Patria Investments (NasdaqGS:PAX): Assessing Valuation After a Strong 3‑Month Share Price Rally

Patria Investments (PAX) has quietly rewarded patient shareholders, with the stock up about 7% over the past month and roughly 12% in the past 3 months, outpacing many diversified financial peers.

See our latest analysis for Patria Investments.

Zooming out, Patria’s 1 year total shareholder return of about 35%, backed by a strong year to date share price return near 42%, suggests momentum is building as investors warm to its expanding private markets platform and earnings growth story.

If Patria’s recent strength has you thinking more broadly about opportunities in alternative asset managers and beyond, now could be a good time to explore fast growing stocks with high insider ownership.

With Patria now trading near analyst targets after a strong run and fast growing earnings, the key question is whether the stock still offers upside or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 2.4% Undervalued

With Patria Investments last closing at $16.18 against a narrative fair value of about $16.57, the valuation gap is narrow but intriguing.

The accelerating global shift of institutional capital towards alternative assets, particularly private equity, infrastructure, and credit, is directly driving robust organic fundraising growth, reflected in Patria's repeated upward revision to annual fundraising guidance and rate of net new fee earning AUM inflows. This underpins long term revenue and earnings expansion.

Curious how steady revenue expansion, a sharply different margin profile, and a reset future earnings multiple still combine into that fair value? The full narrative unpacks the math.

Result: Fair Value of $16.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on margins holding up, and Patria’s rapid expansion and regional exposure could still pressure profitability and temper that growth narrative.

Find out about the key risks to this Patria Investments narrative.

Another Angle on Valuation

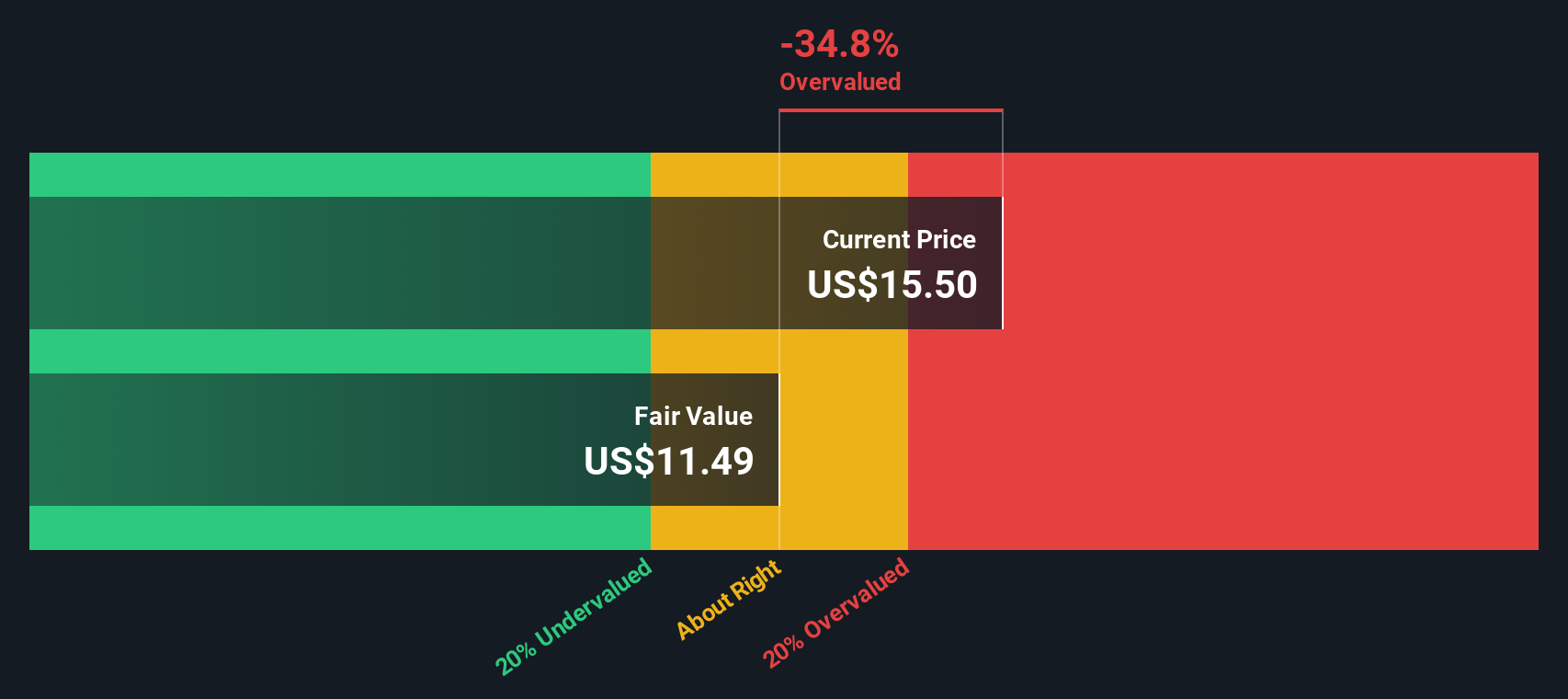

Our DCF model takes a stricter view, putting Patria’s fair value closer to $11.41. This implies the shares are trading rich versus their long term cash flow potential. Is the market correctly pricing in durable growth, or leaning too hard into the current momentum?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Patria Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Patria Investments Narrative

If you see the story differently or simply want to dive into the numbers yourself, you can build a complete narrative in minutes, Do it your way.

A great starting point for your Patria Investments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop sharpening their edge, so before you move on, consider your next opportunity with targeted ideas built from real fundamentals and proven data.

- Amplify your potential gains by targeting companies priced below their estimated cash flow value through these 907 undervalued stocks based on cash flows that highlight mispriced opportunities.

- Position yourself at the forefront of innovation by focusing on these 26 AI penny stocks that are shaping how businesses harness artificial intelligence.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can support reliable, above average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com