Insulet (PODD): Valuation Check After FDA Clearance and Upbeat Earnings Growth Outlook

Insulet (PODD) just picked up FDA 510(k) clearance for a major Omnipod 5 algorithm upgrade, adding a lower 100 mg/dL glucose target and smoother automation that could quietly reshape expectations for its growth story.

See our latest analysis for Insulet.

Even after the FDA news and upbeat commentary around faster EPS growth, Insulet’s share price return has cooled in recent weeks, with the stock now at $295.70. However, its positive year to date share price return and solid five year total shareholder return suggest the longer term growth story still has support and momentum rather than outright fatigue.

If this kind of healthcare innovation is on your radar, it could be worth exploring other potential leaders through healthcare stocks to see what else fits your strategy.

With the stock still trading below consensus targets despite double digit revenue and earnings growth, the key question now is whether Insulet is quietly undervalued or if the market is already pricing in years of future expansion.

Most Popular Narrative Narrative: 21.8% Undervalued

With Insulet last closing at $295.70 against a narrative fair value near $378, the story suggests meaningful upside if its growth runway holds.

Rapidly rising adoption of Omnipod 5 in both the U.S. and international markets driven by strong clinical evidence, ease of use, and integration with the latest glucose sensors is positioning Insulet to capture a disproportionately large share of the expanding global diabetes device market, supporting top line revenue growth for several years.

Want to see what powers that growth runway, and the premium valuation that comes with it? The narrative relies on revenue scaling, improving margins, and a higher future earnings multiple. Curious how those moving parts combine to support that fair value gap? Dive in to see the assumptions spelled out.

Result: Fair Value of $378.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy dependence on Omnipod and intensifying diabetes tech competition mean any stumble in product execution or pricing could quickly narrow that perceived undervaluation.

Find out about the key risks to this Insulet narrative.

Another Lens on Valuation

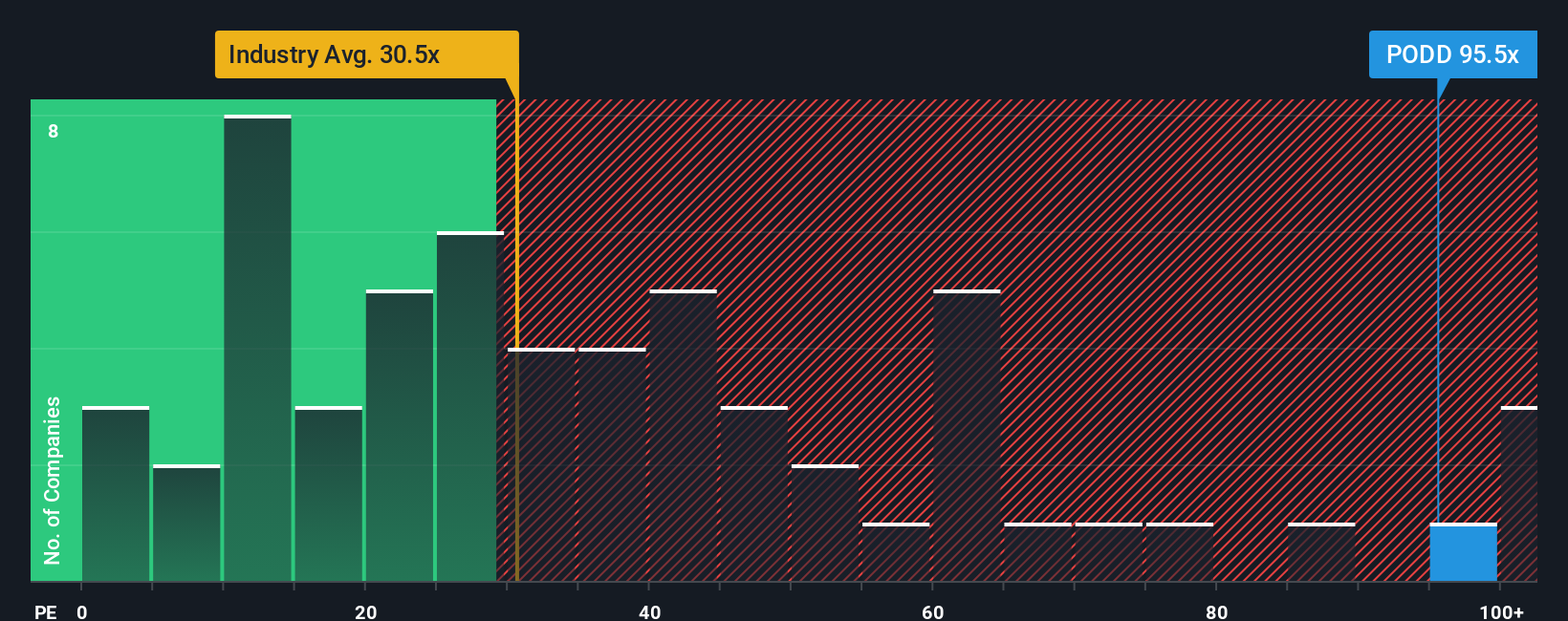

On earnings, the picture looks less forgiving. Insulet trades on a price to earnings ratio of about 84.5 times, compared with an industry average near 30.1 times and a fair ratio closer to 37.4 times. This raises the risk that any slowdown could trigger sharp multiple compression.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Insulet Narrative

If you see the story differently, or prefer to dig into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Insulet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider building a stronger watchlist by using the Simply Wall St Screener to uncover fresh opportunities that could sharpen your next investment decision.

- Capture potential multi baggers early by targeting growth stories hidden within these 3606 penny stocks with strong financials before the wider market fully catches on.

- Harness the wave of automation and data disruption by focusing on companies shaping tomorrow through these 26 AI penny stocks.

- Strengthen your margin of safety by pinpointing high quality businesses trading below intrinsic value with these 907 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com