance arrive, they are an easy, accessible way to keep your thesis current and see how your fair value moves with the facts, instead of relying only on static PE or DCF snapshots.

Do you think there's more to the story for Micron Technology? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com