Chewy (CHWY): Reassessing Valuation After Strong Q3 Beat and Raised Full-Year Outlook

Chewy (CHWY) just delivered a stronger than expected third quarter, then followed it up by tightening and slightly raising its full year outlook, signaling more confidence in its growth and efficiency story.

See our latest analysis for Chewy.

Even with the upgraded guidance and recurring revenue momentum, Chewy’s recent 90 day share price return of negative 5.54 percent and year to date share price return of negative 3.34 percent show that sentiment is still resetting after earlier optimism, while a modest 1 year total shareholder return of 1.49 percent hints at slowly rebuilding confidence over a longer horizon.

If Chewy’s pet care ecosystem has your attention, this could be a good moment to see what else is gaining traction in e commerce and consumer tech via fast growing stocks with high insider ownership

With revenue still growing, margins widening and the stock trading at a steep discount to analyst and intrinsic value estimates, is Chewy quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 27.2% Undervalued

With Chewy’s last close at $32.74 versus a narrative fair value near $44.95, the story leans heavily on long term growth and margin expansion.

The company's increased focus on innovation, such as the Chewy+ membership and mobile app improvements, is driving new customer acquisition and higher conversion rates, enhancing both revenue growth and net sales per active customer (NSPAC). Active customer growth has reached an inflection point, with expectations for continued growth in 2025 due to improved marketing strategies and customer acquisition channels, positively affecting top line revenue.

Want to see why this narrative supports the possibility of a richer future valuation than today’s price suggests, while assuming only modest margin changes and measured revenue growth? Dive in.

Result: Fair Value of $44.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected active customer growth and heavy reliance on Autoship subscriptions could undermine revenue momentum and delay the margin gains that this narrative assumes.

Find out about the key risks to this Chewy narrative.

Another View: Valuation Looks Rich on Earnings

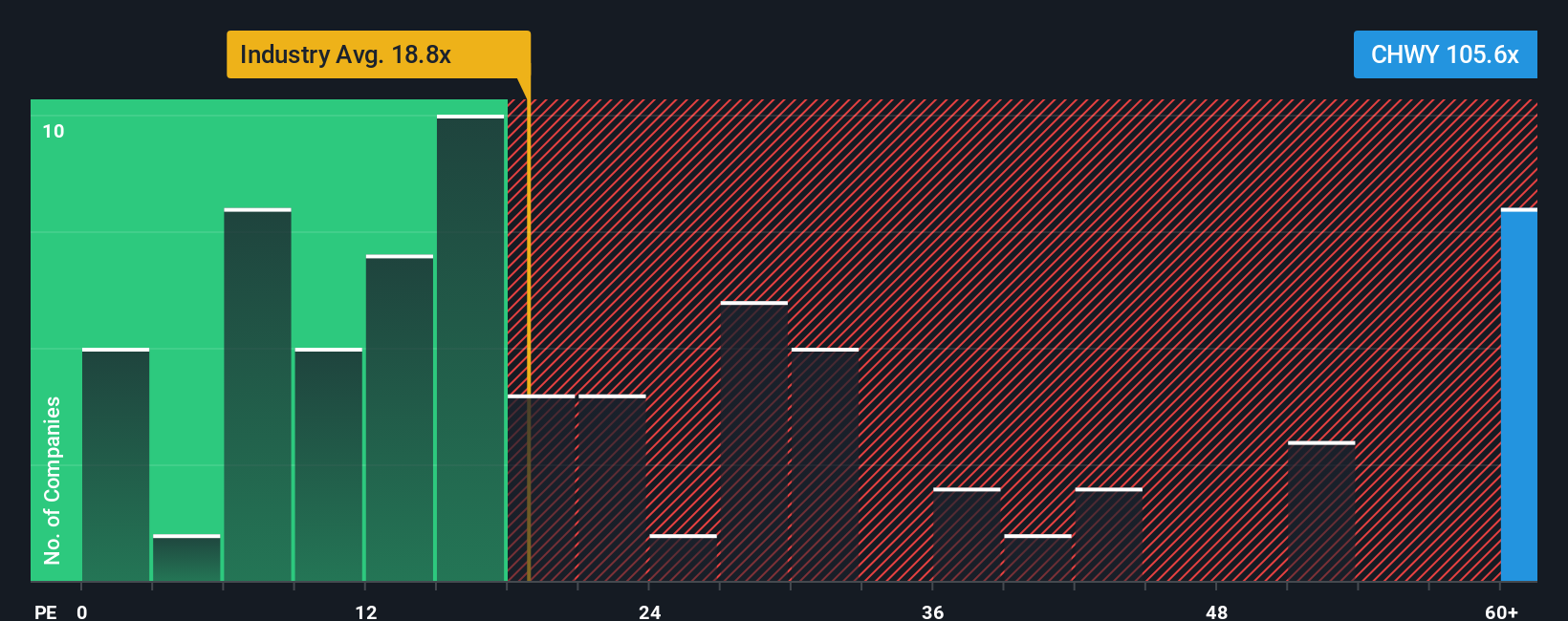

While our narrative based fair value suggests Chewy is undervalued, a simple earnings lens tells a different story. The stock trades on a 65.8 times price to earnings ratio, far above the US Specialty Retail average of 20.2 times and our fair ratio of 28.7 times. That gap points to real downside risk if growth stumbles or sentiment cools, so how comfortable are you paying up for this story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh opportunities by running targeted screens on Simply Wall St, so you are not leaving potential winners unseen.

- Capture early stage momentum by scanning these 3606 penny stocks with strong financials that already back their potential with solid financial foundations.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks shaping how artificial intelligence transforms entire industries.

- Strengthen your portfolio’s core by zeroing in on these 13 dividend stocks with yields > 3% that can help support more reliable long term income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com