Dollarama (TSX:DOL): Valuation Check After Strong Q3 Beat, Guidance Hike and International Expansion

Dollarama (TSX:DOL) just delivered another upbeat quarter, with sales and net income climbing faster than expected, full year Canadian same store sales guidance raised, and international expansion adding an extra growth layer.

See our latest analysis for Dollarama.

That story is clearly resonating with investors, with the share price now at CA$202.23 and a powerful year to date share price return of 44%, underpinned by a three year total shareholder return above 150%. This signals momentum that is still very much intact.

If strong comp growth and expansion have caught your eye, this could be a good moment to widen the lens and explore fast growing stocks with high insider ownership.

Yet with Dollarama trading near record highs and only a modest discount to analyst targets, investors now face a tougher question: is the latest surge leaving a genuine buying opportunity, or is future growth already fully priced in?

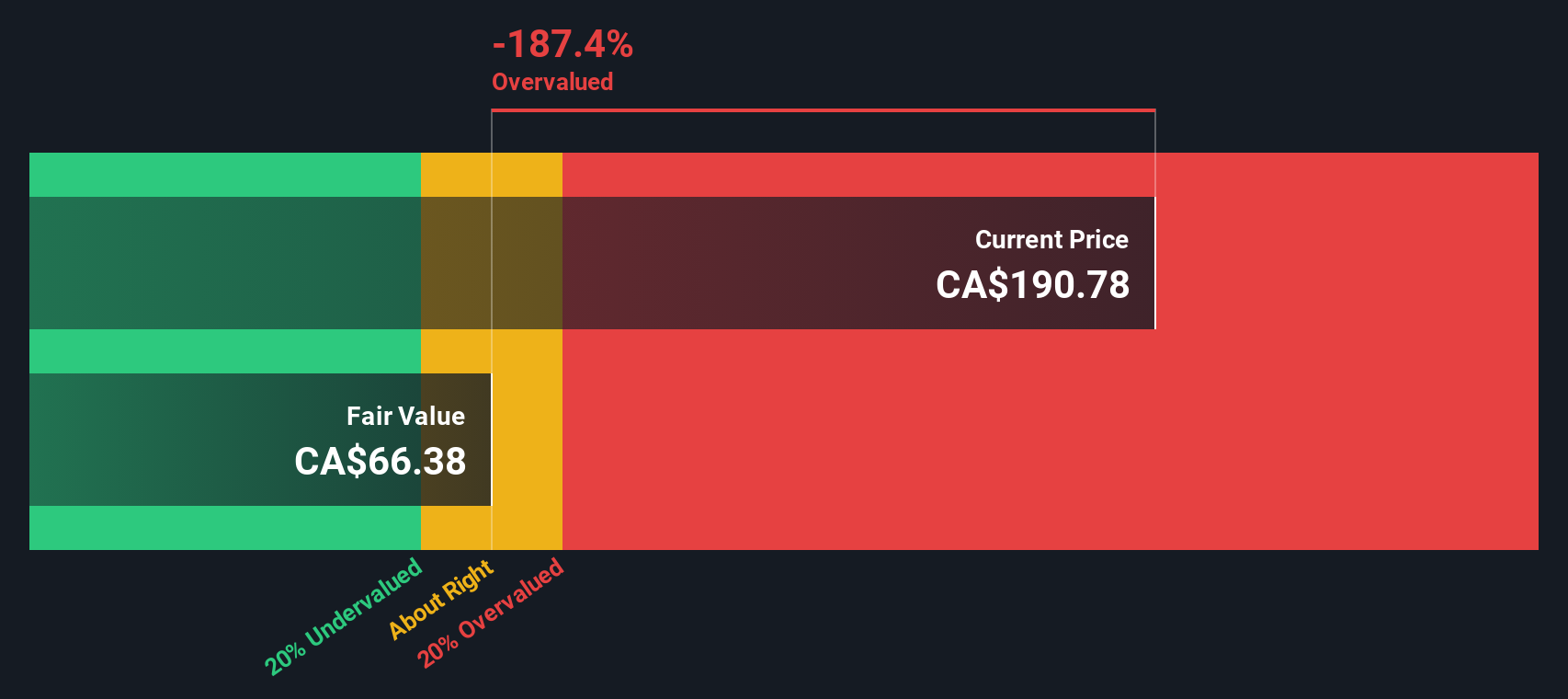

Most Popular Narrative Narrative: 0.7% Overvalued

At CA$202.23, Dollarama now trades slightly above the most followed fair value estimate of about CA$200.81, putting subtle pressure on the upside case.

The company's aggressive international expansion opening Dollarcity's first store in Mexico and acquiring Australia's largest discount retailer unlocks new, large addressable markets, positioning Dollarama for multi-year top-line revenue growth through broader geographic and demographic exposure.

Curious how this cross continent push, slower margin profile, and a rich future earnings multiple still add up to upside potential? The growth math behind this fair value might surprise you.

Result: Fair Value of $200.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in Australia or slower Canadian same store sales as the market matures could quickly challenge the premium growth narrative.

Find out about the key risks to this Dollarama narrative.

Another View on Value: DCF Says Undervalued

While the narrative based fair value suggests Dollarama is slightly overvalued, our DCF model paints a different picture, putting fair value closer to CA$211.97 and implying upside from today’s price. Is the cash flow outlook pointing to hidden value the market is underestimating?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dollarama for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dollarama Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Dollarama research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to pinpoint your next opportunity and stay a step ahead of other investors.

- Capture potential mispricings by targeting companies trading below intrinsic value through these 907 undervalued stocks based on cash flows and build a watchlist of candidates before sentiment shifts.

- Focus on cutting edge innovation by identifying businesses harnessing machine learning and automation with these 26 AI penny stocks and position yourself early in structural growth trends.

- Seek more reliable income streams by concentrating on companies offering attractive payouts using these 13 dividend stocks with yields > 3% and reduce the need to scramble for yield when rates change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com