Transcontinental (TSX:TCL.A) Margin Improvement Reinforces Bullish Profitability Narrative Despite Softer Sales

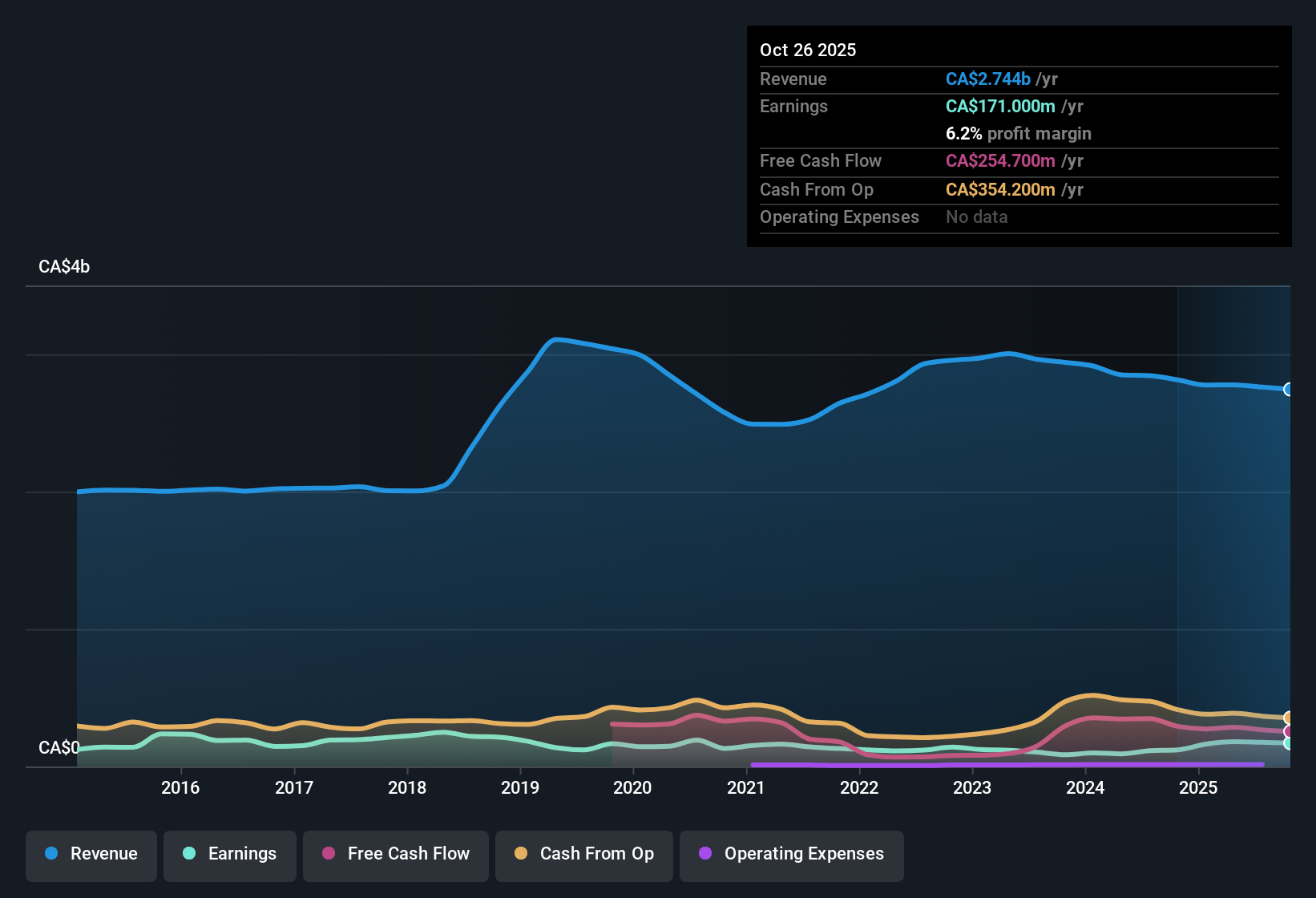

Transcontinental (TSX:TCL.A) has wrapped up FY 2025 with fourth quarter revenue of CA$732.4 million and basic EPS of CA$0.51, capping a year in which trailing twelve month EPS reached about CA$2.04 on revenue of roughly CA$2.7 billion as earnings grew 41.1% and net profit margin moved to 6.2% from 4.3%. Over the past few quarters, the company has seen revenue move from CA$700 million and EPS of CA$0.50 in Q3 2024 to CA$684.4 million and CA$0.46 in Q3 2025, setting the stage for investors to evaluate that earnings trajectory in the context of future developments. With profitability now running at a higher margin level, the latest print provides the market with a clearer benchmark for assessing how sustainable those gains might be.

See our full analysis for Transcontinental.With the headline numbers on the table, the next step is to see how this earnings profile aligns with the dominant narratives around Transcontinental, and where the data begins to challenge those stories.

See what the community is saying about Transcontinental

Margins Strengthen Despite Softer Sales

- Over the last 12 months, net profit margin improved from 4.3% to 6.2% even as trailing revenue slipped from about CA$2.8 billion to roughly CA$2.7 billion.

- Bulls point to cost reduction and efficiency programs as key drivers of this margin lift, and the recent numbers give them support, with trailing net income rising from CA$121.3 million to CA$171 million while revenue edged down, although bears can still argue that margin gains may be harder to maintain if volumes in packaging and printing continue to soften.

LTM Earnings Growth Outruns Five Year Pace

- Trailing twelve month EPS of CA$2.04 is up 41.1% year on year, well ahead of the roughly 2% average annual EPS growth over the last five years.

- From a bullish angle, consensus narrative comments about stronger free cash flow and potential real estate sales line up with this earnings step up. Yet skeptics can note that quarterly EPS has moved from CA$0.66 in Q1 2025 to CA$0.51 in Q4, which makes it fair to question how much of the 41.1% jump is repeatable versus timing related.

Cheap On P E, Yet DCF Is Cautious

- At a share price of CA$23.48, the stock trades on a trailing P E of 11.5 times versus a DCF fair value of about CA$14.63, and both sit against an analyst price target reference of roughly CA$27.14.

- Bears highlight that forecasts in the data call for earnings to shrink about 33.6% per year and revenue about 34.8% per year over the next three years, and that contraction path lines up more with the conservative DCF fair value of CA$14.63 than with the current price, even though the lower P E and 3.83% dividend give value investors a reason to stay engaged.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Transcontinental on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle? In just a few minutes you can turn that view into a structured story: Do it your way.

A great starting point for your Transcontinental research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite margin gains, Transcontinental faces a cautious DCF, forecast multi year revenue and earnings declines, and questions over how durable the recent EPS surge really is.

If shrinking forward earnings and a potential valuation air pocket concern you, pivot toward stable growth stocks screener (2103 results) to quickly focus on businesses built around steadier, more predictable growth paths.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com